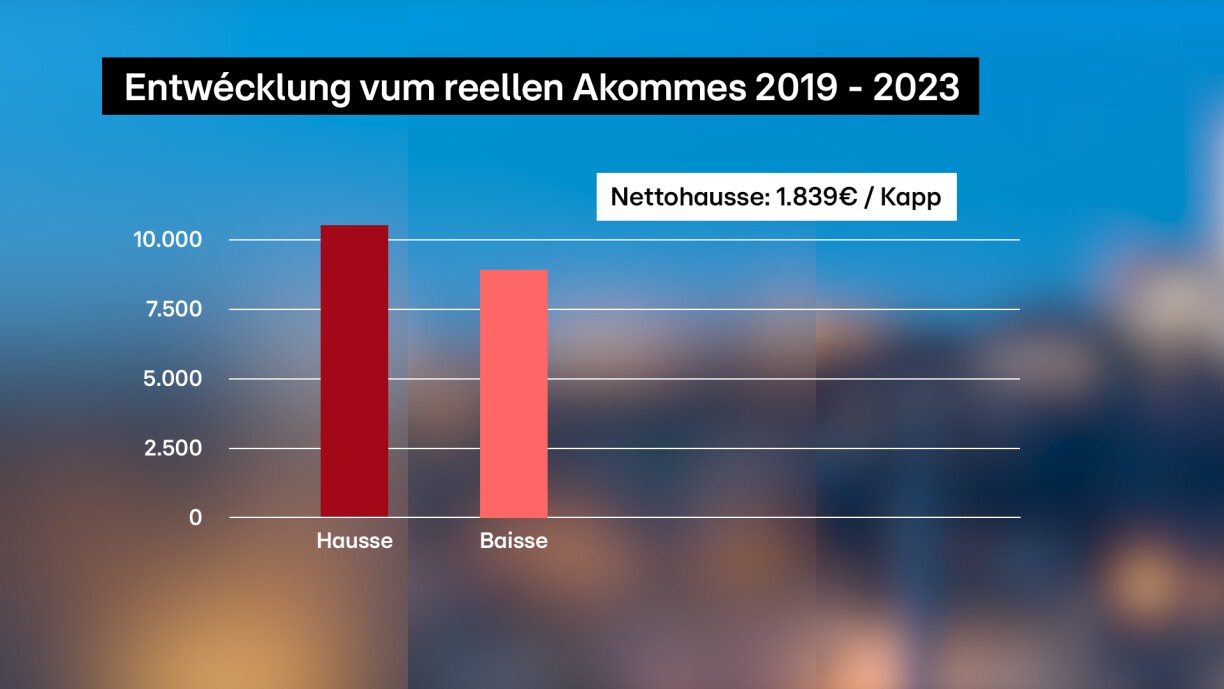

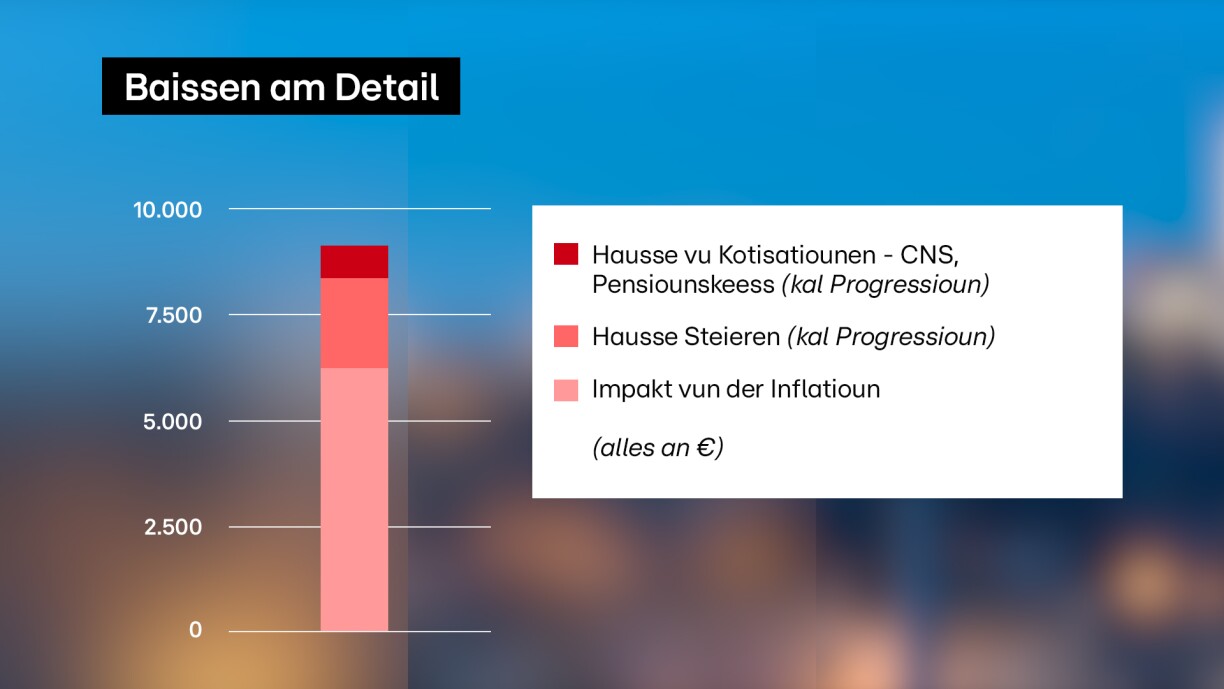

However, their analysis also shows that the revenue increase through indexation has not been enough to cover the loss of purchasing power due to significant inflation.

Disregarding indexation, salaries have still increased

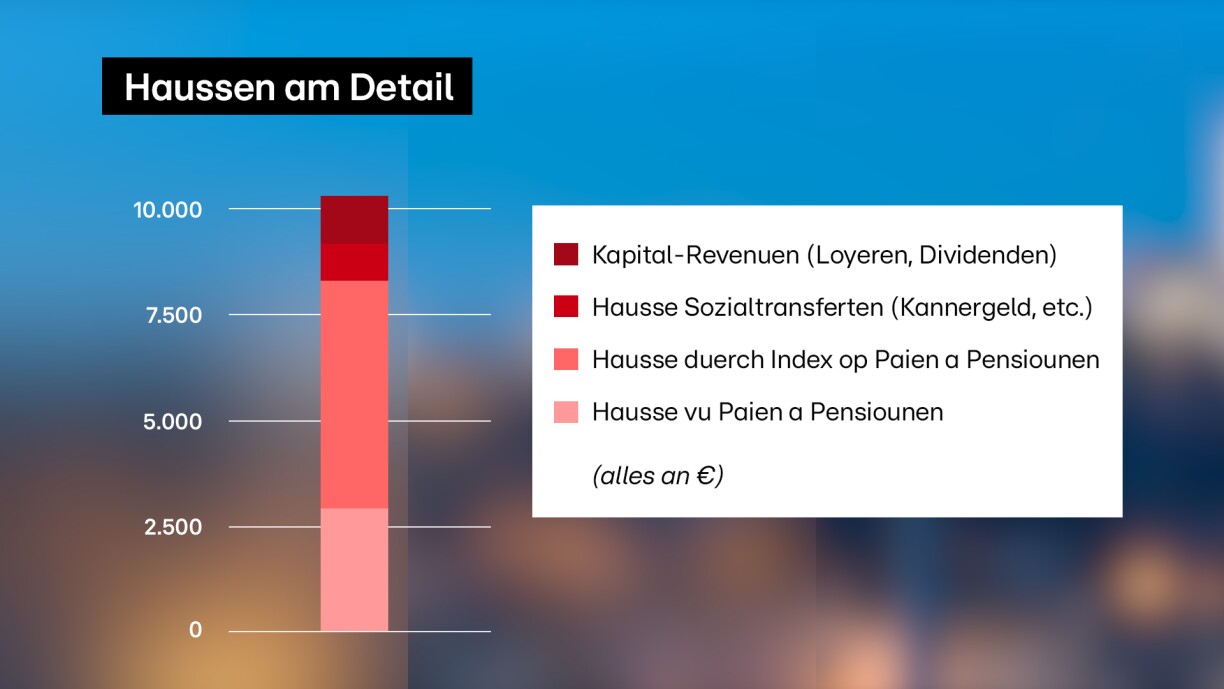

Real disposable income increased, as salaries increased on their own, on top of the indexation boost. Per person, this increase comes out to €3,000, spread across the four years since 2019.

These calculations are based on real data from the internal revenue office and the General Inspectorate of Social Security. Therefore the fact that the tax rate is not adapted for the index rate is taken into consideration. Increased salaries also lead to more taxes. Furthermore, the number of people in employment has gone up, in turn leading to more people being taxed on their salaries.

Not the same increase for everybody

Analysing the situation per household, Statec comes to the same conclusion. Over the past four years purchasing power rose despite inflation. This is true, on average, for all Luxembourgish households but also on average for the different revenue categories.

Tom Haas from Statec explains: “For households with the smallest income, their purchasing power increased by around €400. Jumping into the next category purchasing power increased by €1,700. For households in the top bracket, their power increased by over €7,000 compared to pre-pandemic times.”

Tripartite corrective measures worked on small revenue households

These increases reflect the corrective measures taken by the different tripartite meetings that took place over the years.

“Without these measures, we would have observed a real loss in purchasing power, especially for the poorest households. 20% of Luxembourg’s poorest households would have lost purchasing power. The rest would have gained power compared to 2019, but not as much. So, the tripartite measures had a positive effect on every household in Luxembourg.”

The difference is that on a higher salary, a new indexation translates to a bigger salary increase than those with lower salaries.

Households on lower incomes are still struggling

However, the main reason why families with a lower income are struggling to make ends meet is due to high rent prices.

When weighing the inflation basket of goods and services used to calculate the index, housing costs now make up around 16% of the total, including housing-related costs such as electricity, heating, and water. Furthermore, Tom Haas explains that the evolution of rent prices is not taken into consideration when calculating the index.

Basket of goods and services does not reflect real spending

The most recent data shows that households with lower salaries spend more of their income in order to be able to afford their rent. In 2019, households in the lowest quintile spent about 50% of their budget on rent. A category above that, households spent about 36% of their income for rent. Compared to the 16% that are intended for that purpose, it represents a big difference.

It is only among the 20% of richest households, that rent prices or mortgage payments make out less than 20% of their budget. Therefore, the weight that housing costs have in the basket of goods and services used to calculate the index does not correspond to households’ real expenditure.

Housing costs increased greatly

Tom Haas says new rents have increased by over 11%, whereas older existing contracts have risen by 7% since 2019. However, when considering income development over the same time period, Haas says the real increase represents around 17%.

For a longer-term comparison - disposable income has risen by just 36% since 1995, compared to the 77% increase in rent prices. Haas says in real terms, this represents a whopping increase of 175% in rent costs over the past three decades.

What is the impact of the interest rate increase?The European Central Bank keeps raising base interest rates, meaning that taking out a mortgage payment for a house or an apartment has also become much more expensive. But Statec is taking this into consideration.“This has a big impact on a few select households. Those that took out a loan with a floating interest rate, can spend up to to 3,000 or 4,000 euros more per month. But they do not have a big impact on the average.”

Glossary

Real income or real disposable income means the income minus household expenses. On one hand there are salaries or pensions, social benefits, capital income such as rents or dividends; while on the other hand this takes into account health and pension contributions, taxes, and the impact of inflation.

Purchasing power describes what a household can afford based on real income.

The cold progression in the tax table occurs when the salary increases through the index, and as a result the rate at which it is taxed rises, because the tax table rates are not adjusted to inflation.

The quintiles are a system for dividing households into five equally large groups (20 percent each). Namely, the 20 percent of households with the lowest income, the 20 percent with the second lowest income, and so on. The threshold between the first and the second quintile currently sits at an income of around 2,600 euros per month, per person. A salary of 3,600 euros places the earner in the third or middle quintile. The limit in the fourth quintile is 4,700 euros of income per month and the fifth and upper quintile starts at 6,100 euros of income per person in the household.