It is no secret that French cross-border workers pay 100% of their income tax in Luxembourg, and it is also no secret that French representatives in the Grand Est region have repeatedly requested fiscal retrocession, namely that Luxembourg pay on a portion of the income tax received from French residents. So far, Luxembourg has never agreed to pay such a retrocession.

Notably, Prime Minister Xavier Bettel declared that Luxembourg does not intend to “pay for Christmas decorations” in bordering towns in an interview with RTL France in 2018.

Following regional pressure, it now appears that Luxembourg will be subject to EU-wide pressure. On Tuesday, the European Council adopted its draft recommendation which stipulates transferring a percentage of cross-border workers’ income tax to their residing country. The recommendation was inspired by the Geneva canton model, which sees €260 million transferred to France annually following a 1973 convention. The former mayor of Geneva, Claude Haegi, declared that the state of Geneva has transferring €2.27 billion to their French neighbours “not as a gift, but as justice.”

The next step if the recommendation will be a decisive one for Luxembourg. The committee of ministers of the European Council will examine the recommendations and could demand negotiations between the Grand Duchy and France. If Luxembourg fails to cooperate, Haegi will encourage local representations to put pressure on the government.

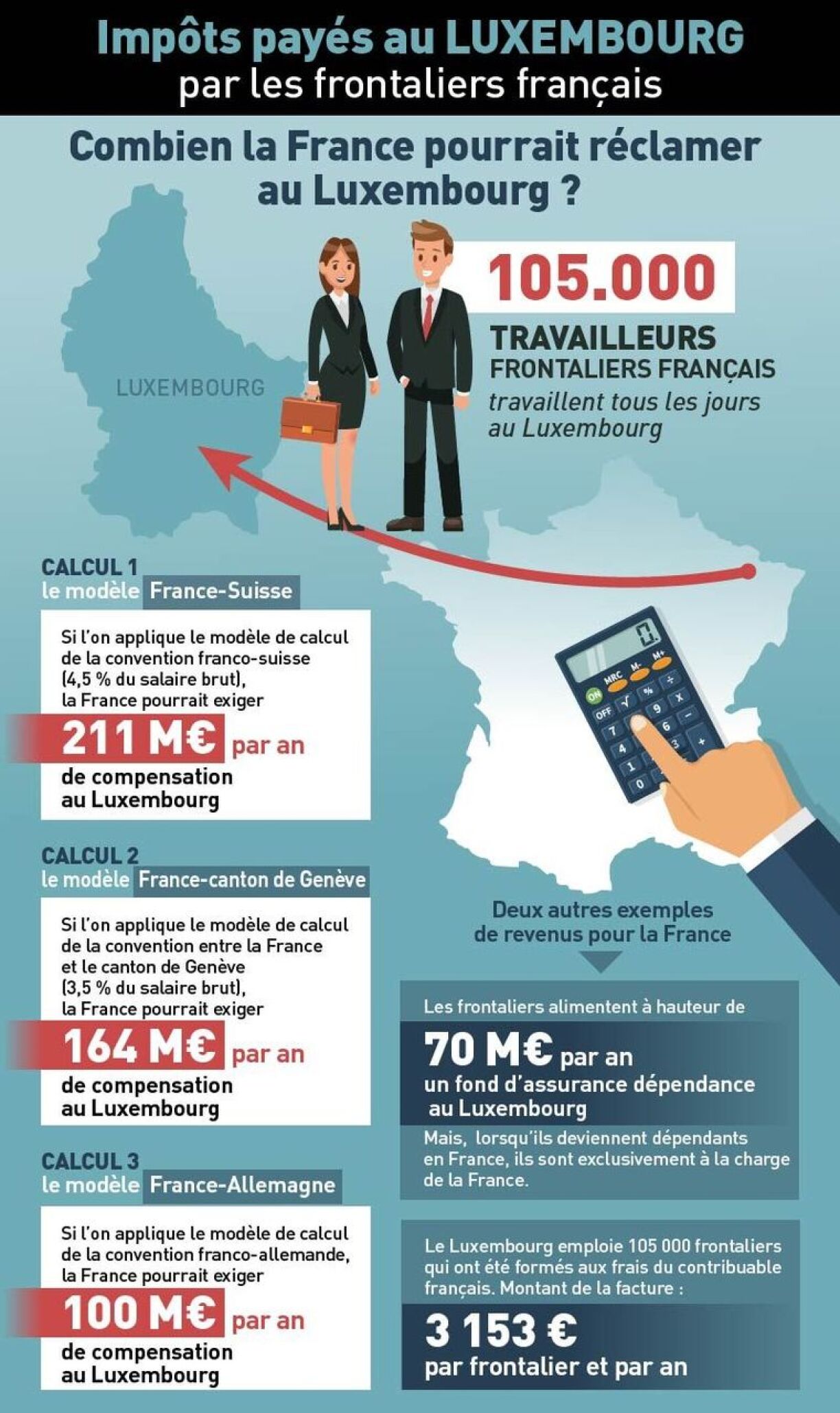

The Luxembourgish economy benefits from 47% of its workforce being cross-border workers, the highest rate in all of Europe. According to calculations used in EU border zones where fiscal compensation exists, Luxembourg could end up paying between €100 million and €211 million to France as annual fiscal retrocession. The news would likely be welcomed by Rhineland-Palatinate representatives who have also demanded compensation from the Luxembourgish government.

Below, our colleagues at RTL 5Minutes have explored the different options.