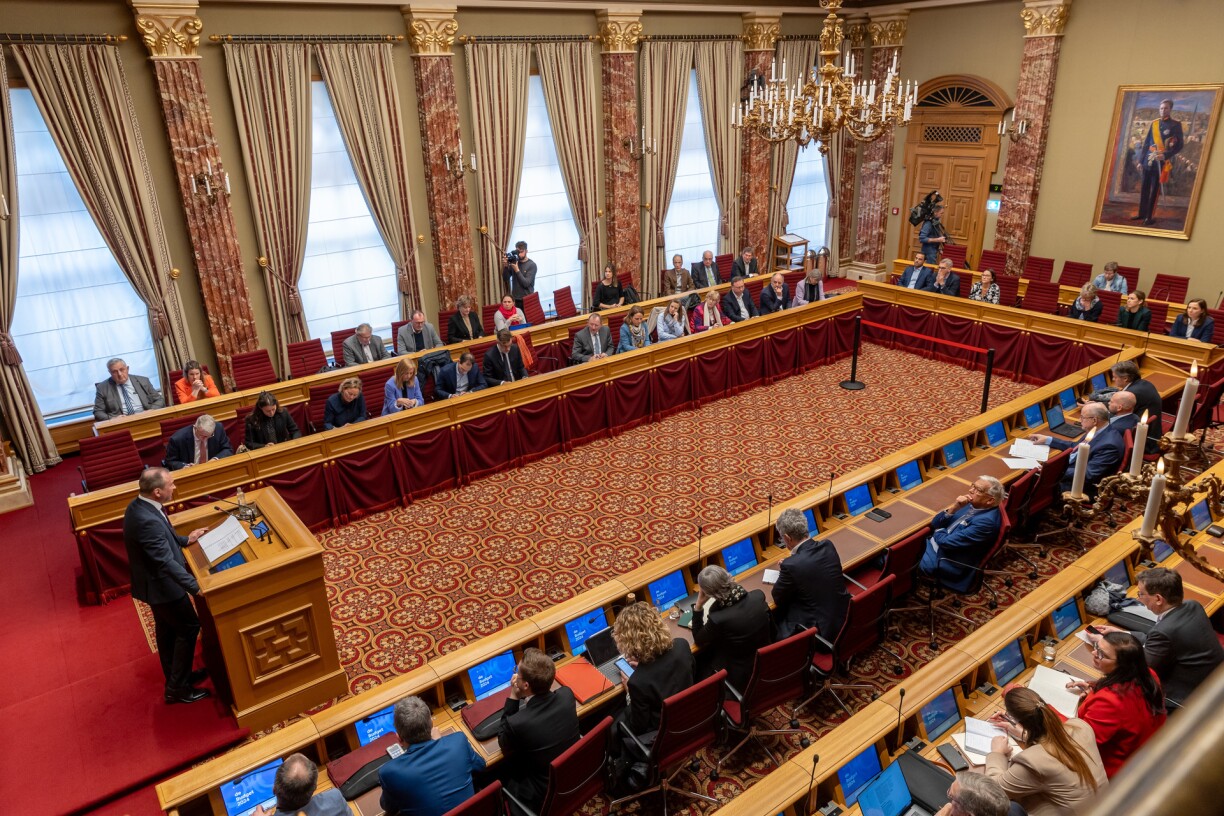

In his hour-long presentation, Minister Roth emphasised the resilience of Luxembourg’s economic foundations despite challenging global circumstances. The budget, exceptionally covering the period from May to December 2024, focuses on optimising current expenditure, initiating strategic investments, and implementing targeted tax adjustments.

Central to the government’s objectives is the restoration of confidence among businesses and citizens alike. Minister Roth underscored the importance of safeguarding the future prosperity of the nation, stating, “It is our duty not to mortgage the future of future generations.”

One of the primary goals of the stimulus budget is to boost the purchasing power of households. Measures include the continuation of adjusting the tax table to wage indexations and providing support for single parents and widows in tax bracket 1a. The budget also accounts for already enacted adjustments to the tax scale, accommodating four wage indexations.

The budget allocates substantial resources towards infrastructure development, digital innovation, and the fight against climate change. Notably, €4.3 billion will be invested in rail and road projects (widening of the A3 and A6, Dippach and Hosingen bypasses, Ban de Gasperich, etc.) over the next four years, with a focus on key initiatives such as the widening of major motorways and enhancements to public transport infrastructure.

Additionally, the government aims to bolster the competitiveness of Luxembourg’s economic landscape by reducing corporation tax by 1% by 2025. This measure is part of a broader strategy to enhance the country’s attractiveness to investors while fostering social cohesion and addressing housing sector challenges.

The measures already announced by the government to boost construction and investment in housing are included in the new budget. Acknowledging the evolving dynamics of the housing market, Minister Roth emphasised the shifting focus from supply shortages to a notable decline in demand. He underscored the magnitude of the housing construction challenge, characterising it as “the biggest challenge faced by our country at this time.”

The budget reflects a commitment to bolstering construction and housing investment initiatives, with significant financial allocations earmarked for these purposes. State revenue is expected to decrease by €130 million due to these measures, while credits for individual aid from the Ministry of Housing are set to increase substantially from €48 million in 2023 to €95 million in 2027. Additionally, the government plans to make substantial investments in buying out construction projects, with funding projected to increase from €110 million to €480 million between 2024 and 2027.

Minister Roth further announced a 2.7% increase in excise duty on tobacco products. Despite this adjustment, Roth reassured that the measure would not compromise the industry’s competitiveness. Furthermore, the budget outlines plans to introduce new excise duties on electronic cigarettes and nicotine sachets in the near future.

Contrary to earlier projections by the Inspectorate General of Finances indicating a budget deficit of €3.6 billion for the central government (excluding local authorities and social security funds), the final figure stands at €1.9 billion.

Minister Roth affirmed previous announcements made on RTL, emphasising forthcoming savings in current expenditure and operating costs. The government’s strategy involves moderating spending growth, aligning it closely with revenue growth by 2024. Optimistically, the government anticipates a reversal of the negative “scissors effect,” with revenues expected to outpace expenditure in 2025.

Under the previous DP-LSAP-Greens government from 2018 to 2023, public debt experienced a continuous upward trend. Projections indicate that public debt will increase from €22.2 billion (26.5% of GDP) in 2024 to €26.5 billion (27.3% of GDP) in 2027, with efforts aimed at stabilising public debt relative to GDP over the legislative period.

Although the recruitment drive for state personnel remains robust, the pace of growth is expected to moderate compared to previous years. Minister Roth highlighted priority areas for recruitment, including the police, national education, and the military. However, he cautioned that finding qualified individuals to fill these positions may pose challenges.

The expansion of the state workforce has been significant, with 6,555 new positions created in Luxembourg between 2020 and 2023. Despite this growth, nearly 1,800 positions remained vacant by the end of 2023, underscoring ongoing recruitment needs. The budget allocation for state personnel has increased substantially, reaching over €7 billion from €4.2 billion in 2018.