The idea of increasing the age of retirement from the current 65 years to 72 years is enough to give anyone in the Luxembourgish labour force grey hairs.

Unfortunately, it is a very real recommendation from the European Commission. In its “Green Paper on Ageing”, published earlier this year, it looks at “fostering solidarity and responsibility between generations”. Their conclusion is fairly unambiguous: people will have to work longer.

The issue in Luxembourg is not new or unknown: an ageing population and an ever increasing life expectancy, with dropping birth rates. Not to forget the cross-border workers, a current boon which becomes costly down the line. All this creates a ticking time bomb sitting under the pension system, as the active labour force will no longer be able to sustain the retired population.

To help remedy the problem, the European Commission is prescribing a shock treatment: “Longer working lives are a key answer to this. According to the most recent Eurostat population projection, the EU old age dependency ratio in 2040 would only remain at the same level as in 2020 if working life were extended to the age of 70.”

This old age dependency ratio measures the rate of the retirement age population in relation to that of working age: if the former exceeds the latter, the ratio turns negative and the country has a problem.

Luxembourg currently boasts great numbers, with the lowest ratio in Europe at 22%, compared with 39% in Italy, for example. We have a large working age labour force, able to support the senior population. But this won’t last, and the future looks much bleaker.

The report lists Luxembourg among a number of countries that will be forced to increase their retirement age: “projections suggest that Malta, Hungary and Sweden would have to extend working life only to 68, while Lithuania and Luxembourg would have to extend it to 72.”

How can the report conclude such a drastic measure will become necessary when everything is looking so rosy now?

Muriel Bouchet, director of the Fondation Idea, a Chamber of Commerce think tank, explained the paradox in 2019: in the short-term, the situation is comfortable, as the Grand Duchy has a surplus of 1% of the GDP for pension schemes. The surplus is significant in fuelling a compensation fund currently at 34% of the GDP. However, in the long-term, there is danger in delaying changes.

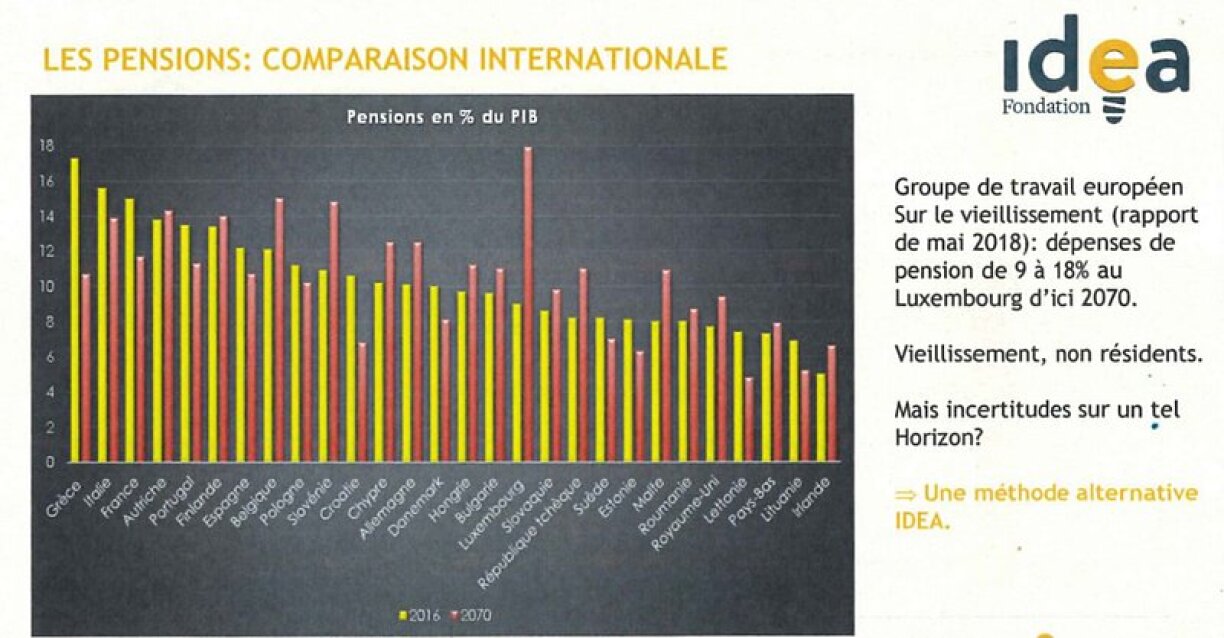

This is reflected in the international comparison which predicts that by 2070, Luxembourg will become the worst performing European country in terms of pension funds as part of the GDP (from currently 9% to 18% in 2070).

But Muriel Bouchet also touched on another sensitive subject: cross-border workers. “Far be it for me to denounce the contribution of these workers, who benefit the Grand Duchy”. But these cross-border workers will also have pensions that must be paid, adding to the pressure on the current system.

The amount of pensions exported to non-resident beneficiaries has more than doubled between 2010 and 2019, increasing from 609 million to 1.3 billion Euros. And that is only the beginning.

The Fondation Idea drives the point home with two striking numbers:

In short, this is a truly terrifying time bomb. To defuse it, economists are proposing an increase of the age of retirement as well as pension contributions, cutting some benefits and returns on big pension amounts. Unpopular measures, for sure, which are likely to have unwelcome knock-on effects...