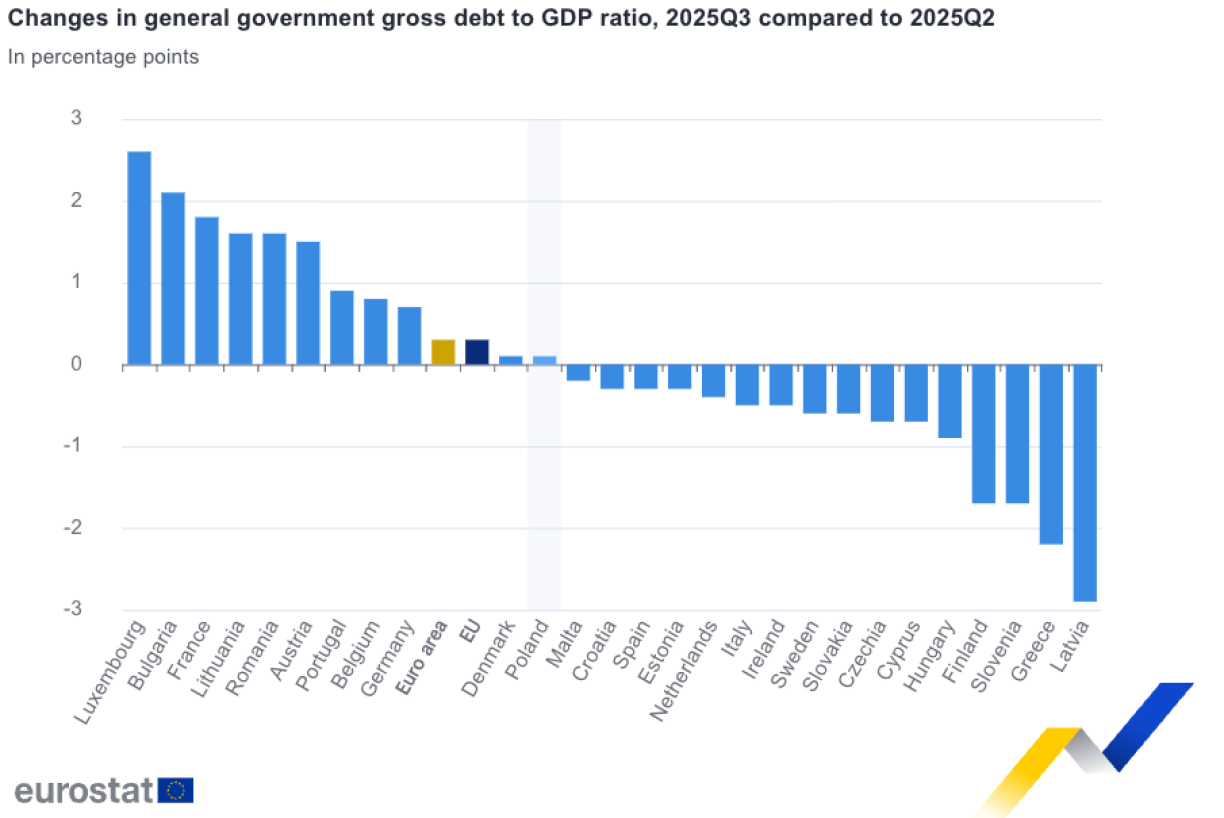

Luxembourg recorded the largest quarterly increase in government debt ratios in the European Union in the third quarter of 2025, despite continuing to post one of the lowest overall debt-to-GDP levels in the bloc, according to the latest figures published by the statistical office of the European Union, Eurostat.

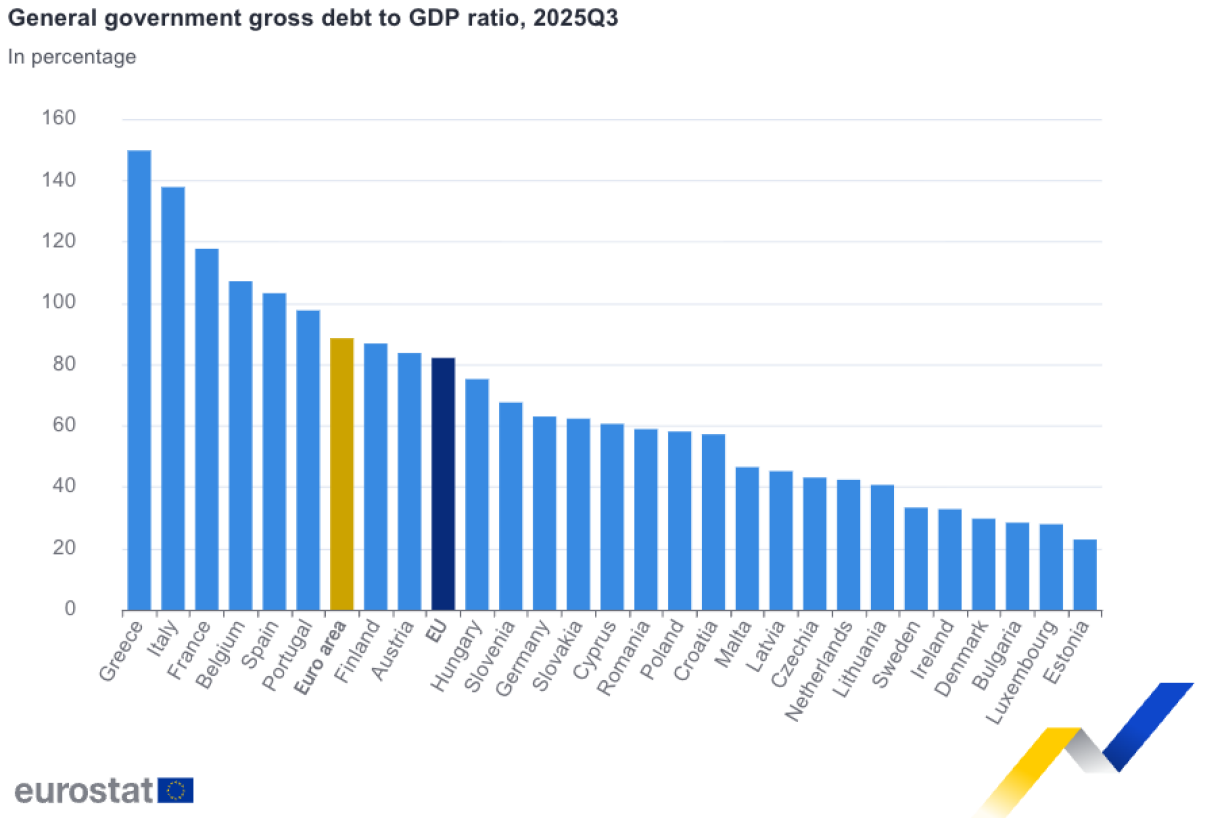

Government debt in the Grand Duchy rose by 2.6% compared with the second quarter, bringing its debt-to-GDP ratio to 27.9%, but maintains its status of having the second lowest ratio in the EU, behind Estonia at 22.9%.

Luxembourg’s debt-to-GDP ratio is particularly sensitive to short-term movements in economic output, given the country’s relatively small and volatile GDP. A modest slowdown or quarterly dip in nominal GDP can push the ratio higher, without implying a significant increase in borrowing. In larger economies, the same effect is typically far more muted.

Across the EU as a whole, government gross debt increased to 82.1% of gross domestic product, up from 81.9% in the previous quarter and 81.3% a year earlier. Eleven Member States recorded an increase in their debt ratios over the quarter, while sixteen reported a decline.

Neighbouring countries continued to record substantially higher debt ratios. France reported government debt equivalent to 117.7% of GDP at the end of the third quarter, while Belgium stood at 107.1%. Germany recorded a debt-to-GDP ratio of about 66%.

The highest debt ratios were recorded in Greece, at 149.7% of GDP, and Italy, at 137.8%. Spain also remained above the 100% threshold, at 103.2%.

The total general government debt across the EU reached €15.25 trillion at the end of the third quarter. Debt securities accounted for just over 83% of the total, with loans making up around 14% and currency and deposits approximately 2.5%.