Starting 2024 with a tax cut: the ‘tax gift’ promised by Luxembourg’s new government is about to become a reality. The bill to adjust the tax scale by an additional 1.5 index brackets from 2024 was submitted to the Chamber of Deputies a few days ago. In tandem with the 2.5-bracket adjustment decided by the previous government, the tax scale will be adjusted by a total of four brackets.

In practical terms, from 1 January 2024, individuals will benefit from tax relief. Their loss of purchasing power due to ‘cold progression’, which until now has been caused by the tax scale not being adjusted, will thus be partially offset.

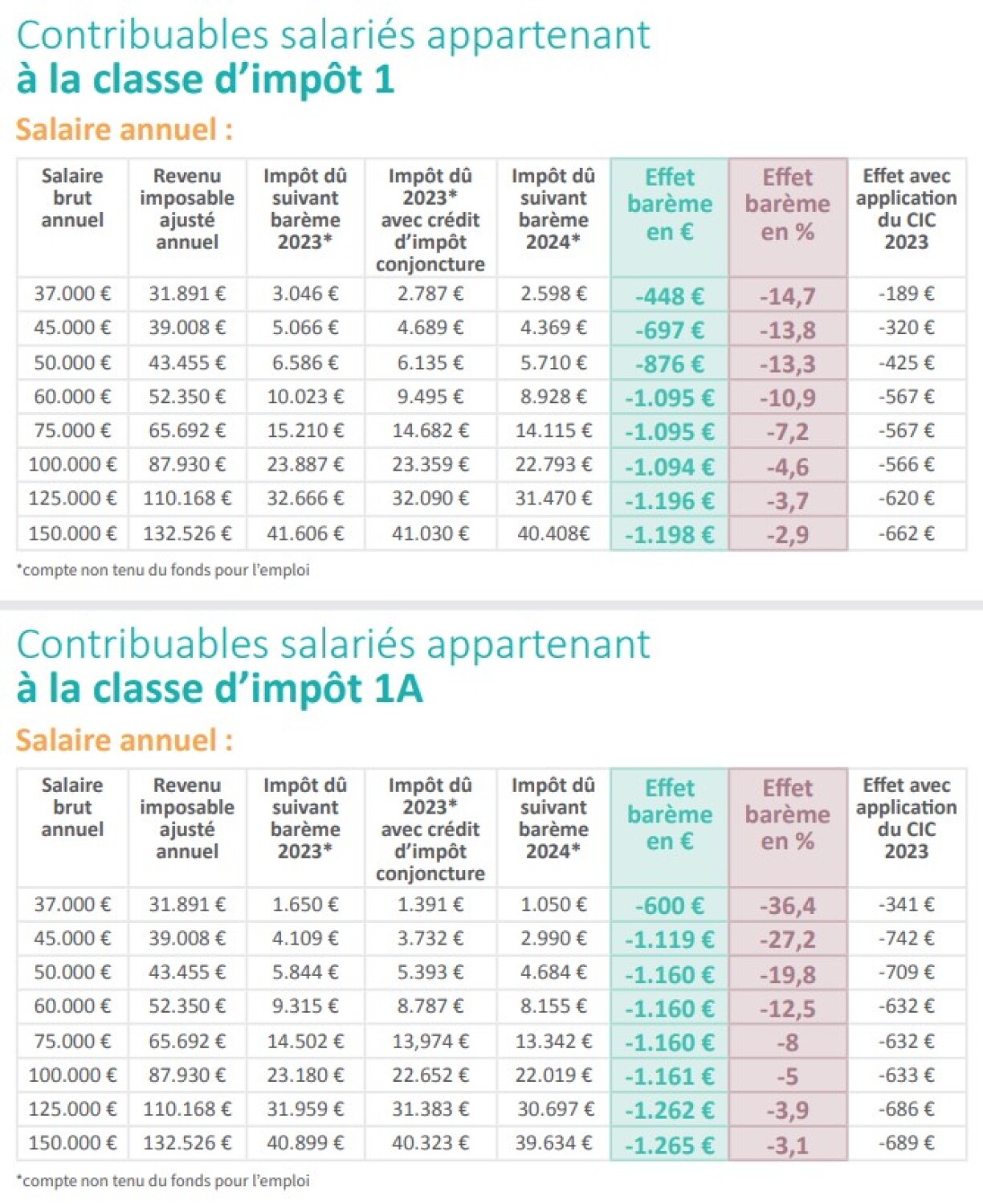

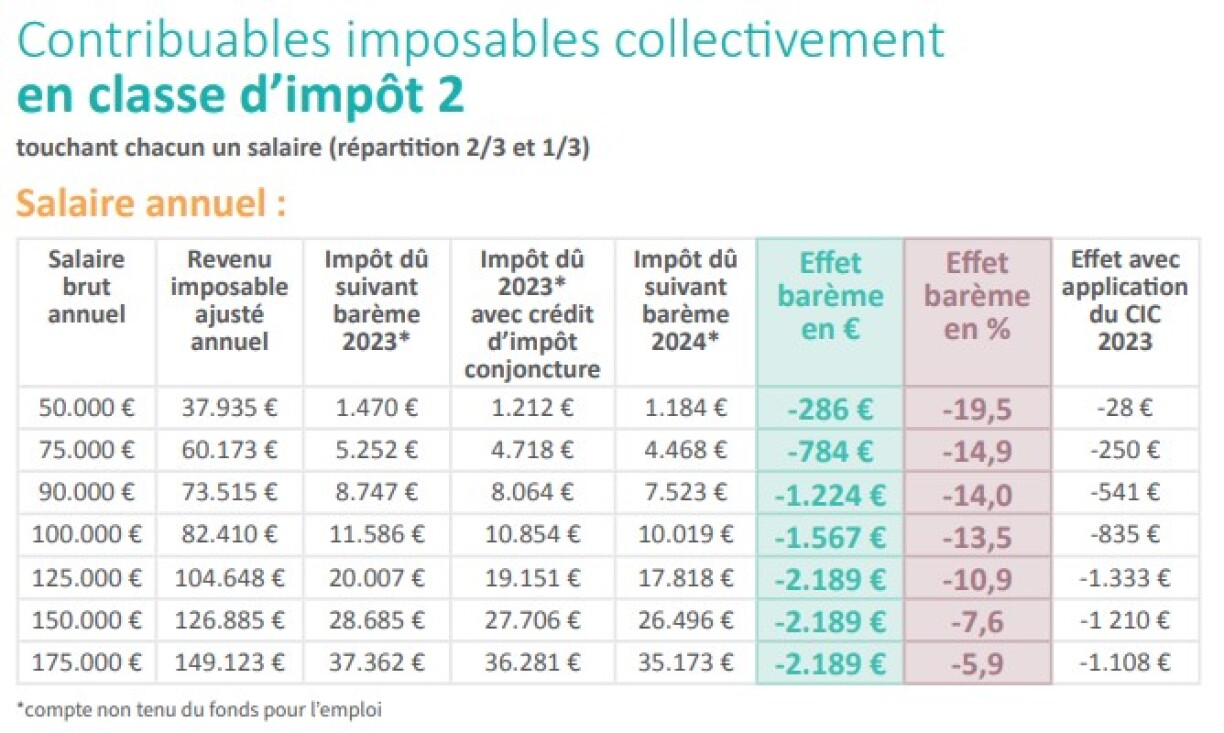

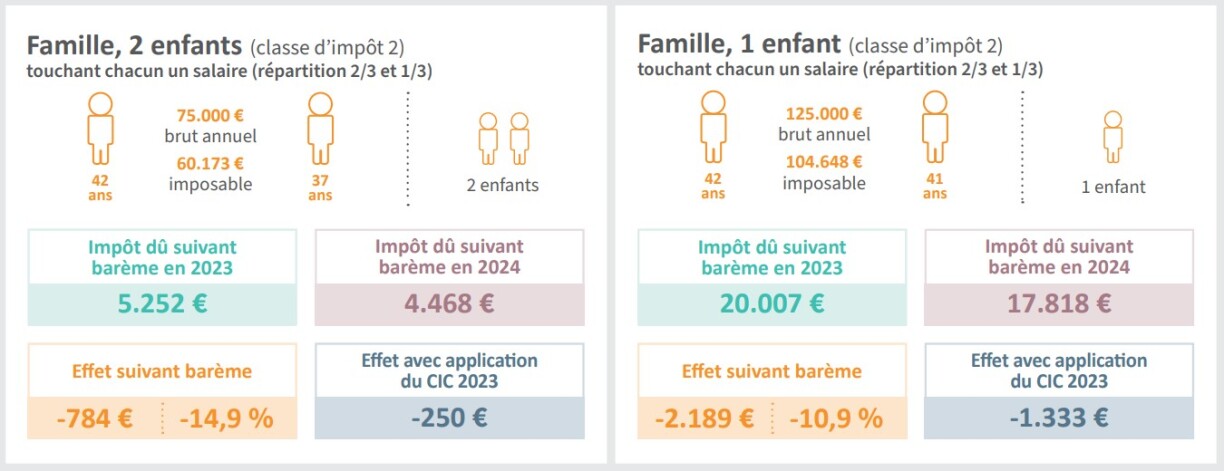

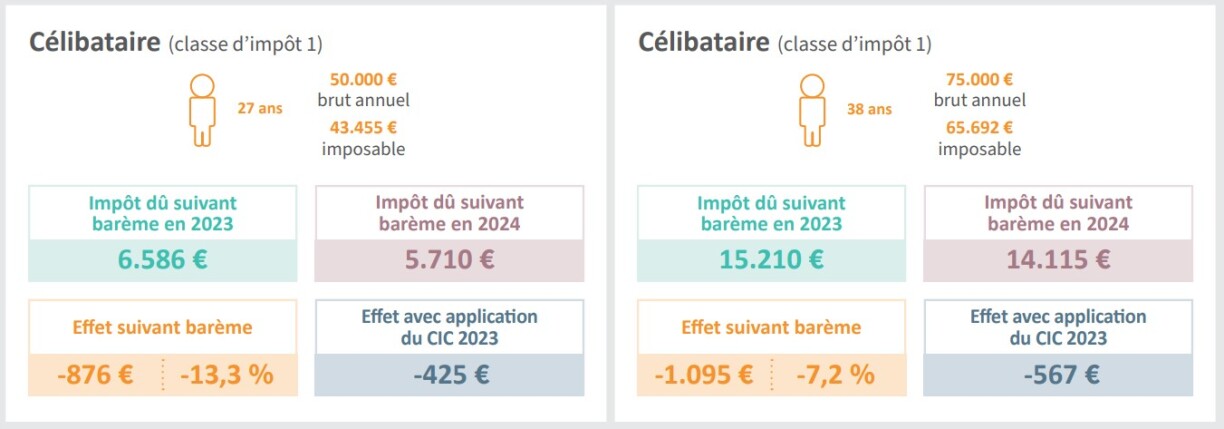

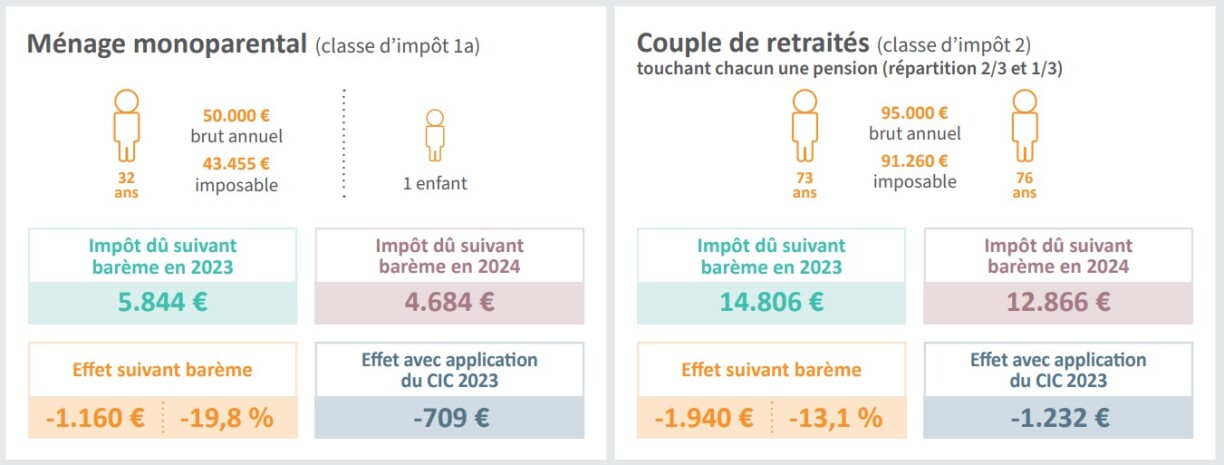

On Thursday, the Ministry of Finance released a series of examples to help the public better understand what this means. Through these examples, it should be possible for everyone to determine how much their take-home pay will increase once the adjustment comes into force.

Here are the examples:

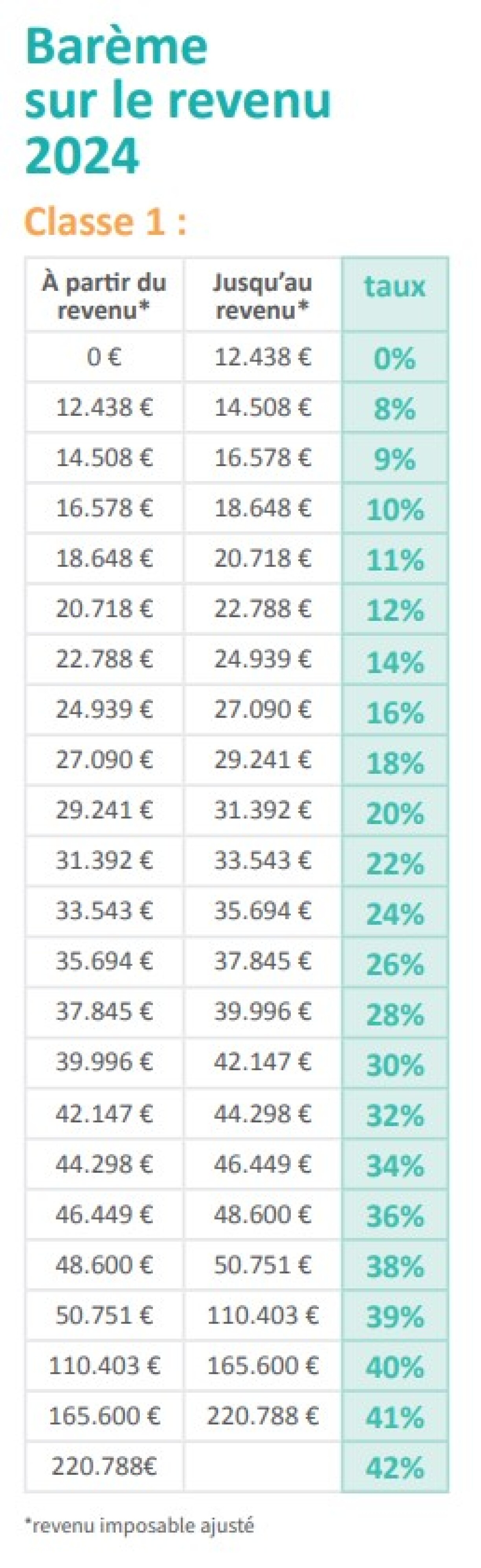

In short, according to the bill, the first income bracket, at which tax is payable, will rise from the current 11,265 euros to 12,438 euros. The basic rate will then look like this: on the bracket from 12,438 to 14,508 euros gross per year, the tax rate will be 8%.

On the next bracket up to €16,578 the tax rate will rise to 9% and so on. The 39% rate will apply to the bracket from €50,751 to €110,403. From 1 January, the maximum tax rate of 42% will apply to incomes of €220,788 instead of the current €200,004. The CSV and the DP have decided not to raise the maximum tax rate, in order to remain attractive in comparison with other countries.

A family with one child and a gross annual salary of 45,000 (partner 1) plus 36,000 euros (partner 2) would have 645 euros more net. A single parent with one child earning 50,000 euros would have 755 euros more net.

For a single person with a gross annual income of 60,000 euros, the tax reduction would be just 705 euros. For a single person earning just 36,119 euros a year, the gain is considerably less, at 285 euros.

This new adjustment will, of course, represent a loss of revenue for the State, estimated at 180 million euros. The total adjustment to four additional index brackets will represent a tax loss of 480 million euros, according to the bill.

The new government is determined - if it is fiscally possible - to bring the scale into line with overall inflation over the next few years.

The last government had already decided on other measures to mitigate the impact of inflation. Among other things, the ceiling on deductible interest on home loans was raised, and the CSV-DP government wants to raise this ceiling even further for its own housing initiatives.

Since 1 January 2017, eight index brackets have been eliminated. The tax scale was last adjusted in the 2017/2018 tax reform.