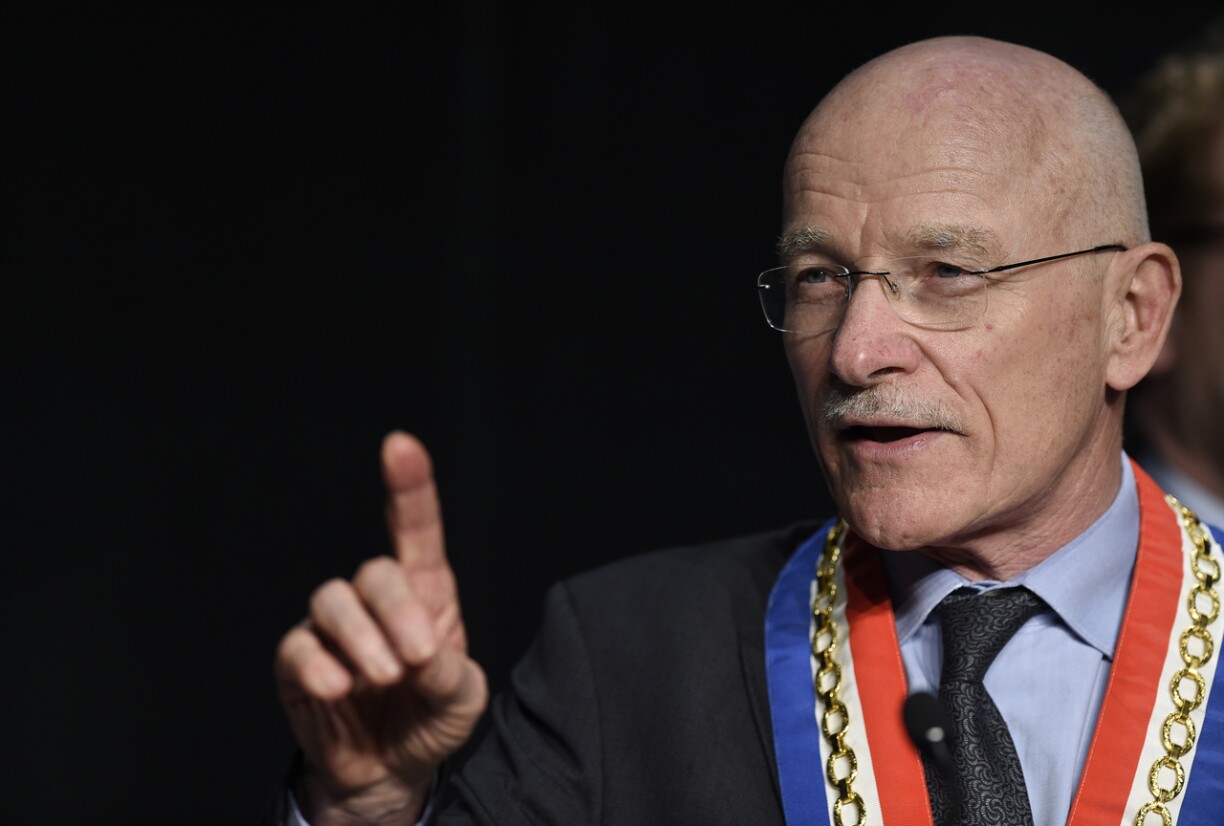

Describing a situation wherein cross-border workers pay income tax in Luxembourg as ‘unjust and inequitable’, Gros has demanded a fair distribution of income tax in cross-border zones. Metz’s mayor has always been on the front line in urging Luxembourg to redistribute some of the income tax it receives from cross-border workers.

Gros likened the economic relation with the Grand Duchy as going in solely one direction, as Luxembourg fails to redistribute its fiscal profits and leaves bordering territories lacking 50% of its productive workforce.

He denounced taxation, the cost of training and care, and the responsibility for job seekers. Current EU regulations stipulate that a worker must contribute to the state they work in. However, once unemployed, the responsibility for compensating job seekers lies with the state of residence. So far, this situation costs France more than €700 million each year.

Last week, the European Council’s Congress of Local and Regional Authorities adopted a draft resolution designed to improve a fair distribution of taxes in cross-border zones, which suggests the employing country paying a proportion of gross salaries to the country of residence. The example for the resolution was the agreement between the Swiss canton of Geneva and France.

However, the subject continues to cause tension between Luxembourg and its neighbouring countries, as the Grand Duchy refuses to agree to such a proposal. On Tuesday, Prime Minister Xavier Bettel reiterated that Luxembourg prefers investing in cross-border infrastructure to benefit workers rather than pay out compensation to neighbours.

Xavier Bettel: Prime Minister is defensive after meeting with Rhineland-Palatinate

Fiscal retrocession: Europe putting pressure on Luxembourg to share income tax of cross-border workers