The property sector went through a challenging period in 2023, primarily attributed to the surge in interest rates, which substantially impacted activity within the Luxembourg residential property market. This diminished activity, combined with a decrease in purchasing power among households and investors, contributed to a widespread reduction in property prices across the country.

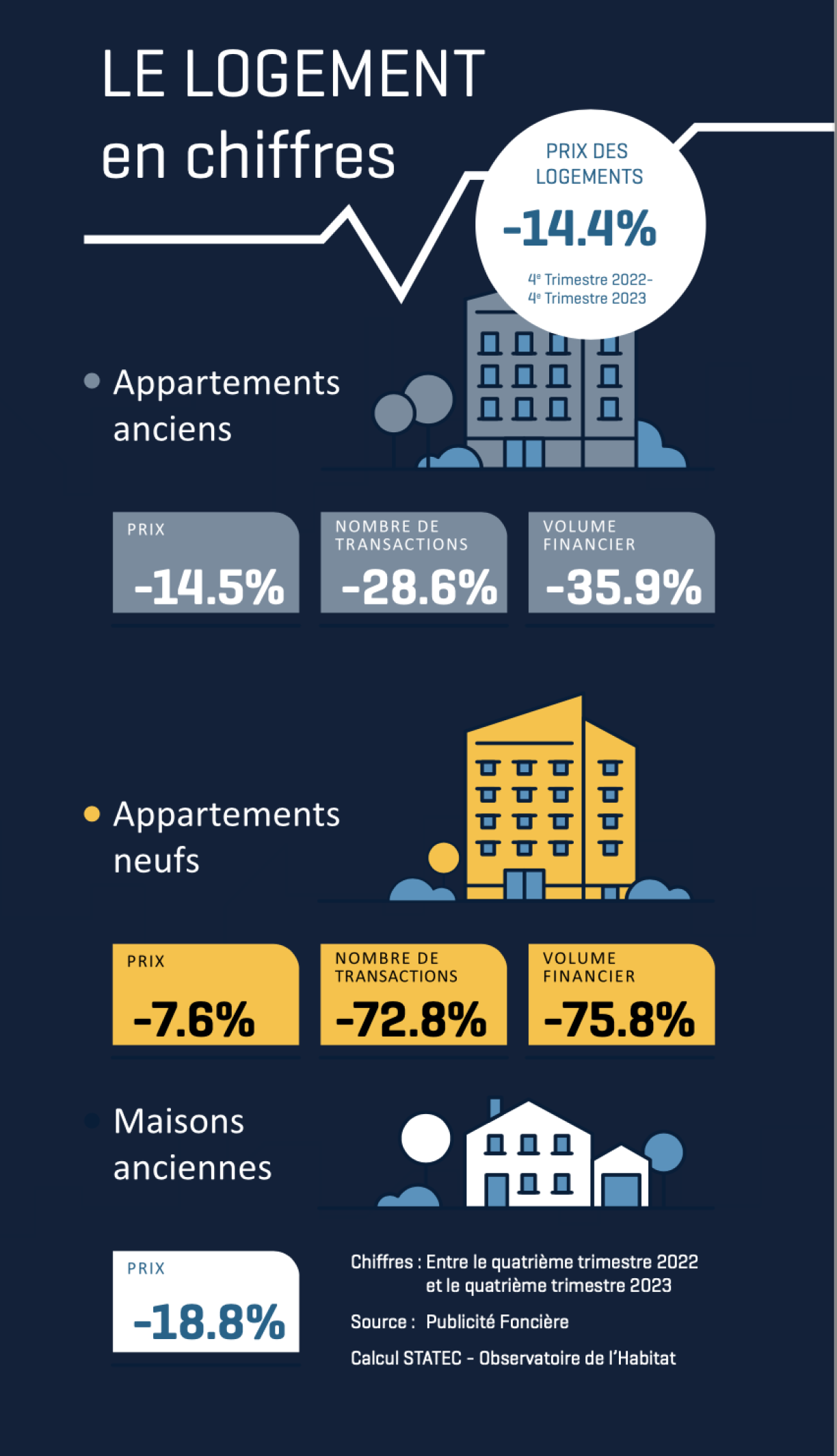

According to the latest data from the Housing Observatory, residential property values depreciated by an average of 14.4% over the course of 2023. The existing property market experienced the most substantial declines, with flats decreasing by 14.5% and houses by 18.8%.

In the new-build market, the adjustment primarily manifested in business volumes, plummeting by 72.8%. However, the price of VEFA properties (vente en l’état futur d’achèvement, or “sale in future state of completion”) only saw a modest decline of 7.6%. It is worth mentioning that sales in this segment totalled just 106 in the final quarter of 2023.

These figures hardly come as a surprise to industry experts or homeowners who attempted to sell their properties last year. The surge in interest rates translated to a 30% decrease in household purchasing power.

This estimation underscores the disparity between the actual decline in prices and the financial capacity of potential buyers. A panel of experts recently estimated that a further decrease of “at least 10%" in property prices would be deemed desirable in 2024.

After a brief plateau in the third quarter of 2023, rents began to rise once more towards the year’s end, registering a 3.9% increase over twelve months, surpassing inflation, notes the Housing Observatory.

This recent uptick in rental rates can be attributed to a “notable surge in rental demand.” The escalation in interest rates prompted many residents to postpone their plans to buy property.

This escalating demand is further straining an already saturated market, and the scarcity of new construction projects may exacerbate the situation in the forthcoming months.