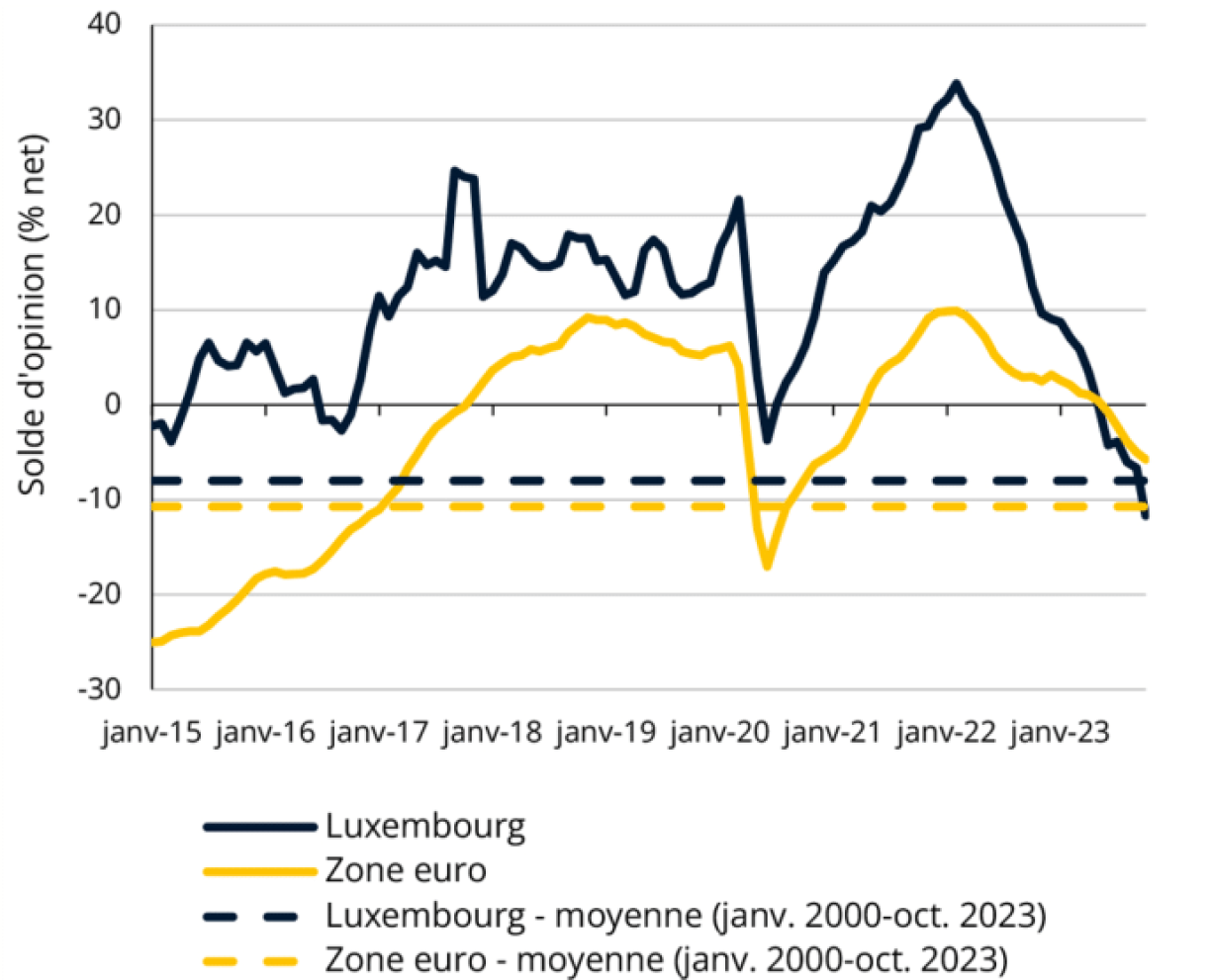

The construction sector has been witnessing a prolonged decline, reaching a disconcerting juncture in November 2023 not seen since the financial crisis of 2009. STATEC’s monthly publication on Luxembourg’s economic state underscores the severity of the situation, noting that the confidence indicator has been consistently below its long-term average since August, hitting levels last observed during the Covid-19 crisis.

STATEC highlights that the decline in Luxembourg’s construction sector is more pronounced than in the broader eurozone.

With the exception of Germany, Luxembourg is the country in the eurozone where the construction industry experiences the greatest difficulties. The sector’s gross value added dropped by nearly 12% year-on-year, compared to 2.5% for civil engineering and building work. This stark difference is attributed to the decline in new building projects, on which the construction sector depends.

The adverse impact on employment in the construction sector is substantial, with continuous job losses since spring. STATEC forecasts a 2.7% decline in salaried employment in October 2023, surpassing the contraction witnessed during the 2009 financial crisis.

Luxembourg joins Italy, Lithuania, and Estonia as one of the four eurozone countries experiencing a decline in construction employment during the second quarter of 2023. Additionally, STATEC notes a concerning 45% increase in individuals registered with the National Employment Agency (ADEM) in the construction sector, indicative of low demand for labour.

Housing: The overarching crisis

In the space of a year, the rate of investment in construction has fallen by 3%, contrasting with rising investment in other sectors.

Property transactions have plummeted by almost 50%, with an even steeper 70% decline for flats under construction. This decrease in demand is attributed to the surge in interest rates.

As a natural consequence, property prices have fallen by 6.4% in one year, causing a corresponding decline in mortgages in the third quarter of 2023. STATEC’s assessment concludes on a sombre note, stating that “banks do not expect a turnaround towards the end of the year,” leaving uncertainty looming over the conclusion of 2023 and casting shadows on the outlook for 2024.