Bee Secure, Luxembourg’s national online safety initiative, works to educate the public about avoiding scams – and offers advice when the damage is already done. We spoke with Igor Loran from Bee Secure about the dark web, and asked police how likely it is for scam victims to recover their money.

This is the second part of our “Asked at Bee Secure” series. The first article looked at the most common scams in Luxembourg and how to avoid them.https://www.rtl.lu/news/national/a/2317470.html

Loran draws a clear line between the “clean web”, the visible part of the internet accessible via search engines, and the “dark web”, a hidden layer where cybercriminals buy and sell large batches of stolen personal data. Such information helps them craft highly targeted scams.

These details can be stolen via phishing emails, but victims do not have to fall for such tricks for their data to end up on the dark web. Massive breaches at platforms like Facebook, Instagram, or TikTok have also leaked email addresses, names, addresses, ID numbers, and bank details. Cybercriminals gather this data, bundle it, and sell it in the dark web’s underground marketplaces.

People can check if their information has been compromised using the website haveibeenpwned.com. A “green” result is no guarantee of safety, and a “red” result does not mean imminent danger; but in the latter case, Loran advises changing passwords, enabling two-factor authentication, or even deactivating the affected email address. And even the strongest password is useless if it is handed over in a phishing scam, he warns, which is why unique passwords for each service are essential.

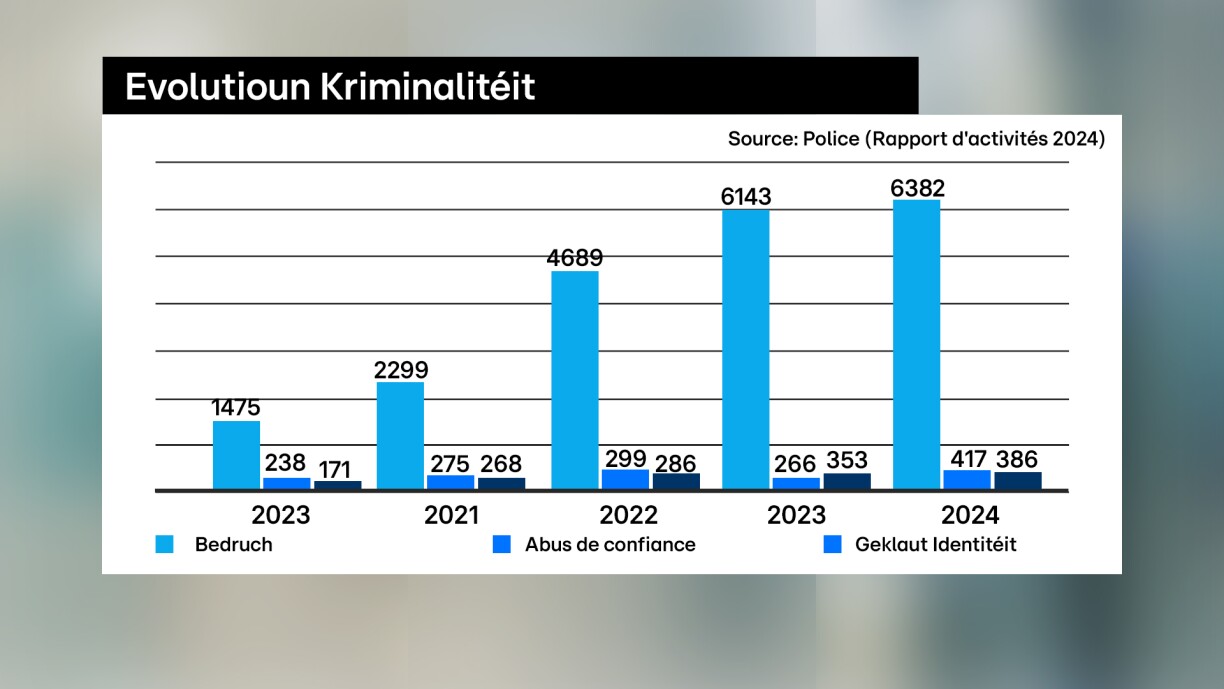

The upward trend is clear in police statistics. In 2020, there were 1,475 reported fraud cases in Luxembourg, both online and offline. By 2024, that figure had jumped to 6,382, a 333% increase in just four years. The police described 2024 as an “impressive wave” of fraud, with other offences such as identity theft remaining relatively stable.

Bee Secure’s own records also show spikes. The number of calls about internet crime rose from 205 in 2020 to 357 in 2021. In the first five months of 2025 alone, the service had already logged 166 such calls.

Almost anyone can become a victim, says Loran, but very young people and the elderly are most at risk – the former due to lack of experience, the latter because of difficulty navigating new technologies. Bee Secure offers special training sessions for seniors under its Goldenme programme.

Amounts vary widely. Police spokesperson Pauline Maes notes that in cases where criminals obtain a victim’s security codes, losses typically range from €1,000 to €10,000, but can be higher in “shock call” scams. In extreme cases, such as one in Germany’s Rhineland-Palatinate, the total reached over €1 million.

Whether victims can recover their money depends largely on how quickly they act. If the bank and police are alerted immediately, transfers can sometimes be stopped. But often, people only notice after the money is gone, by which time it may have been moved abroad, sometimes beyond Europe, where cooperation is harder due to bank secrecy laws. Criminals also use “money mules” to launder funds, often recruiting young people who may not realise they are breaking the law.