Characterised by “adjusted” selling prices, stabilising rents, and a notable decline in interest rates, the property landscape suggests a gradual resurgence. AtHome’s latest report anticipates a transitional phase in 2024, with a more robust recovery projected for 2025.

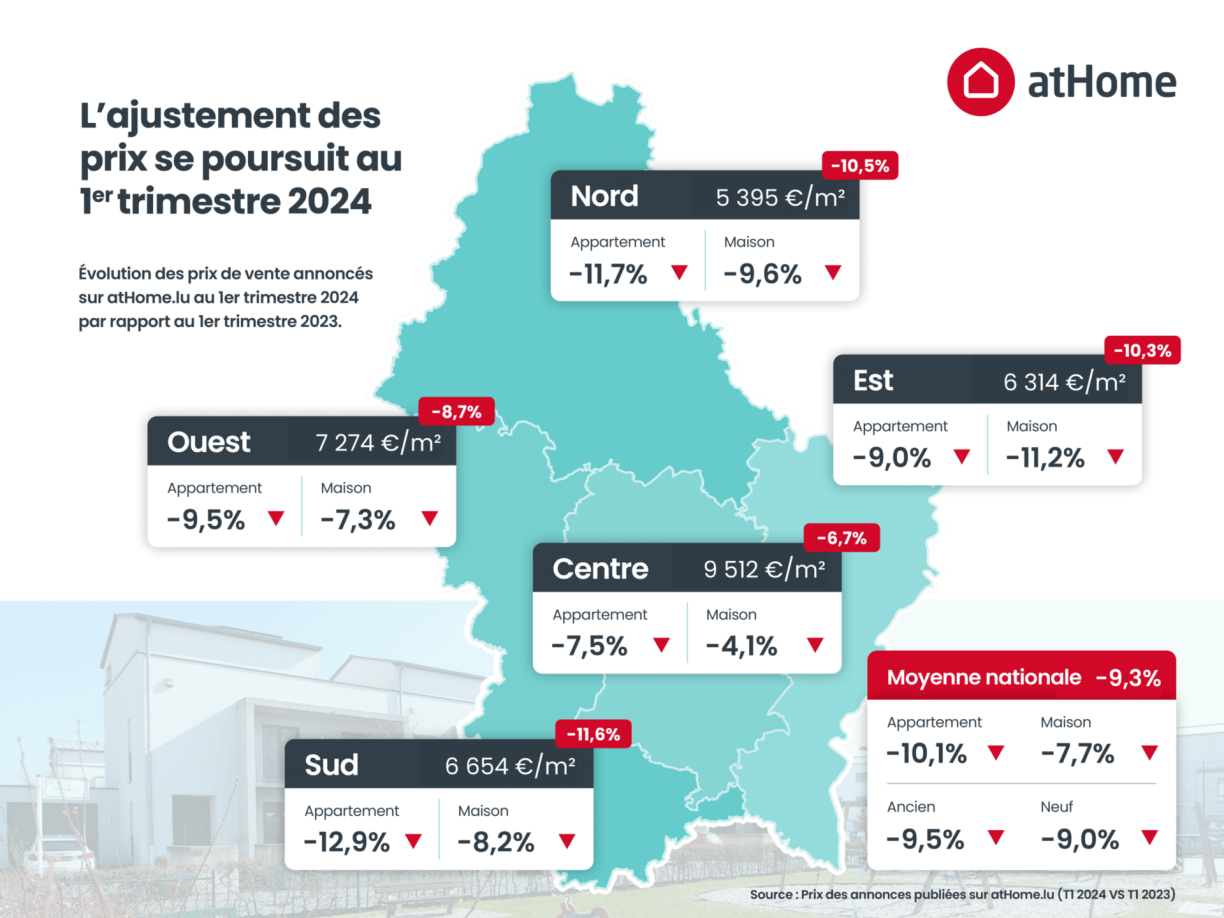

The first quarter of 2024 witnessed a trend of price adjustments across all regions of Luxembourg. Data indicates a general decrease in prices, averaging around -9.3%. Notably, flats experienced a more pronounced decline at -10.1% compared to houses at -7.7%.

Here is a breakdown of prices per square metre and their evolution by region in Q1 2024, compared to Q1 2023:

Centre: Average price of €9,512/m², with a moderate decrease of -6.7%. Flats registered a -7.5% adjustment, while houses saw a milder decline of -4.1%.

North: Average price of €5,395/m², with a more substantial decrease of -10.5%. Flats recorded a decline of -11.7%, while houses experienced a reduction of -9.6%.

South: Average price of €6,654/m², reflecting an 11.6% decrease. Flats observed a decline of -12.9%, whereas houses contracted by -8.2%.

East: Average price of €6,314/m², with a notable adjustment of -10.3%. Flats and houses witnessed declines of -9.0% and -11.2%, respectively.

West: Average price of €7,274/m², indicating an average adjustment of -8.7%. Flats and houses experienced declines of -9.5% and -7.3%, respectively.

AtHome underscores that the decline in prices intensified throughout 2023, eventually plateauing towards the year’s end and into early 2024. This alignment of price adjustments with increased market activity signals a promising trajectory for transactional recovery.

The rental market in Luxembourg demonstrates a trend towards stabilisation, with a notable but moderate 1.7% increase in rents on average during the first quarter of 2024.

AtHome notes a deceleration in the pace of rent hikes, signalling a potential shift from renters back to buyers in the housing market. This contrasts with the previous trend of a substantial transition from buyers to renters: “This time, buyers seem to be returning to the market, and gradually turning away from renting.”

However, the moderation in rent growth varies across property types. While flats experienced a 2.5% increase, rents for houses decreased by 6.2%.

Here is a breakdown of average rents and their annual changes by region:

Centre: Average rent of €2,101, reflecting a modest increase of 0.7%. Notably, flat rents increased by 1.6%, whereas house rents sharply declined by 9.8%.

North: Average rent of €1,462, indicating a noteworthy increase of 5.1%. Flats witnessed a substantial increase of 6.0%, while house rents slightly decreased by -1.0%.

South: Average rent of €1,581, with a growth of 2.9%. Flat rents rose by 3.3%, while house rents declined by -3.3%.

East: Average rent of €1,812, marking a moderate increase of 1.9%. Flats experienced a significant rise of 6.3%, contrasting with a sharp decline of -10.5% for houses.

West: Average rent of €1,932, with a slight increase of 2.0%. Flat rents saw a modest increase of 1.2%, while house rents rebounded with a notable rise of 6.2%.

In a positive development for potential property buyers, interest rates are finally witnessing a notable decrease, marking a significant shift from the upward trajectory observed in previous years. This news comes as a relief, especially considering that interest rates had tripled by 2022, reaching levels between 4.5% and 5%.

According to AtHome, this recent drop in interest rates represents the most substantial decline in the property market since the onset of the crisis. “Some banks are even offering very aggressive promotional deals, with rates dropping below 3.5% on certain applications,” AtHome reports.

The central banks and Luxembourg’s banking institutions are optimistic about further reductions in interest rates in the upcoming months. This forecast bodes well for accelerating the recovery of the property market, with projections indicating a potential rebound by 2024-2025.