Now that she has passed the age of 40, Christiane* is convinced: “I will no longer be able to buy [property] in Luxembourg, it’s over. Unless I win the lottery or meet a rich sugar daddy,” she laughs.

Christiane* works in a big company in the Grand Duchy. However, this is far from enough to convince the banks to finance her property project.

Like her parents, who thought that renting would only be a temporary step before they could buy, she sees her dream evaporating before her eyes. “My parents could have afforded to buy, but not in the city, it was already too expensive. But they wanted to live in the capital, so they choose to rent,” she explains.

When her father died, her mother remained a tenant. “My mother lived in the same flat for 30 years, because the rent was low. In 2012, she was still only paying €850 for 90m2. It was a 1960s flat, never renovated, with single glazing on the windows,” Christiane* recalls.

Then the owner of the building died, and the heirs split the flats between themselves. According to Christiane*, “they cleared out all the tenants, did some renovations, and more than doubled the rent. Even if they would have offered to move her back in, it would have been too expensive for my mother anyway, so she found another flat, smaller and older, so not too expensive…"

That’s why Christiane* wanted to become a homeowner: “When I saw that, I said to myself, I’m not going to do what my parents did, I want to have my own place, so that I’m not dependent on a landlord who refuses to renovate their flat or who takes advantage of it and charges you more.”

As soon as she finished her studies in 2008, Christiane* started looking for a flat. “I was looking for a flat, ideally a two-bedroom, in the city or nearby,” she remembers. Eventually, she seemed to have struck gold: a flat on Rue de Hollerich, 85m2, €320,000, a loft with a garage… “It had everything I needed,” according to Christiane*. “I went to the bank, telling myself that my full-time job in a large communications agency would help me to convince them,” she explains. The discussion that followed, however, did not go as she expected.

“You are single? But you work in a precarious environment,” the banker told her. “Is that so? I didn’t know that communication was a precarious business,” she replied.

Next question: “Can your parents vouch for you?” Christiane* explains to our colleagues from RTL 5 Minutes that even if her parents had been able to vouch for her, she would not have felt comfortable with the bank having the power to seize their salaries.

Third question: “Can you provide a down payment of €50,000?” Christiane* replied that, no, “not that much.”

At the time, Christian* was earning €2,700 gross. While that was €500 more than the minimum wage, “it wasn’t great for Luxembourg.” As a result, she was told that it would not be possible and that she would have to find something for €220,000 maximum. “But we couldn’t find anything at that price, or if we could then it was at the other end of the country, far from my work and my family,” Christiane* remembers.

After several unsuccessful attempts, she decided to rent a flat – a temporary solution, she hoped at the time. “I had to find a rent that did not exceed 50% of my salary. I struggled for a while but eventually found a flat in Crauthem, €1,040 for 75m2, two bedrooms, and a garage, 15 minutes from the city,” Christiane* recalls. A huge number of people came to see the flat, “it was crazy!” In the end, the owner decided that Christiane*, single, without children, without dogs, but with a university degree and a full-time job in a big company, was the best profile.

Some might wonder if, seeing as she has a university degree, Christiane* has ever considered becoming a civil servant in Luxembourg, a position that not only guarantees a decent salary but is also sure to convince the banks. She smiles and admits she has thought about it. “In terms of professional security and money, yes, of course, it has tempted me. But in terms of personal fulfillment, not at all. I couldn’t see myself in a ministry, and jobs in communications are few and far between anyway. And above all it seems so rigid, so many rules, such a strict hierarchy… I was afraid of becoming jaded at not even 30 years old. I was still very young, I wanted to explore, to have several experiences. Working in the private sector meant that I could interact with clients, go on shoots, etc., it was really exciting.”

And why hasn’t she been able to put money aside, in all these years? “I’ve tried, really. But it’s nothing new that life is very expensive in Luxembourg. All it takes is my car breaking down once and I’m instantly in the red. When I was still with my boyfriend, I was able to save some money, but since I’m single, it’s almost impossible. The breakup alone cost me almost €15,000 since I had to buy new furniture and so on. And for the deposit on my flat, I had to put aside €3,000, plus €1,500 to pay the agency fees…"

It’s not surprising that some people choose to stay a couple for financial security, she adds, “because otherwise life in Luxembourg is much too expensive and difficult. I thought about it, but I preferred to suffer financially. I prefer to have my freedom, even if it means having less money. In Luxembourg, there is a saying ‘ze räich fir ze stierwen, ze aarm fir ze liewen,’ i.e., ‘too rich to die, too poor to live.’”

And what about buying a property to rent out? “First of all, the bank would have to agree, and even if, I had so little financial margin that the slightest problem, e.g., unpaid rent or damage, would have been the end of the matter.”

She cites the example of “wealthy” friends who had bought a beautiful flat to rent out. “They had found a tenant, an executive of a multinational company who was expatriated to Luxembourg for two or three years,” she remembers. While her friends were certain that they had found the “dream tenant,” they were shocked to find the flat completely ruined when he left. “The floor and walls were ruined, and as he had gone back to the United States, it was impossible to make him pay. The deposit was obviously not enough to repair all that. So, what would I have done?”, Christiane* wonders.

Today, Christiane* lives in a quiet area north of Luxembourg City. “I pay €1,500 + €200 euros in additional costs for 75m2. I’m lucky, in the sense that you can’t find a flat for that price anymore. My landlord lives on an island paradise for eight or nine months a year, so he probably doesn’t have to worry too much about rent. I’ve never met him, the agency manages everything,” Christiane* explains. She spends more than 40% of her income on rent. Her dream of becoming a homeowner has evaporated. “I’m not in a relationship. I don’t have a guarantor. I have no property to mortgage. I don’t have an inheritance that fell from the sky, and I’m over 40 years old. In short, I’m an unwanted customer for the banks,” she concludes.

“Tell you what, let’s torture ourselves and let’s look at the ads,” she laughs. She ticks her “dream” criteria: between 80 and 110 m2, two bedrooms, a fitted kitchen, a terrace, a lift, and parking space, in the city. “Nine ads match. The cheapest is €985,000. Next!” she quips.

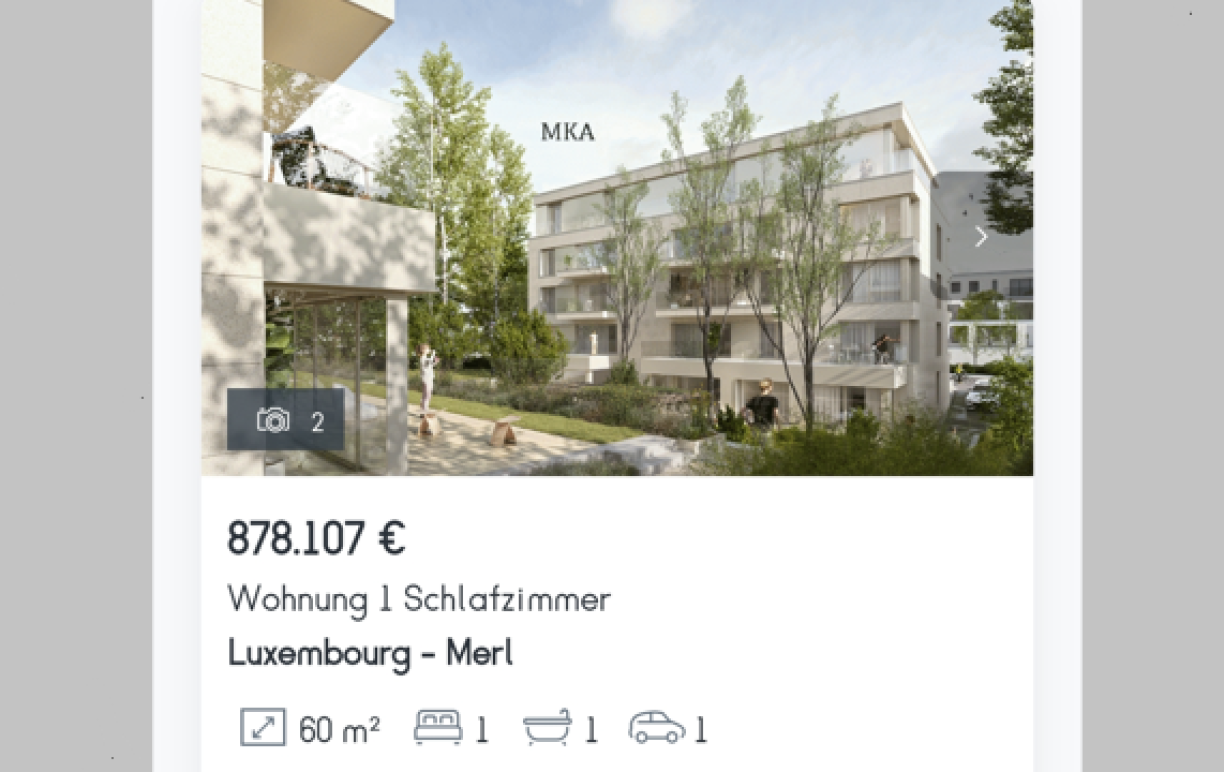

“Let’s remove the lift, go for just one room, replace the terrace with a balcony, and reduce it to between 60 and 90m2. Here we go: a room in Merl, 60m2, €878,000.” The second ad she finds lists 645.000€ for 60m2 in Hollerich. “An old thing from the 70’s it seems, so why not… Except that I can’t borrow more than €450,000, and even if the bank says yes, I’d have to say goodbye to my social life and eat rusk every day. And in any case, at that price, it’s unobtainable,” she sighs.

In an interview about excessive property prices in Luxembourg with the business magazine ‘Paperjam,’ an expert explained that, in theory, only 3% of the population can now hope to buy the €1-million-homes that have become the norm.

So, why not cross the border to find happiness in Luxembourg’s neighbouring countries? For Christiane*, this is not an option: “Some people will probably say that I should go and live in Thionville, Arlon, Trier… but no, I don’t want to spend an hour in traffic jams, I don’t want to not know anyone in my neighbourhood, and I want to stay close to my family, my life is here. Is that too much to ask?” Besides, “prices are also skyrocketing there. I have a friend who bought a flat to renovate near Trier, 100 m2 for €350,000. She is paying €1,400 over 25 years. Ok, that’s great, but it was in a terrible state, fortunately her boyfriend is a handyman, so they were able to save a lot of money by doing the renovations themselves. Anyway, even that is out of my reach.”

The worst thing, she says, is that “if, at the time, the bank had accepted my loan of €320,000 for the flat on Rue de Hollerich, I would have already finished paying for it, with a nice margin. If I had been able to start with a monthly payment of €1,000 and then gradually increase it with my income, I would have already paid it off.” Christiane* also argues that, in any case, if the worst came to the worst, the bank could always take back the house and sell it. As Christiane* sees it, “they would have won in any case, so what were they afraid of? And that, that pisses me off, that pisses me off!”

Last suggestion: start a new life, far away from Luxembourg? “It’s an option, but as long as my mother is alive, no way. If she’s no longer there, I might be tempted to start a new life. I speak four languages, that could help me abroad. I wouldn’t say no to New Caledonia,” she laughs.

*The first name has been changed at her request.