As typical for Janauary, the Conjoncture Flash report from the National Institute of Statistics and Economic Studies (STATEC) offers an overview of Luxembourg’s economy at the end of 2025, covering household finances, the labour market, inflation, housing, public revenues, trade and tourism.

The report shows a mixed end to 2025 in the Grand Duchy: household assets grew and job creation accelerated, but unemployment rose as more people, particularly highly qualified professionals, began seeking work.

STATEC also highlights continued services-led inflation despite its comparatively low figures when compared with the rest of the EU, renewed volatility in housing after temporary support measures expired, weaker household income tax receipts, widening trade imbalances with China, and a fall in travel from Luxembourg to the United States.

Luxembourg’s labour market strengthened in the second half of 2025, with faster job growth drawing more people into work and job-seeking, although the unemployment rate also rose.

Employment growth accelerated in the third quarter of 2025 and was expected to hold at about 0.5% quarter on quarter at the end of the year, according to preliminary, seasonally adjusted figures from the General Inspectorate of Social Security (IGSS), the National Employment Agency (ADEM), and STATEC. Over the same period, unemployment increased to 6.2% of the labour force in November and December, up from 5.9% at the end of summer.

The increase represents an 8% increase from the end of 2024, driven largely from an increase in highly qualified professionals looking for work.

Cross-border commuters accounted for about 60% of net job creation in the second half of 2025, compared with 35% in the first half. Resident employment grew less quickly over that period.

The labour force expanded through inward migration and higher participation, including previously inactive people moving directly into work or registering with ADEM.

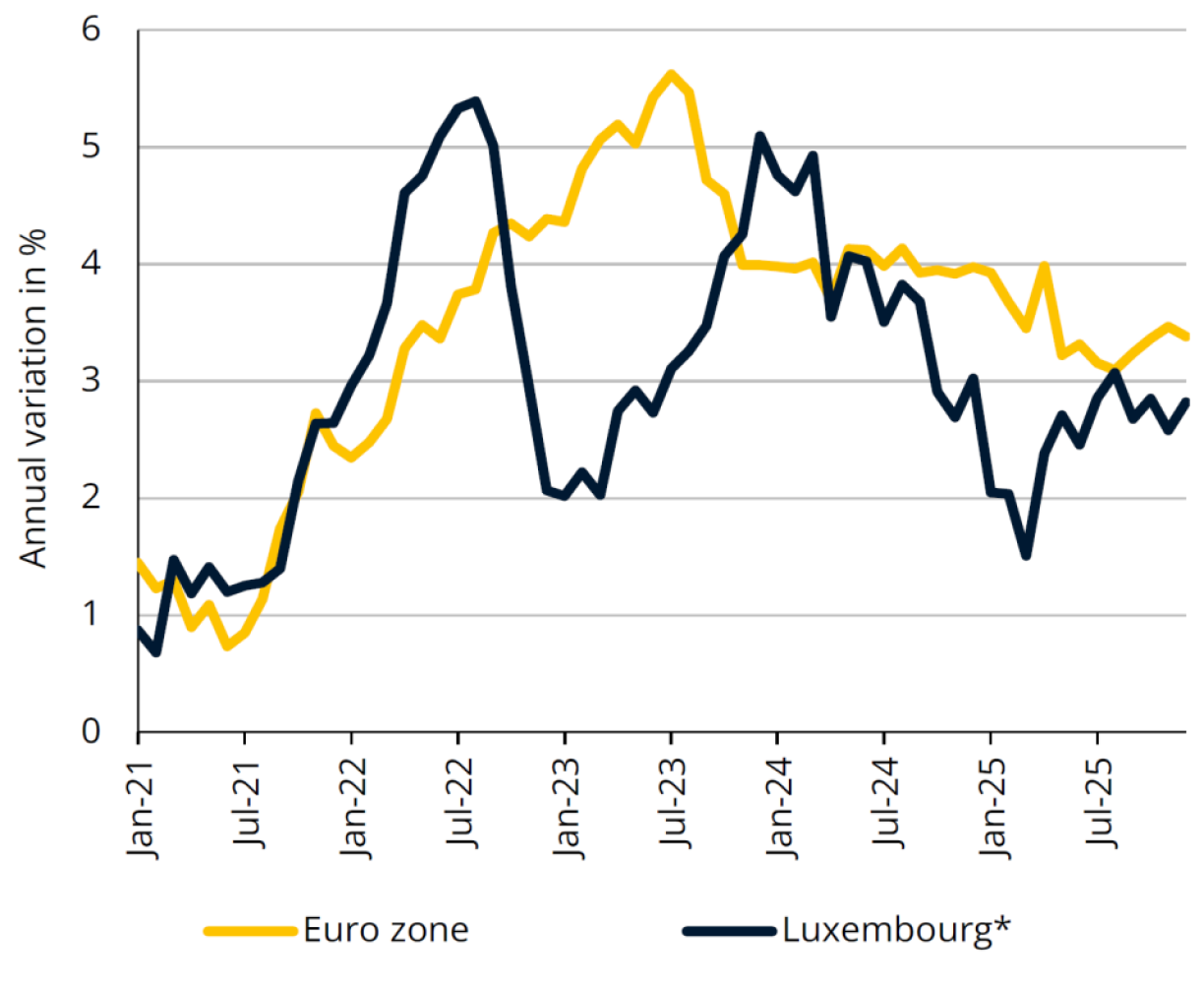

Services remained the main driver of inflation in Luxembourg in December 2025, but service price growth in the Grand Duchy stayed below the eurozone average over the year, according to Eurostat and STATEC.

In December, services contributed 1.3 percentage points to Luxembourg’s overall inflation rate of 3.1%. In the eurozone, services contributed 1.5 percentage points to overall inflation of 1.9%. Over 2025 as a whole, services inflation in Luxembourg was 2.5%, among the lowest rates in the eurozone, alongside France. The eurozone average was 3.4%.

According to the report, across the eurozone, service inflation has been supported by wage catch-up, particularly in Central and Eastern Europe, where the 2022 energy price shock was felt most.

In 2025, 70% of the 96 service categories tracked in both Luxembourg and the eurozone made a larger contribution to inflation in the eurozone than in the Grand Duchy. The widest gaps were in restaurants and accommodation, insurance, and rents.

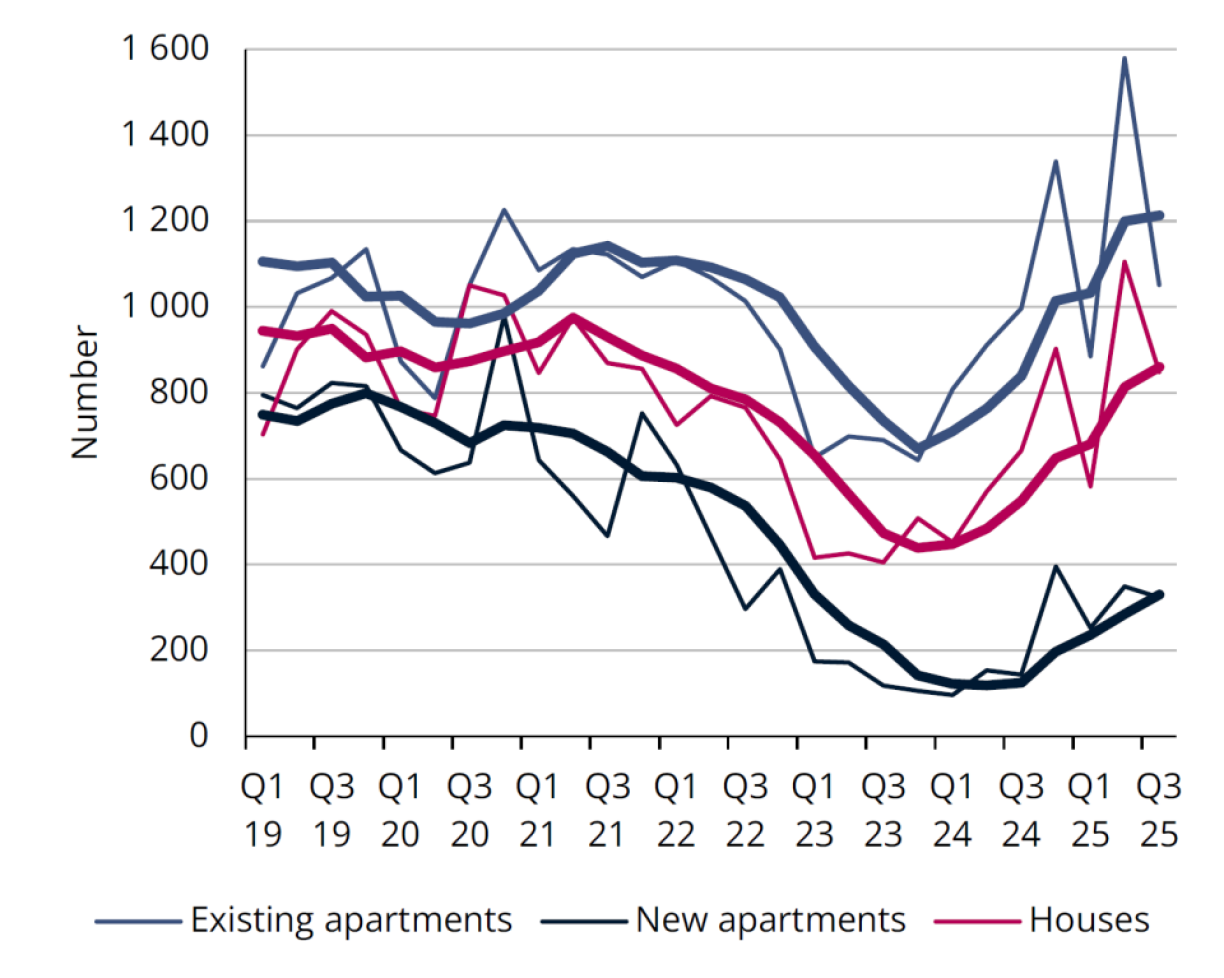

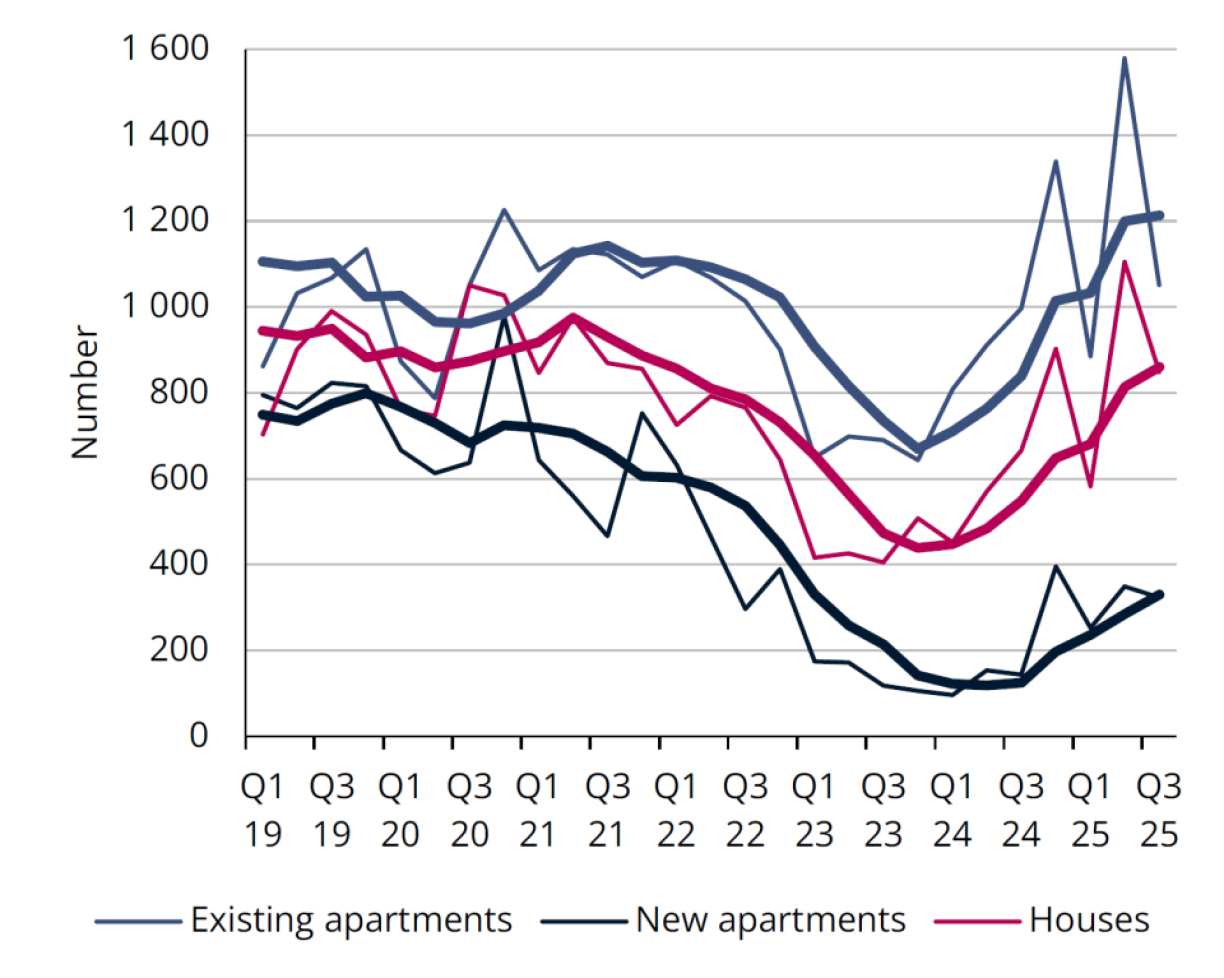

Luxembourg’s housing market showed an uneven recovery in the third quarter of 2025, with prices and transactions moving in opposite directions after a surge in activity earlier in the year linked to the expiry of temporary support measures.

STATEC and the Housing Observatory recorded a 3.1% fall in house prices over the quarter in Q3 2025, following a 4.4% rise in the previous quarter. The shift was linked to the end of temporary support measures in late June. Over the year, prices were up 1.2%, which the institutions describe as a modest underlying upward trend despite short-term swings.

Housing transactions fell in the third quarter after an unusually strong second quarter, which was boosted by buyers and sellers moving before the measures expired. A similar, though less pronounced, pattern was seen around the turn of 2024 and 2025, when some measures were due to lapse before they were extended. Despite the quarterly fall, transactions were 23% higher year on year in Q3.

The recovery has varied widely by property type. Transactions in existing flats and houses have returned to pre-crisis levels, while sales of new flats remain about half their pre-crisis level. Flats under construction made up about 20% of flat sales, down from around 40% before the market downturn.

Luxembourg’s goods trade deficit with China reached €576 million in 2025, as imports from China continued to rise in high-value categories such as electrical, audio, and video equipment, according to STATEC.

The national statistics office recorded €922 million of imports from China over the year, compared with €346 million of exports, mainly valves and copper foil. China accounted for around 3% of Luxembourg’s overall goods imports by value.

In the first ten months of 2025, Chinese products represented 20% of Luxembourg’s imports of electrical, audio, and video equipment, up from 3% in the same period a year earlier.

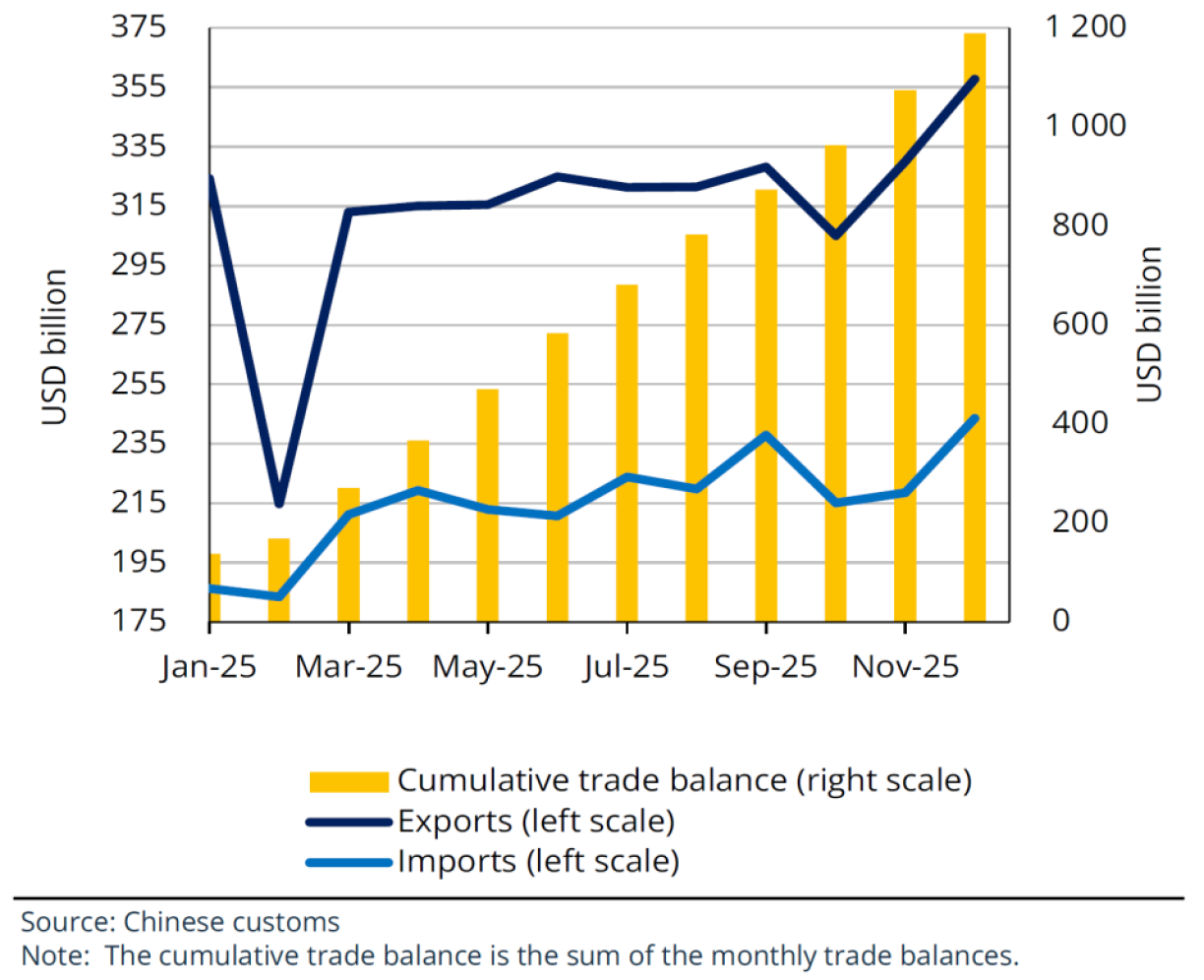

The latest data mirrors a global trend in 2025, which saw China experience higher US tariffs, causing Chinese exports to be redirected towards other markets, including Europe and Asia, and contributing to the continued growth of China’s trade surplus. Overall, China recorded a record goods surplus of $1.188 trillion, as exports increased while imports remained weak amid slow domestic demand.

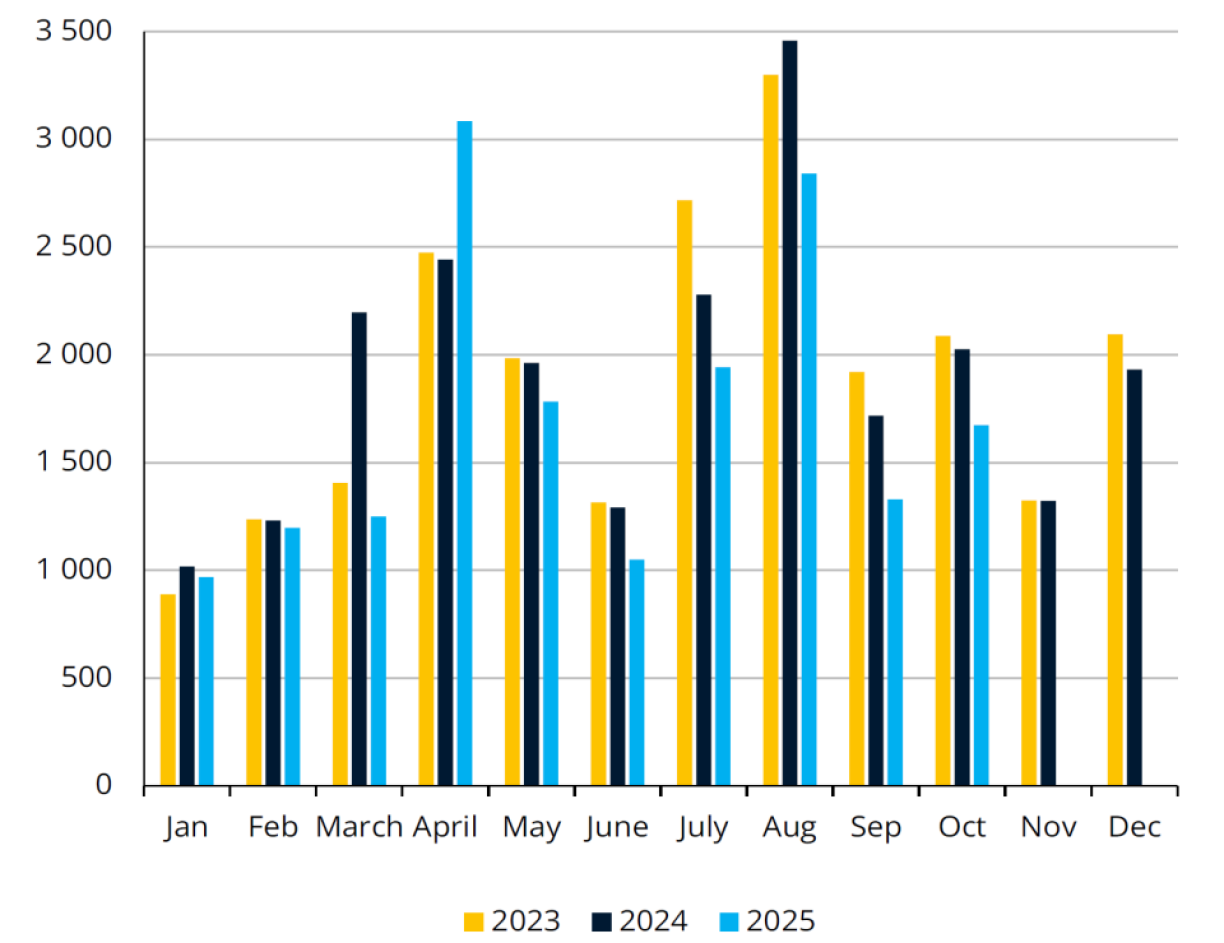

Visitors from Luxembourg to the United States fell by close to 13% in 2025, despite global tourism increasing over the same period.

Official US figures show international arrivals to the United States were down by just over 5% in 2025, based on the first ten months of the year, a drop of more than three million visitors. Global tourism grew by about 4%, according to UN Tourism estimates.

The decline in US arrivals was driven mainly by fewer visitors from Canada, down 22%, alongside falls from Germany (12%), France (7%), India (5%), and South Korea (6%). Some markets increased, including Mexico (10%), Argentina (16%), Japan (6%), Italy (6%), Israel (15%), and the United Kingdom (1%).

Across Europe, trends were mixed, with gains in many Eastern European countries and declines across much of western Europe.

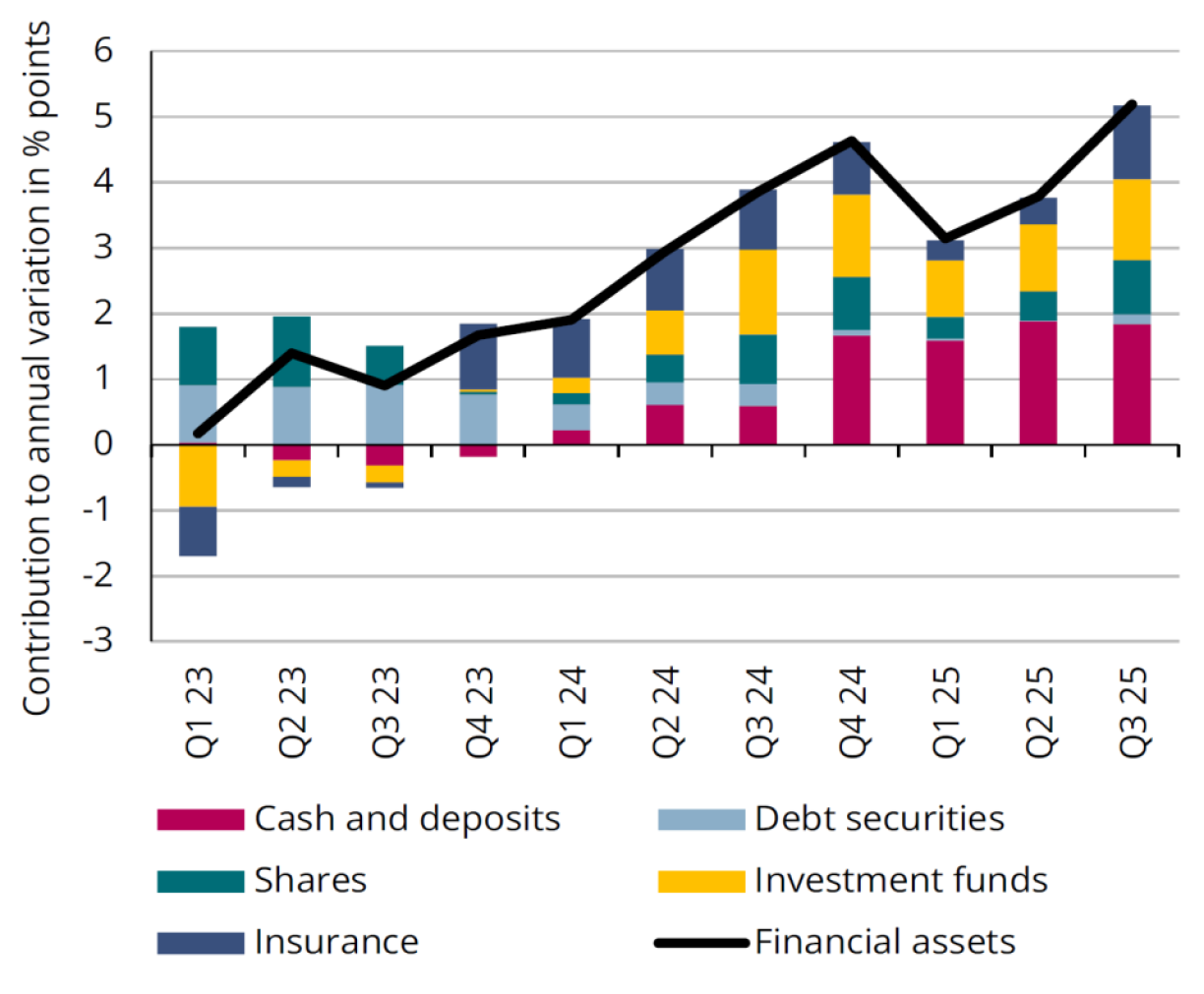

Household financial assets in Luxembourg became more diversified in the third quarter of 2025, with growth driven by higher bank deposits and increased investment in equities and life insurance.

Over the year to Q3 2025, household financial assets rose by 5.2%, with growth of 0.7% over the quarter, according to figures from STATEC and the Banque centrale du Luxembourg. Households increased bank deposits by 4.4% and added to equity holdings and life insurance. Equity investment rose by 3.8% through transactions, while valuations fell by 0.5%. For life insurance, transactions increased by 7.0% and valuations by 4.1%.

In investment funds, valuations for holdings in non-money market funds rose by 27%, while transaction volumes fell by 17%, indicating that portfolio values rose mainly through market movements rather than new buying.

Deposits remain the largest single component of household financial assets in Luxembourg, accounting for 40%, compared with an average of 29% in the eurozone. Equities represent 25% of household assets in Luxembourg, close to the eurozone average of 26%. Investment funds account for 13% in Luxembourg and 12% in the eurozone. Life insurance represents 10% in Luxembourg, below the eurozone average of 14%.

Although deposits take a larger share of household portfolios in Luxembourg, the long-term trend has been downwards outside crisis periods. Thirty years ago, deposits accounted for about half of household financial assets.

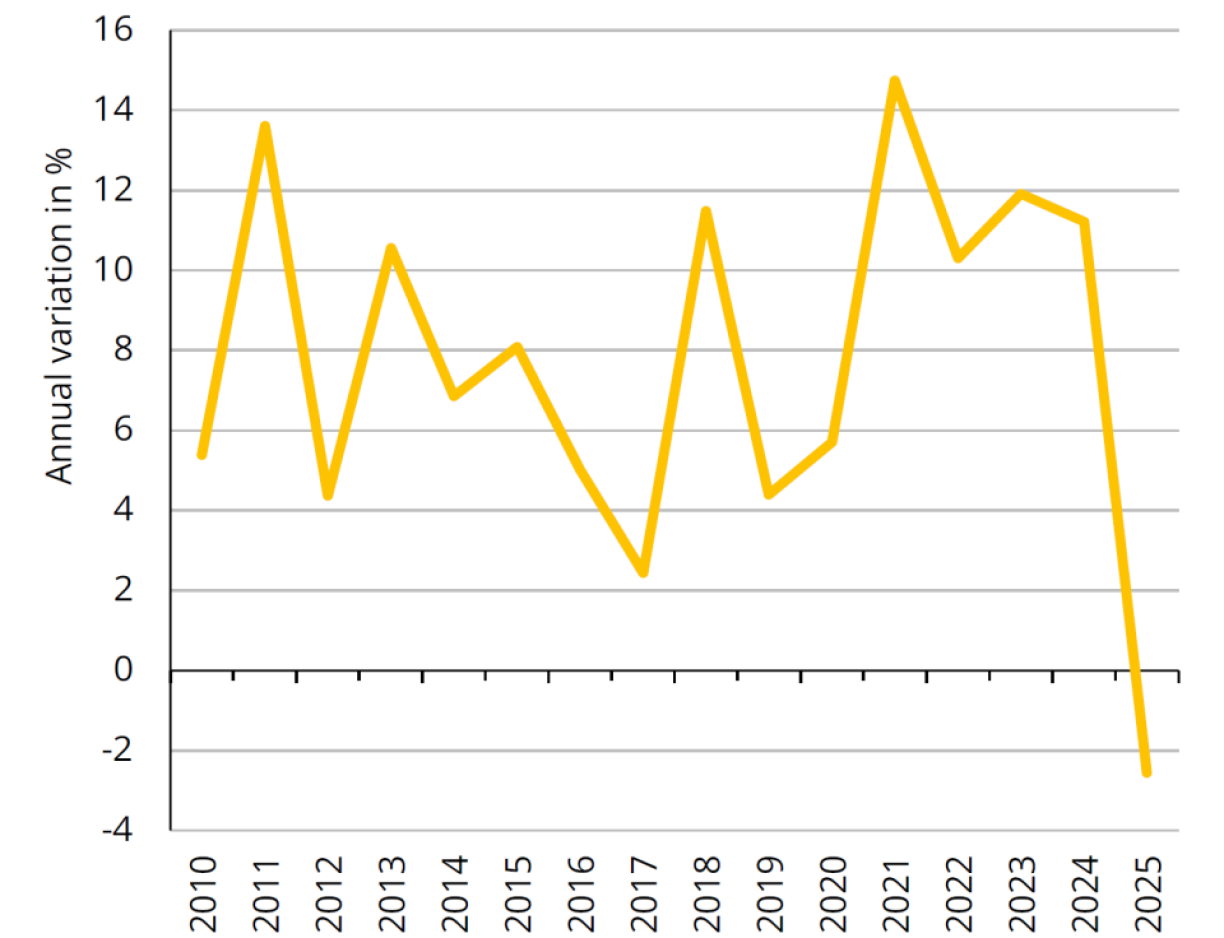

Taxes collected on household income in Luxembourg fell in 2025 for the first time since 2009, ending a 15-year run of annual increases, according to the direct tax authorities and STATEC.

STATEC reports a 2.6% year-on-year decline in household income tax receipts in 2025, after an average annual rise of 8.4% over the previous 15 years. Withholding taxes on wages and salaries continued to increase, but at a much slower pace, up 1.7% year on year, compared with an average of almost 10% a year between 2018 and 2024. The report links the slowdown to weaker employment growth and tax relief measures under the ‘Entlaaschtungs-Pak’ (‘Relief Package’), adopted on 11 December 2024.

The package included an adjustment of the personal income tax scale by 2.5 index brackets, tax relief for tax class 1a, and an exemption for income at the level of the unskilled minimum social wage, STATEC says.

The report also points to a fall in tax collected on capital income as interest rates and bond yields declined. Taxes on capital income fell by 24% in 2025, after rising 33% in 2024. Tax collected on interest fell by 11%, although withholding tax on interest income remained around nine times higher in 2025 than in 2022.

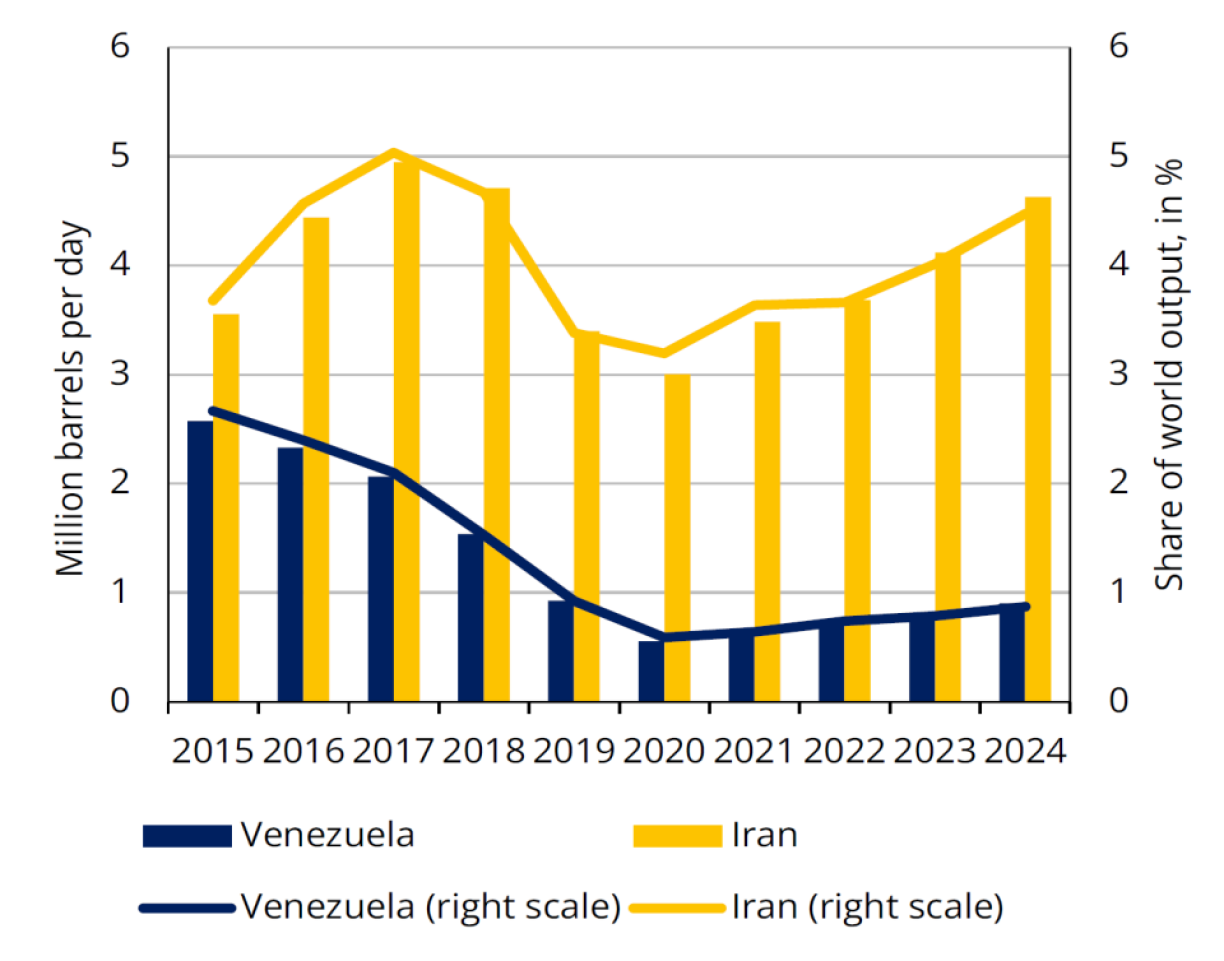

Oil prices rose at the start of 2026, interrupting the broader fall seen in recent months, after the US intervention in Venezuela and renewed threats of action against Iran increased concern about supply disruption.

STATEC notes that Brent crude moved from about $60 a barrel to around $65. The report describes the direct impact from Venezuela as limited because the country now accounts for less than 1% of global output after years of sanctions. It adds that, although the US administration has urged multinational oil companies to invest in Venezuelan infrastructure, firms have been reluctant, with some executives describing the country as “uninvestable”.

The greater risk, STATEC adds, lies with Iran. Despite sanctions, Iran accounts for almost 5% of global production and exports most of its oil to China. It also warns that any escalation could affect shipping through the Strait of Hormuz between the Persian Gulf and the Gulf of Oman, a route used for roughly one fifth of the world’s oil.

If those risks do not materialise, STATEC points to the International Energy Agency’s expectation that oil markets could return to oversupply in 2026, as they were in 2025.