Their demands include a change of direction for pension reform. Here’s what you need to know about this sensitive issue that is shaking up the country and could affect your retirement.

Since October 2024, the government has been developing a major pension reform. Initially organised as a public consultation, the debate is expected in the shape of a reform to be presented this autumn.

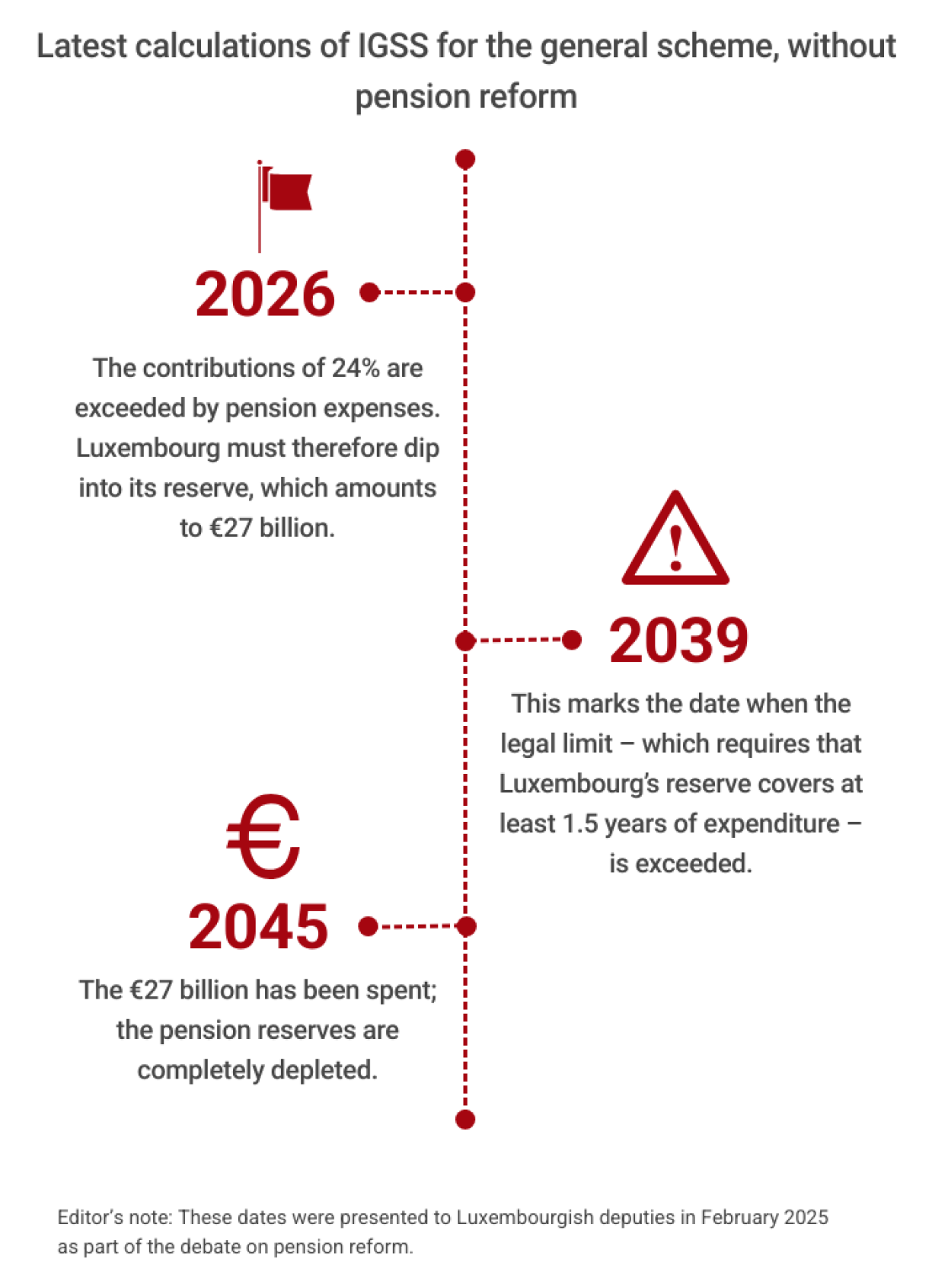

The Luxembourgish pension system, one of the most advantageous in Europe, has reached its financial equilibrium. However, the recent calculations of the General Inspectorate of Social Security (IGSS) were categorical: starting in 2026, the system will cost more money than it earns. This imbalance is only going to increase as years go by. The reason is a continuous increase in the number of retirees.

The switch to a deficit scheme will force the State to draw on the €27 billion set aside for pensions. To protect this money, and the State’s finances, the government therefore wants to review the conditions for financing pensions.

The Luxembourg system, which now requires 40 years of contributions, has held up well so far particularly due to the labour market, which has grown very fast. As a result, contributions have been able to cover pension expenses.

From 2026, the IGSS estimates that the contributions deducted from salaries, from employers, and paid by the State will no longer be sufficient to pay the pensions of current retirees. This would cross a red line for the government, which wants to keep the system in the black.

Opponents of the reform believe that the forecasts are too pessimistic and that the system still has room for financing. This has been the case for many years.

However, the IGSS very recently revised its forecasts downwards, with 2026 as the first cut-off date, a sign that the system may be on its last legs as it stands. ‘Doing nothing is not a solution’, repeated Health Minister Martine Deprez. The government wants to ensure that pensions are properly financed and, above all, not to touch the reserve.

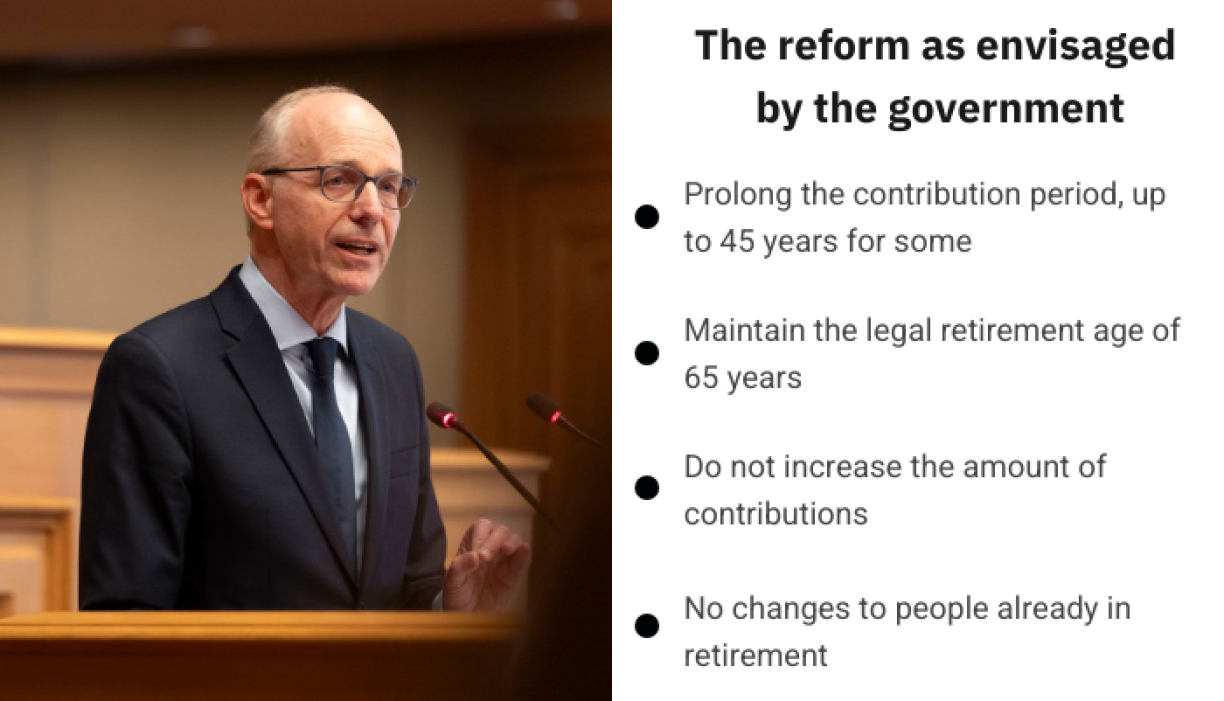

To ensure the “sustainability” of pensions, meaning their long-term financial equilibrium, the government is looking at a number of options. The main one was announced by Luc Frieden himself – a reform that would rely on workers, whose careers would gradually be extended by several years. This could mean that up to 45 years of contributions are needed for the less fortunate, compared with 40 years today.

The exact details of the reform have not been defined as of yet, making it impossible to determine whether the amount of pensions will decrease. In exchange, the government has made two promises – to not change the conditions of people who are already in retirement, and to keep the legal retirement age at 65 years old.

To assess the effects of a reform of pension funds, the IGSS answered questions from several parties. Taken individually, none of the ideas put forward would be sufficient to finance the system in the long term (raising contributions from 8% to 9%, raising or lowering the contribution ceiling, postponing the actual retirement date by five years, etc.).

It will therefore be necessary to find a formula made up of several measures to balance the Luxembourgish system.

Martine Deprez is due to conclude the long debate launched in October with the publication of a report in July. The social partners are also due to meet on 9 July. She will then present a draft bill in the autumn.

However, at this stage, the government has not stated when the reform will come into force. The Prime Minister did present a few examples of its effects, assuming (hypothetically) that these will start in 2030.