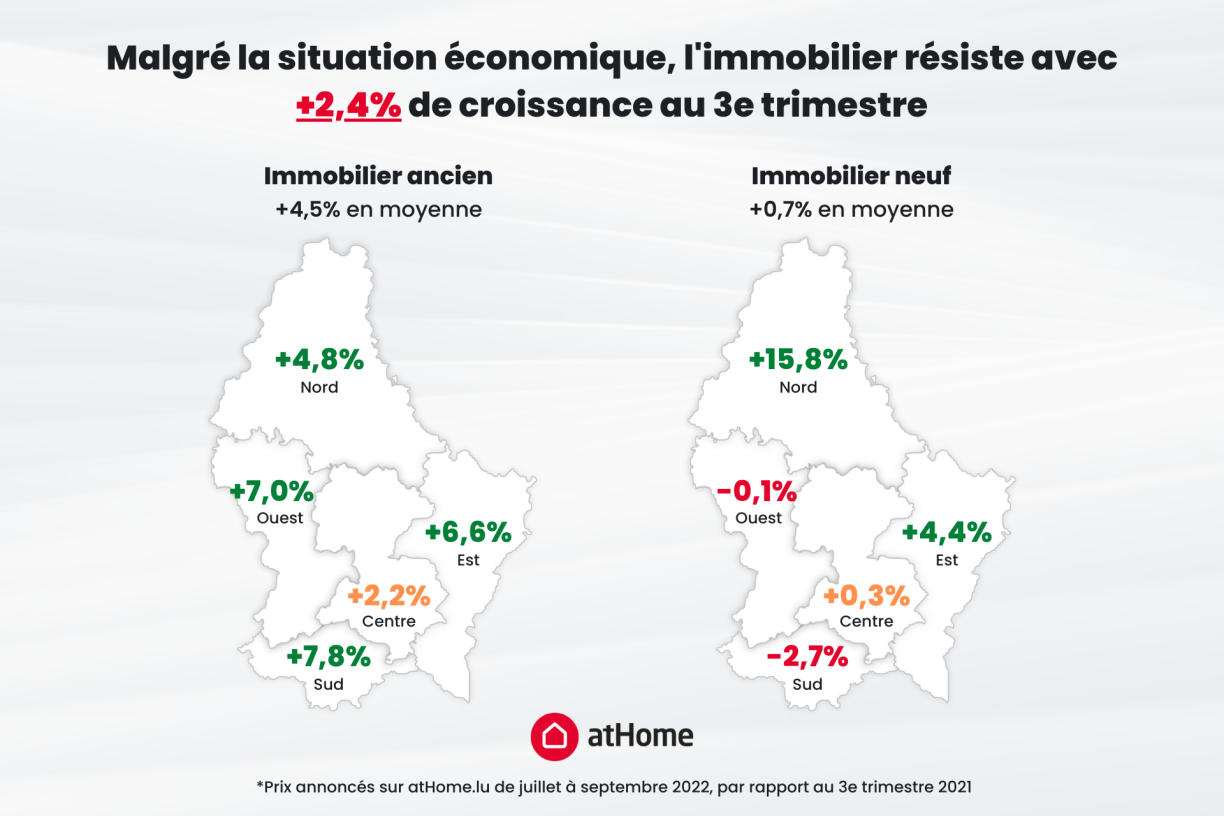

Overall prices continue to increase in the third quarter of 2022 comparted to the previous year. However, the situation is very different in some parts of the Grand Duchy, according to atHome Group.

It is not all fairytales: The prices for new and old houses continue to increase by 5.2% and 4%, respectively, as is the same for old apartments (5.9%). New apartments, surprisingly, are seeing a price change of -1.1%. These are averages established over the entire country.

Concretely, the price of new apartments has fallen in three out of five regions: the centre, south and west. The atHome group points to a 6.4% drop in the south. In the center and the west, prices fell by 2.1% and 2% respectively - a situation that has not been visible in the Grand Duchy for the last decade.

As a disclaimer, atHome Group’s numbers are the ‘advertised’ prices. Only the Housing Observatory Luxembourg has access to the final prices, as it centrally collects all data.

However, in the case of new real estate, it is rare for the price to be renegotiated. Barring major changes or a construction price indexation clause, new apartments are often purchased at the advertised price. In this case, the data from atHome Group is therefore relatively reliable.

Speaking to our colleagues at 5minutes, Yann Gadéa, head of finance consultants at atHome, explains that the Luxembourg market has become “a buyer’s market”. Buyers can more easily negotiate prices than those who rent.

With regards to new properties, Gadéa confirms that developers are taking rising indexation into account. Other practices have also emerged, like offering indoor parking spaces with the purchase of a new apartment. All to make a purchase more attractive.

The interest rates by Luxembourg banks are much higher than at the beginning of the year, specifies Gadéa: “With fixed rates over 30 years we are between 3.9%-4.2%, while the variable rate is around 2.2%.”

Read also: “Never before have so few building permits been issued”

To really draw conclusions we will have to wait for the final figures from the Housing Observatory, which are published at the end of the year. Then we will know how the market has evolved over the third quarter of 2022.

And if the decline is not yet substantial, the increase in interest rates by the European Central Bank could have a significant impact on the borrowing capacity of all buyers in the Grand Duchy.

It is therefore a safe bet that this will affect the figures for the last quarter of 2022.