The decline of land prices has been broadly consistent across the country, offering a glimmer of hope for those planning to buy new property in the coming years.

If one of the biggest cost factors for developers continues to ease, they may be able to offer more competitive prices. However, the timing remains uncertain. Some plots are already “ready to build”, while others still require preparation work, meaning new, more affordable projects might appear in the near future or take considerably longer to materialise.

Julien Licheron, of the Luxembourg Institute of Socio-Economic Research (LISER) and the Housing Observatory, attributes part of the drop to rising interest rates but cautions against drawing a direct causal link between the fall in property prices and the decline in land values. He pointed out that landowners are rarely in a hurry to sell, a remark that aligns with ongoing discussions about introducing a tax to encourage the use of undeveloped plots.

According to the Housing Observatory, there has already been a rebound in activity in 2024. Licheron, who wrote the Housing Observatory’s report, confirmed that developers have begun purchasing land again, often with the intention of preparing it for future construction.

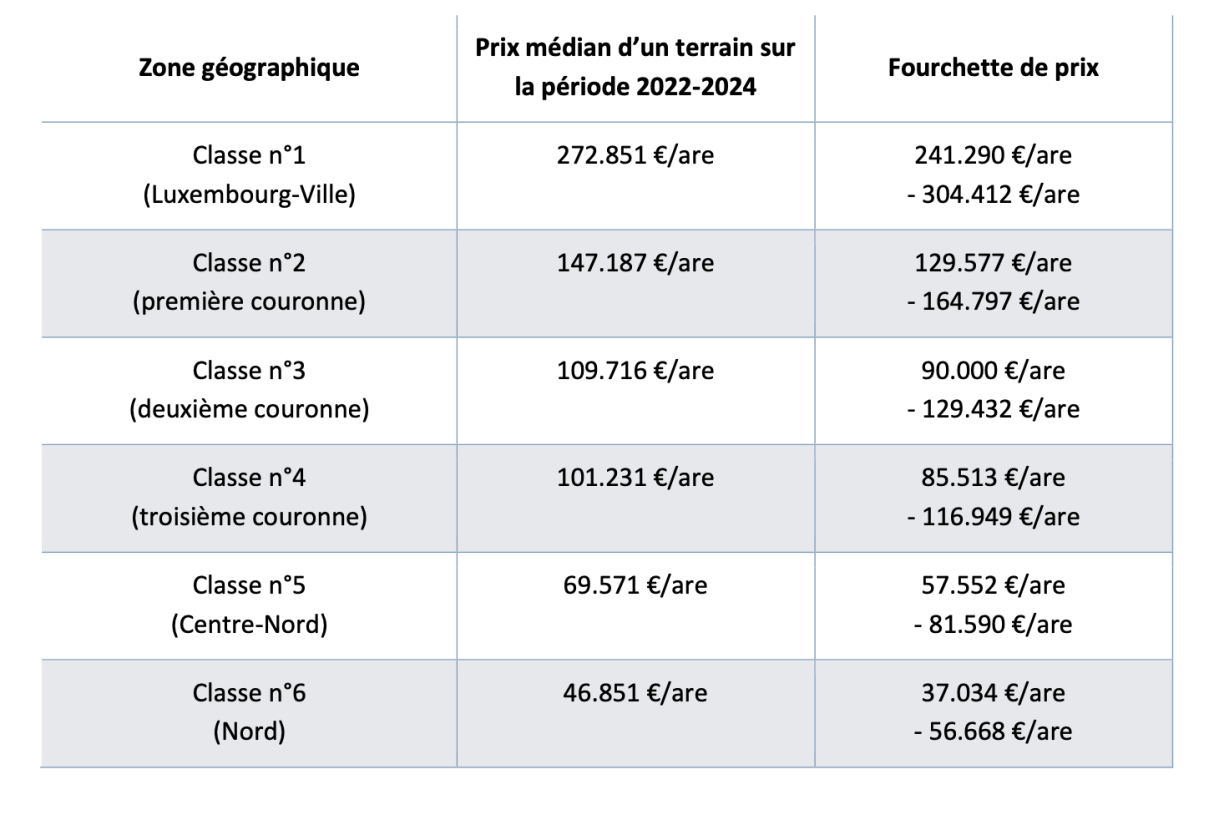

While it is too early to predict when these projects will reach the market, he noted that prices will still vary widely depending on location. Housing remains more affordable further away from the capital.

Significant price differences persist between Luxembourg City and the rest of the country, and the overall price map of the Grand Duchy has remained stable, according to Licheron. In other words, buying property in Wiltz will remain considerably easier than in Strassen.

Before interest rates began to rise, land prices had surged dramatically. Between 2010 and 2022, the Housing Observatory calculated a cumulative increase of over 150%, making land one of the most profitable investments of the period. Property prices followed the same upward trend, rising by 139% for existing homes and 130.7% for new builds, while the construction cost index increased by just 52.1% over the same time frame.

As the Observatory explains, higher housing prices increased expected returns from developing vacant plots, which in turn pushed up land values. These higher purchase prices were then incorporated into the final sale price of new homes, perpetuating the cycle.

As for the most recent data, Licheron said that figures from the land registry for 2024–2025 will not be available until spring 2026, meaning investors will have to rely on the current report when making their decisions.

Key translations