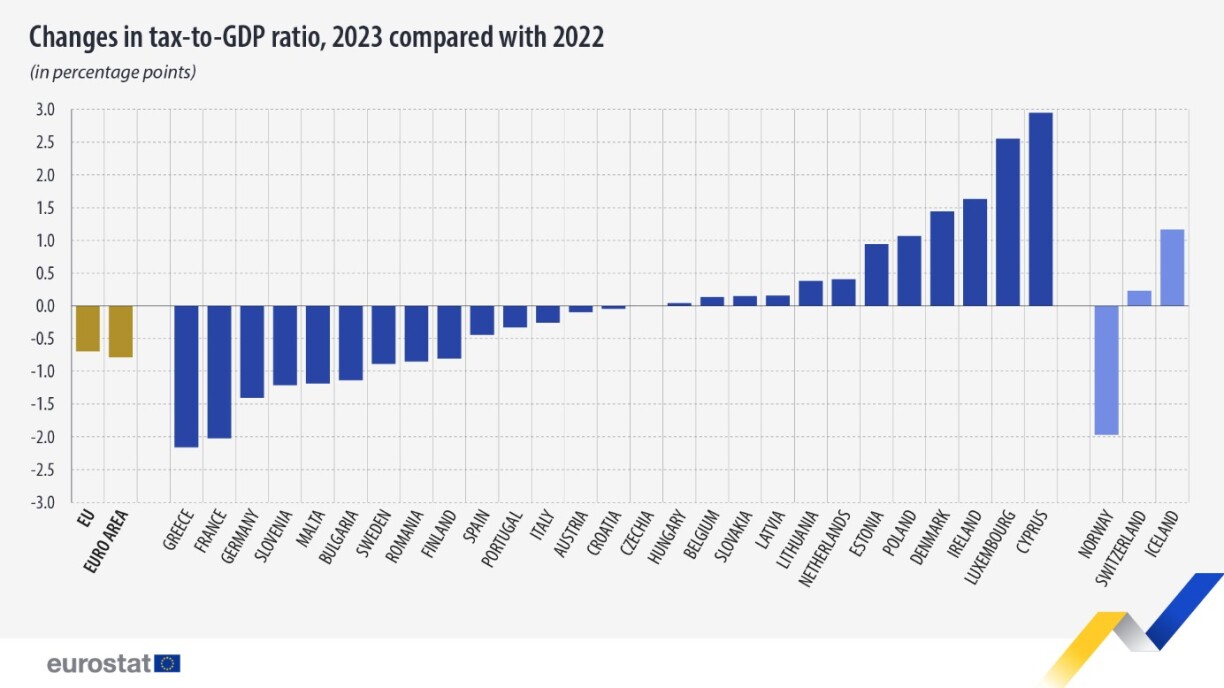

This ratio, which measures the total of taxes and net social contributions as a percentage of GDP, which reflects the rising fiscal burden. Luxembourg’s increase places it highly among the top EU countries where tax pressure has intensified over the past year.

As the OECD highlights, “fiscal pressure” refers to the total tax revenues collected by a country, expressed as a percentage of its GDP. Within the EU, this tax burden can vary greatly, sometimes by nearly double. In 2023, the average tax-to-GDP ratio across the EU was set at 40%, slightly down from 40.7% in 2022.

Among EU countries, France, Belgium, and Denmark experience the highest tax pressures, often perceived as “tax hells,” with the largest shares of taxes and social contributions relative to GDP: 45.6% in France, 44.8% in Belgium, and 44.1% in Denmark. Luxembourg also ranks high, with a tax burden of 42.8%, placing it as the fifth-highest in the EU according to the latest Eurostat figures.

On the other end of the spectrum, Ireland is seen as a “tax haven” with the EU’s lowest tax-to-GDP ratio at just 22.7%.

Luxembourg stands out as the EU leader in tax increases for 2023. The tax-to-GDP ratio rose in 11 EU countries last year, with the most significant jumps observed in Cyprus, climbing from 35.9% in 2022 to 38.8% in 2023, and Luxembourg, which saw an increase from 40.2% to 42.8%.

Across the EU, tax revenues also grew, with all member countries reporting increases in 2023. Revenue from taxes and social security contributions rose by €308 billion compared to 2022, reaching a total of €6,883 billion.

Read more: