According to a recent study conducted by the National Institute of Statistics and Economic Studies (STATEC) and unveiled on Tuesday, the property sectors in Luxembourg and Finland are the hardest hit across the entire European Union.

The overarching cause behind the decline in demand lies in the surge of interest rates and, consequently, increased borrowing costs. This factor has led to a decline in real estate transactions across the continent, though the extent of the impact varies among countries.

With a staggering 45% year-on-year reduction in real estate transactions, the Grand Duchy ranks among the EU’s worst-performing real estate markets, surpassed only by Finland.

One of the most adversely impacted segments is the new-build flat market, which has experienced a sharp decline of 63%. This plummet in demand has also translated into a noticeable drop in property prices.

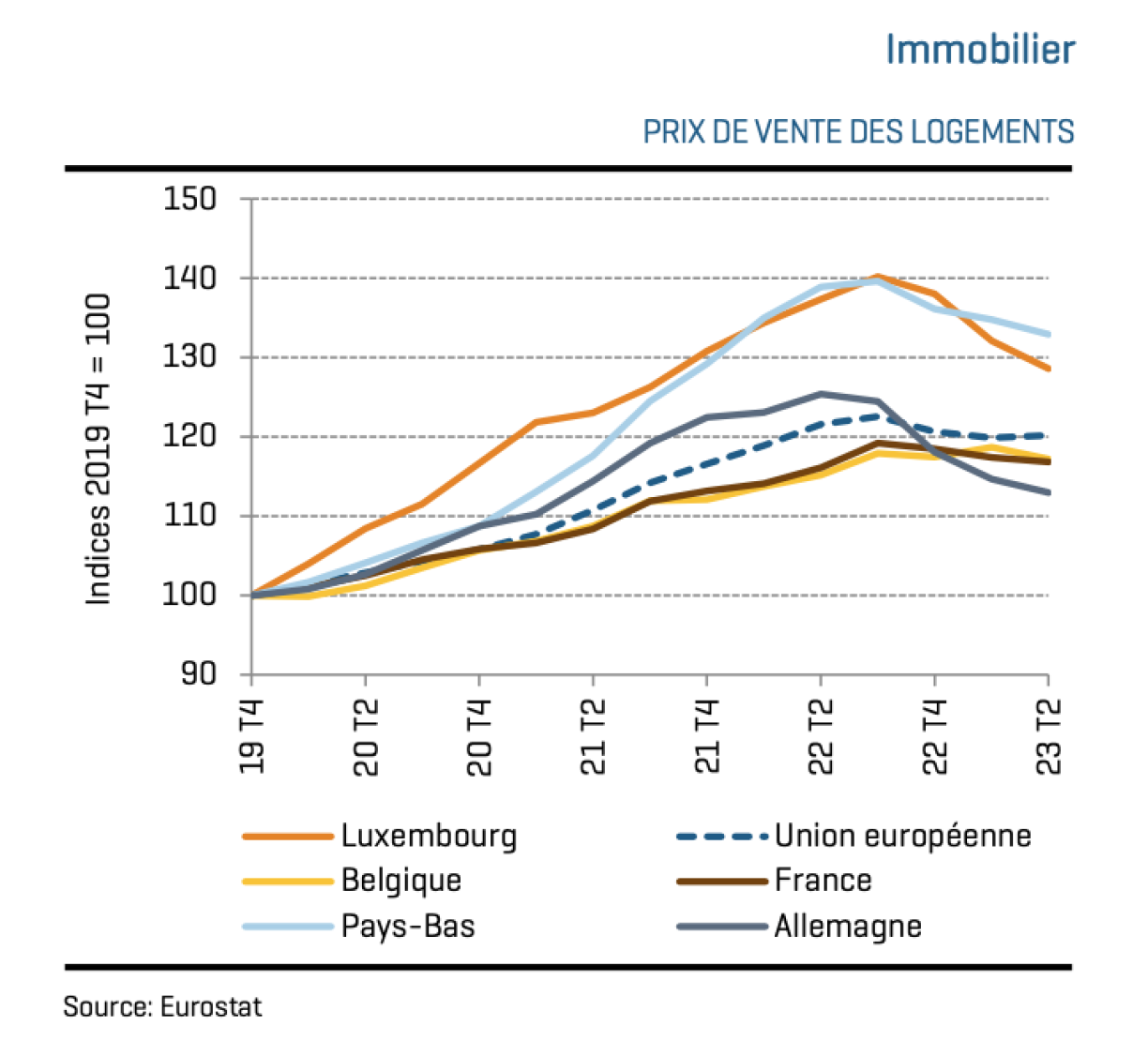

Based on data from the second quarter of 2023, STATEC has compiled a ranking of nations where the real estate market has seen the most substantial contraction. Once again, Luxembourg emerges as a prominent presence, experiencing a decline of 6.4%, second only to Germany, which faces a more considerable 10% drop.

The Institute notes that while some European countries have not witnessed a decrease in property prices, they are beginning to display early signs of a slowdown. Meanwhile, three nations are bucking the trend and showing signs of recovery: Denmark, Spain, and Italy.