With the pension reform discussions on hold during the summer holidays – though set to resume behind the scenes ahead of the government’s autumn draft bill – our colleagues from RTL Infos address readers’ pressing questions on the issue.

The debate has dominated Luxembourg’s political agenda in recent months, marked by a contentious statement in the State of the Nation address, alarming estimates for workers, and large-scale protests against the government’s proposed changes. Below, our colleagues from RTL Infos clarify key concerns raised by their readers.

1) I believe employers and the State don’t want an increase in contributions, as their share would also rise. What do you think?

Under Luxembourg’s current system, pension contributions are split equally between employees (8%), employers (8%), and the State (8%). Raising this rate would mean lower net wages for workers and higher costs for businesses and public finances.

Initially hesitant to raise contributions, the government now finds itself facing mounting opposition to Prime Minister Luc Frieden’s reform framework, shifting the tone and trajectory of the debate. Deputy Prime Minister Xavier Bettel recently suggested that a modest hike – such as the 0.5% floated on RTL – could be reconsidered.

Employers, however, remain firmly opposed. Michel Reckinger, president of the Luxembourg Employers’ Association (UEL), argues that such a move would weaken business competitiveness.

2) Are pensions currently capped? If not, why not cap them? If so, why not reduce the amount?

Luxembourg’s pension system includes a cap that limits retirement benefits to a maximum of five times the minimum pension – currently €10,883.74 per month – regardless of prior income. This ceiling aligns with the contribution cap, which is set at five times the minimum wage (€13,518.68 per month). The two limits are directly linked: higher contributions lead to higher pension payouts, while lower contributions reduce future benefits. Although reducing the contribution ceiling would limit pensions for high earners, it would also shrink the system’s overall revenue.

3) Why not remove the contribution cap for high earners while keeping the payout cap?

One proposed solution would require top earners to contribute more without receiving additional benefits – a measure that could bolster the pension system’s finances but risks being perceived as inequitable by the affected group. Critics argue that lowering the contribution ceiling could make Luxembourg less attractive to highly skilled professionals, who are often courted by employers.

The General Inspectorate of Social Security (IGSS) analysed the proposal at the request of the Green Party (Déi Gréng). Their findings suggest such a reform would extend the pension reserve’s viability, delaying the point at which it dips below the legal threshold from 2039 to 2045. It would also postpone total depletion of the reserve from 2045 to 2051.

While impactful, the measure alone would not guarantee the system’s long-term sustainability. It would also mark an unprecedented shift, disproportionately affecting Luxembourg’s highest-paid workers.

4) An increase in contributions would be problematic for the self-employed, who have to pay double the contributions (employee and employer portions) each month compared to salaried employees. Have politicians proposed solutions on this matter?

Currently, the government has not prioritised raising contributions, leaving the status of self-employed workers unresolved. Should rates rise, it remains unclear whether they would face a disproportionate burden or receive compensatory measures.

5) Why not align public sector pensions with those in the private sector and thus generate substantial savings?

The ongoing reform focuses on the general pension scheme, which covers 90% of workers (private sector only). The projected 2026 deficit applies solely to this system, meaning public sector adjustments would not address its shortfall.

That said, Prime Minister Frieden has confirmed that public sector employees – who fall under separate pension schemes – will face parallel reforms, including extended career requirements.

6) Why not tax high net-worth individuals to cover the gap?

In its coalition agreement, the government promised not to introduce a wealth tax on individuals. Along the same lines, it promised not to increase the top income tax rate for individuals (capped at 42%). These are indeed two straightforward options that have been ruled out from the outset for political reasons.

This leaves limited alternatives beyond revisiting Question 3’s proposal: uncapping high-earner contributions without increasing their future benefits.

7) Why not stagger the reform based on the length of contributions already made?

Prime Minister Frieden’s proposal already incorporates a staggered approach: gradually extending careers by three months annually over a set period. This would largely shield older workers from the full impact while placing greater adjustments on younger generations.

According to information obtained by RTL, the government is also considering an alternative model – spreading an eight-month career extension over five years. Under this scenario, workers would add one to two months of work per year until completing the additional time required.

8) How many more years would I have to work if I’m 40 today?

At present, and without a government decision, it’s impossible to say whether a 40-year-old worker would actually have to add two, three or four years to their career. Just as it is impossible to estimate the same for a 30-year-old worker. Frieden did provide an estimate in May (between 2.5 and 3 more years for a 45-year-old), but this should be taken with a pinch of salt as several scenarios are still on the table (see Question 7). Clear answers await an agreement between social partners, and subsequently, this autumn’s draft bill.

9) How long until retirees recoup their contributions?

The IGSS has not explicitly calculated this data, but in a study published in June 2025, it estimated that a person who earned an income equivalent to twice the minimum wage and then retired in 2012, received a pension equivalent to 79.9% of their former salary. Over their retirement, they collected 19.2 years’ worth of salary – funded by just 8.9 years’ worth of contributions. This translates to over €2 returned for every €1 paid in.

10) Since Luxembourg is Europe’s paradise for investment funds, why not include a higher proportion of capitalisation in the pension system?

The government has indeed proposed expanding capitalisation options – specifically by strengthening voluntary second- and third-pillar pension schemes, which come with tax incentives. As outlined in the CSV-DP coalition agreement, authorities may raise contribution ceilings for these private plans.

While this approach could supplement retirement savings, it should be noted that this would primarily benefit higher earners with disposable income to invest beyond the mandatory first-pillar state pension.

11) Why is the pension fund playing with our money on the stock market?

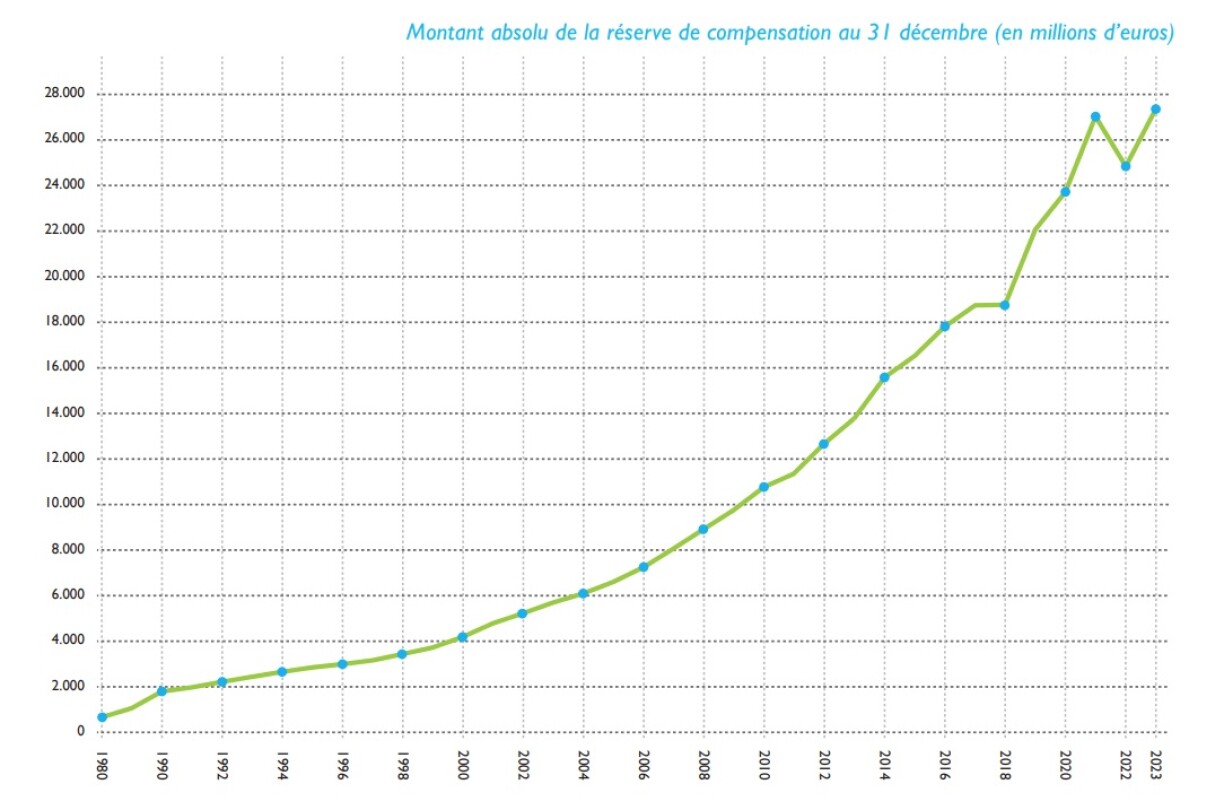

While it is perhaps a bit provocative to suggest it is “playing” with it, the national pension insurance fund has indeed entrusted the pension reserve, amounting to €30 billion in 2024, to the compensation fund. This money is invested in financial markets and generates returns annually.

Returns vary significantly by year: strong periods like 2019, 2021, and 2023-24 generated over €2 billion annually, while geopolitical shocks such as the 2022 Ukraine war resulted in a €2.5 billion decline. Despite this volatility, the long-term strategy has proven effective in maintaining Luxembourg’s pension reserves.

12) Why not also make pensioners contribute, so that everyone shares the burden of change?

Currently, retirees in Luxembourg are exempt from paying pension insurance contributions under both the general (private sector) and special (public sector) schemes. However, they are still required to contribute to health insurance, maternity coverage, and long-term care, and remain subject to income tax.

The Christian Social People’s Party (CSV) recently requested the IGSS to analyse a proposed 1% pension levy. According to calculations, this measure would delay the reserve’s decline below the legal threshold by one year (from 2039 to 2040) and postpone total depletion by one year (from 2045 to 2046). While fiscally marginal, the move would symbolically involve pensioners in sustaining a system they supported during their careers.

The debate has gained urgency in light of IGSS projections indicating that Luxembourg’s retiree population will more than double – from 225,000 today to over 500,000 by 2050 – eventually surpassing the number of active workers. Without action this year, pressure to introduce a levy or similar measures is likely to intensify in future reform efforts.

13) Why not reduce the number of working hours per week to increase the number of workers, and thus the country’s attractiveness?

The current CSV-DP coalition campaigned on maintaining Luxembourg’s 40-hour work week while offering greater flexibility. This makes any reduction to, for instance, 35 hours – as implemented in France in the 2000s – highly improbable under the present government.

14) Will current retirees face changes?

Prime Minister Luc Frieden has pledged that existing pension payments will not be affected by upcoming reform measures. This reassurance comes after his earlier proposal to extend working lives by three to five years – a suggestion he has since rebranded as just one of several options under consideration. The final shape of the reform will depend on the outcome of ongoing negotiations between the government and social partners.

15) Luxembourg does not recover contributions on salaries and pensions that leave the country. With this money, we could fund pensions.

It is true that half of Luxembourg’s pension beneficiaries reside abroad (nearly 40% live in one of the three neighbouring countries). The amount paid to them, however, is half that paid to Luxembourg residents.

Crucially, European regulations on social security contributions are clear: individuals contribute in only one country. For pensioners with cross-border or mixed career histories – such as those who worked partly in Luxembourg – contributions are based on their country of residence, not where their pension is paid. As a result, only those who spent their entire careers in Luxembourg contribute fully to the national system. Luxembourg therefore cannot compel all pensioners to pay into its social security scheme.