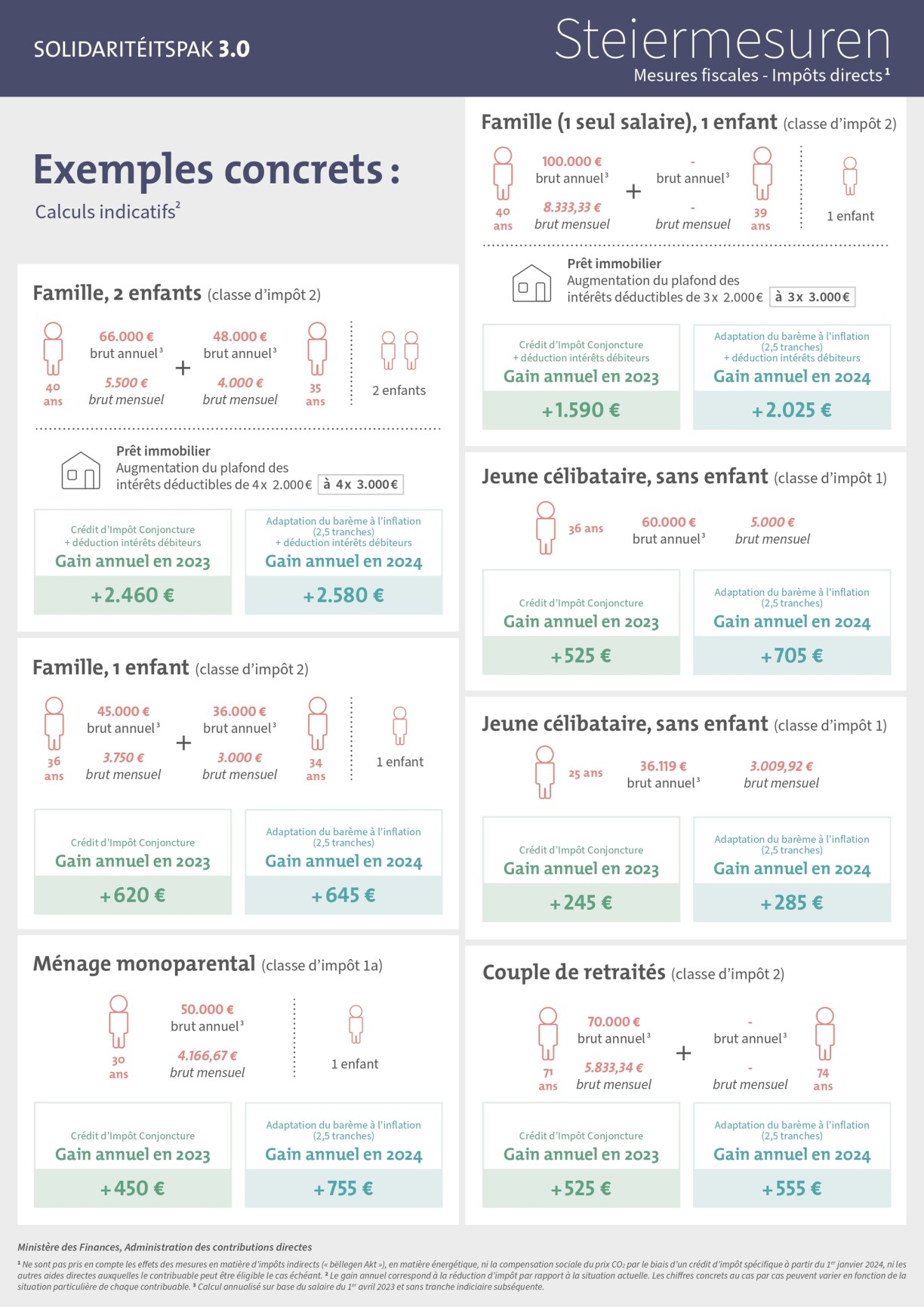

As part of the latest tripartite agreement, the government and the social partners introduced several fiscal measures to relieve households.

These tax measures include a short-term tax credit, an increase in the ceiling on deductible interest, and an adjustment of the tax table to inflation from January 2024.

The Ministry of Finance has just published a document with concrete examples that show how much various households will be able to save in taxes.

Example 1: Family (1 salary), 1 child (Tax Bracket 2)

Household Income

Person 1 (40 years old): €100,000 gross per year (€8,333.33 gross per month)

Person 2 (39 years old): no income

This household has taken out a property loan -> increase of the ceiling of deductible interests from 3 X €2,000 to 3 X €3,000

Tax Savings

Tax credit + interest deduction

Taxes saved in 2023: +€1,590

Adjustment of the tax table to inflation (2.5 index brackets) + deduction of interest expenses

Taxes saved in 2024: +€2,025

Example 2: Family, 2 children (Tax Bracket 2)

Household Income

Person 1 (40 years old): €66,000 gross per year (€5,500 gross per month)

Person 2 (35 years old): €48,000 gross per year (€4,000 gross per month)

This household has taken out a property loan -> increase of the ceiling of deductible interests from 4 X €2,000 to 4 X €3,000

Tax Savings

Tax credit + interest deduction

Taxes saved in 2023: +€2,460

Adjustment of the tax table to inflation (2.5 index brackets) + deduction of interest expenses

Taxes saved in 2024: +€2,580

Example 3: Young single person, no children (Tax Bracket 1)

Household Income

Person 1 (36 years old): €60,000 gross per year (€5,000 gross per month)

Tax Savings

Tax credit

Taxes saved in 2023: +€525

Adjustment of the tax table to inflation (2.5 index brackets)

Taxes saved in 2024: +€705

Example 4: Family, 1 child (Tax Bracket 2)

Household Income

Person 1 (36 years old): €45,000 gross per year (€3,750 gross per month)

Person 2 (34 years old): €36,000 gross per year (€3,000 gross per month)

Tax Savings

Tax credit

Taxes saved in 2023: +€620

Adjustment of the tax table to inflation (2.5 index brackets)

Taxes saved in 2024: +€645

Example 5: Young single person, no children (Tax Bracket 1)

Household Income

Person 1 (25 years old): €36,119 gross per year (€3,009.92 gross per month)

Tax Savings

Tax credit

Taxes saved in 2023: +€245

Adjustment of the tax table to inflation (2.5 index brackets)

Taxes saved in 2024: +€285

Example 6: Single-parent household (Tax Bracket 1a)

Household Income

Person 1 (30 years old): €50,000 gross per year (€4,166.67 gross per month)

Tax Savings

Tax credit

Taxes saved in 2023: +€450

Adjustment of the tax table to inflation (2.5 index brackets)

Taxes saved in 2024: +€755

Example 7: Retired couple (Tax Bracket 2)

Household Income

Person 1 (71 years old): €70,000 gross per year (€5,833.34 gross per month)

Person 2 (74 years old): no income

Tax Savings

Tax credit

Taxes saved in 2023: +€525

Adjustment of the tax table to inflation (2.5 index brackets)

Taxes saved in 2024: +€555