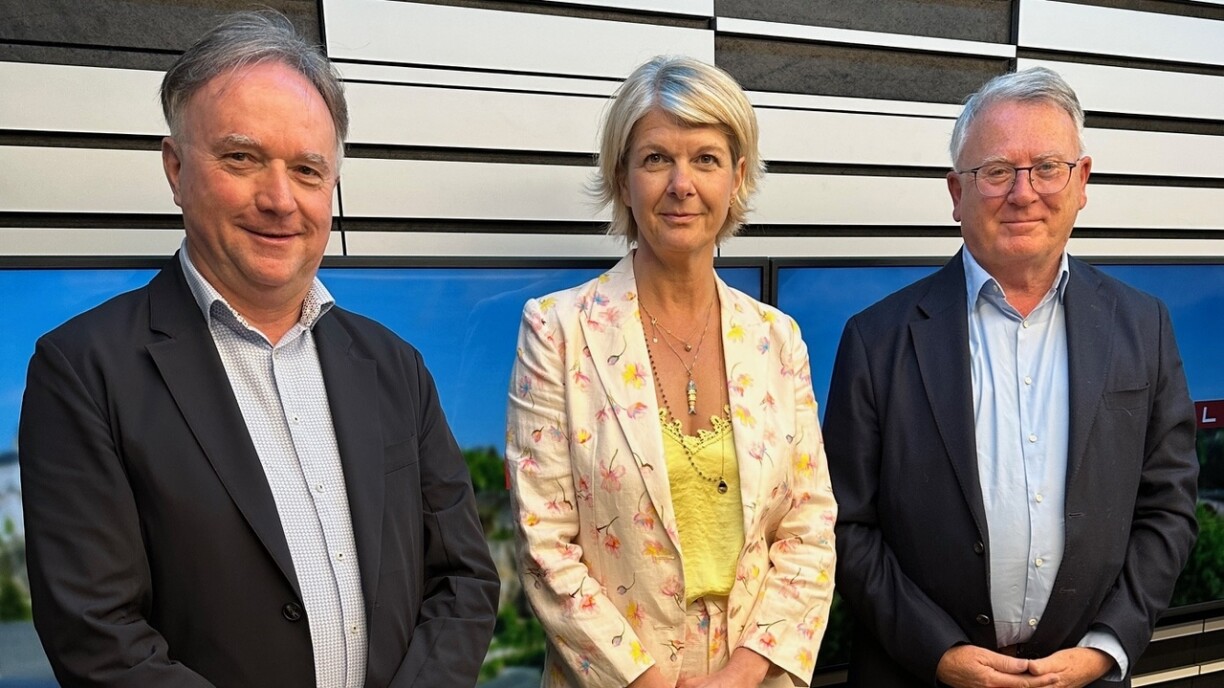

On Saturday, our colleagues from RTL Radio hosted a trade policy roundtable featuring Aline Muller, Director of the Luxembourg Institute of Socio-Economic Research (LISER), Paul Schockmel, the head of automotive supplier IEE, and Nicolas Schmit, former EU Commissioner and politician of the Luxembourg Socialist Workers’ Party (LSAP).

All three guests agreed that while the implementation of US tariffs has been “a mess”, the policy has a clear strategic rationale.

Nicolas Schmit noted the dual aims of US President Donald Trump’s approach: undermining China’s dominance while revitalising US industry. Paul Schockmel observed early signs of success, including reshored computer chip production – a trend initiated under Biden but accelerated under Trump.

Schockmel emphasised China’s overwhelming market share as the primary US target, citing the automotive sector where China produces 45 million vehicles annually but consumes only 28 million domestically.

Schmit interpreted Trump’s 90-day tariff pause as both a reaction to stock market volatility and a tactic to pressure trading partners into US-favourable negotiations.

Aline Muller highlighted Luxembourg’s balanced trade with the US (notably in steel and automotive sectors) but warned of risks to the financial centre and broader economy. While unable to quantify local impacts, she cited European forecasts of a potential 0.5% GDP contraction continent-wide.

Schockmel noted that Luxembourg’s automotive suppliers face no immediate relocation risk, as most production serves the European market. However, he acknowledged that vehicle manufacturers have already halted US exports due to tariffs adding approximately $3,600 per car.

Schmit emphasised Luxembourg’s integration into European supply chains, warning that broader EU trade disruptions would inevitably affect the Grand Duchy. He predicted the US policies would trigger a dollar devaluation – a global risk given the currency’s reserve status – citing China’s $750 billion holdings in US bonds as an example. Schmit also identified a potential upside: increased US investment in Europe.

Regarding the EU’s response, Schmit praised its swift but measured tariff retaliation. He questioned whether the US truly seeks zero tariffs, suggesting their real goal might be pressuring Europe to mirror US tariffs on China – a move that would disproportionately harm Germany. “The EU cannot let the US dictate its external trade policy” Schmit stressed.

Muller argued that Trump’s “America First” doctrine contradicts the principles of global trade. While acknowledging globalisation’s mixed effects, she underscored Europe’s significant net gains from the system.

Schockmel commended the European Commission’s measured reaction to US tariffs, emphasising that Europe should neither overreact nor reject dialogue. He called for expanded negotiations on free trade agreements with other global regions to diversify economic partnerships.

Schmit expressed surprise at the US administration’s apparent shock over market volatility, while Schockmel noted its cascading effects: equity declines in the automotive and supplier sectors, coupled with tightened bank lending.

Regarding China, panelists identified a dual reality. While acknowledging the appeal of China’s vast consumer market and its investments in European companies, they highlighted competitive challenges – particularly in sectors like automotive, where Chinese producers leverage lower production costs to undercut European prices.