New regulations coming into force on Thursday will make electronic money transfers faster and more secure for consumers. The changes mandate the broad availability of “instant payments” and introduce a new security check to combat fraud.

From Thursday, all banks within the Single Euro Payments Area (SEPA) will be required to offer instant payment services. This means transfers between euro accounts must be completed within ten seconds, a significant reduction from the standard one-to-two-day timeline. While banks have been required to receive instant payments since January, they must now also be able to send them.

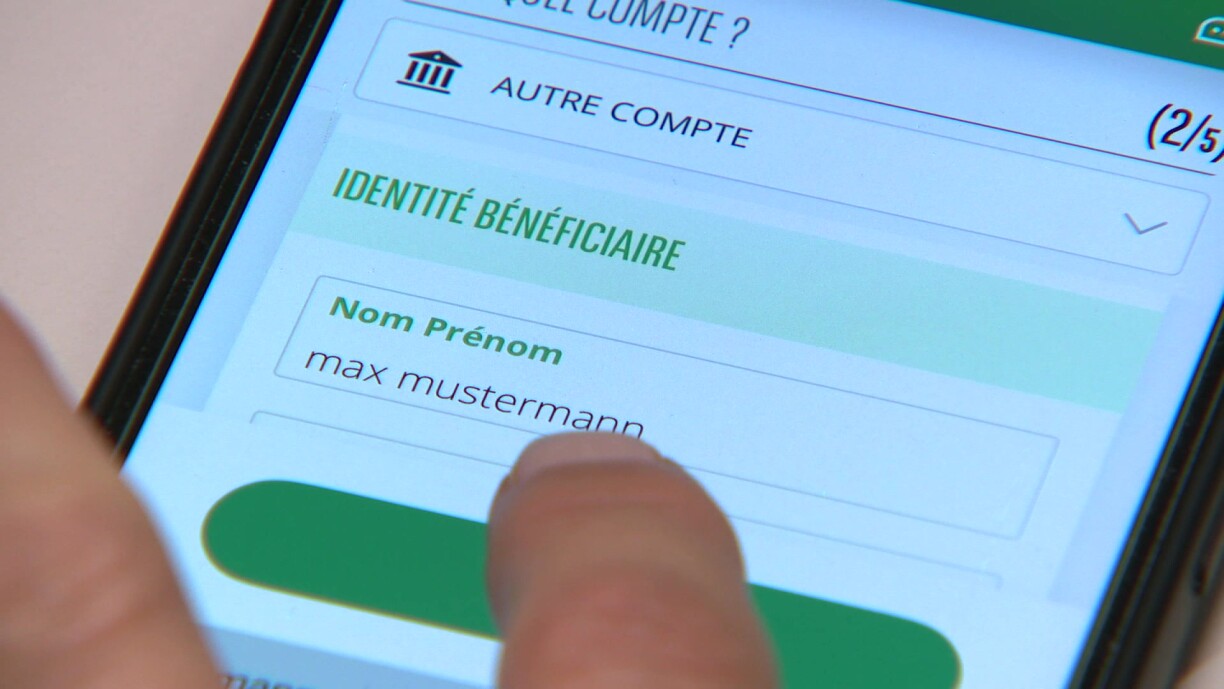

Paul Wilwertz, head of communications at the Luxembourg Bankers’ Association (ABBL), outlined practical applications for the new system. "[This could be used by parents who] have a child abroad that urgently needs money,” he said, or a shopper at a foreign flea market using their phone to pay a seller who does not accept credit cards.

The feature may be set as the default option by some banks, though clients will retain the ability to disable it. Others may need to activate it first. According to Wilwertz, fees for instant transfers will remain aligned with those for conventional ones.

A second key change involves payee verification. Banks will now check if the recipient’s name matches their International Bank Account Number (IBAN) before processing a transfer.

This new check is designed to prevent transfers based on errors or fraud. For instance, if a customer receives a fake invoice with a legitimate company name but a fraudulent account number, the discrepancy will be flagged.

The system will generate different responses. A perfect match will allow the transfer to proceed. In cases of a minor discrepancy – such as a misspelling or an omitted part of a name – the user will receive a “close match” alert with a suggestion for the correct payee, which they can then select. This added layer of confirmation aims to give users greater confidence that their money is going to the intended recipient.

The new verification system will also return a “No Match” message if the payee’s name and IBAN are completely unrelated, such as when an abbreviation is used.

Wilwertz clarified that a “no match” or “close match” notification does not prevent a customer from proceeding with the transfer. However, choosing to ignore the warning carries a significant change in liability.

If the client proceeds with the name and account number they have entered, it means that in the event of a misdirected transfer – one that goes to the wrong person – the liability will be on the client, and the bank will no longer be responsible, Wilwertz explained.

Due to this shift in responsibility, customers are advised to review and update their saved payee lists to ensure names are entered accurately and completely.

The change presents a specific challenge for businesses, which often process bulk payments through systems like MultiLine. Under the new rules, a single payee mismatch could block an entire batch of transfers, depending on the bank’s configuration.

To maintain operational efficiency, businesses can request an opt-out from their financial institution. “The MultiLine system will then work as before, but without payee verification,” Wilwertz noted.

In general, Wilwertz advises clients to avoid making transfers in a hurry and remain vigilant against strange calls and messages.