A recent study showed that 83% of Luxembourg residents consider themselves to be middle class.

However, defining the boundaries of this middle class is easier said than done, with varying perspectives within the political landscape. While no party has officially defined who might qualify as middle class, looking at the structure of tax relief proposals aimed at supporting middle class earners provides some insight.

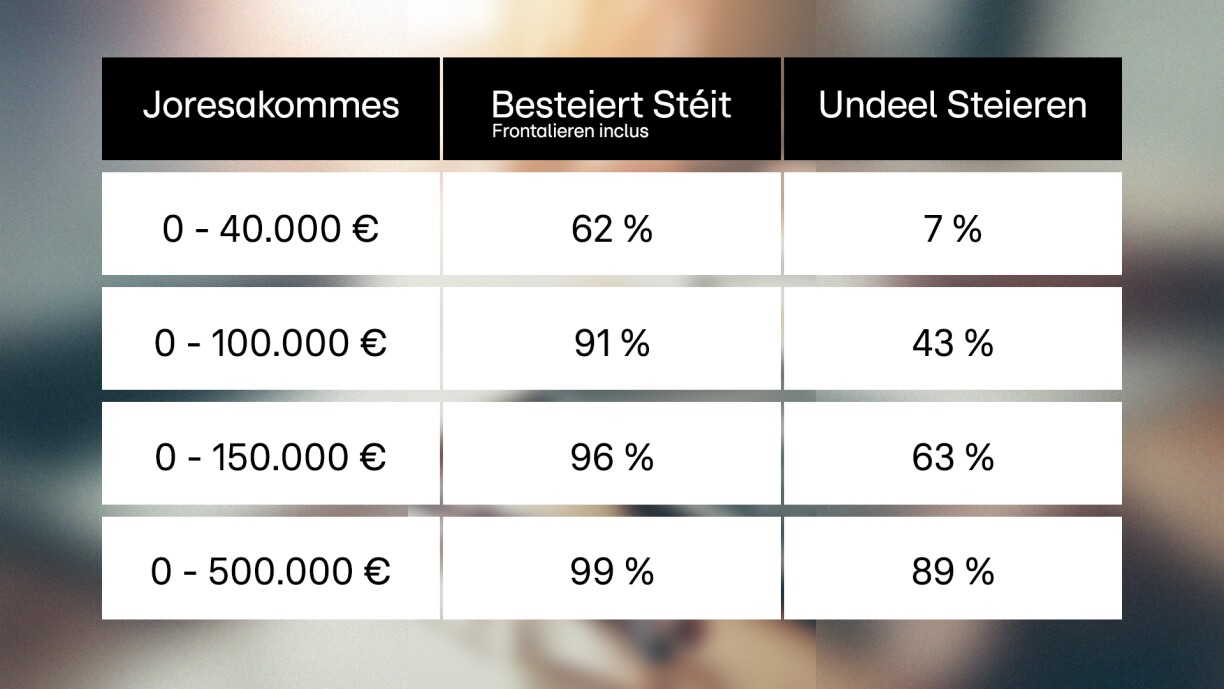

The Green Party (déi gréng) aims to alleviate the tax burden for households earning up to three times the social minimum wage, equivalent to an annual income of nearly €93,000. According to the latest tax analysis by the Economic and Social Council (CES), this proposal would benefit approximately 90% of taxpayers in Luxembourg, who currently contribute just over 40% of total taxes.

In contrast, the Luxembourg Socialist Workers’ Party (LSAP) is seeking to increase taxes for monthly incomes exceeding €12,000, equating to an annual income of €144,000. This would result in a higher tax burden for about 4% of households, which presently contribute 37% of the total tax revenue.

How would both proposals affect civil servants, for example? In 2021, civil servants earned an average of nearly €9,500 per month, or around €113,000 annually. Consequently, both the Green Party and the LSAP proposals would lead to increased taxation for civil servants in higher-income positions.

The Christian Social People’s Party (CSV) prominently features tax relief promises on their campaign posters. It sets the threshold for the middle class at an annual income of €500,000. This would mean increasing taxes for 1,230 households in Luxembourg, constituting 0.2% of the population, and currently responsible for 10% of tax income.

Data indicates that Luxembourg has relatively few high-income individuals that could be taxed more substantially. Those earning the unqualified minimum wage receive approximately €30,000 annually. Over half of all taxed households in Luxembourg, including cross-border workers, fall into this category, contributing less than 7% of tax income.

Meanwhile, the Democratic Party (DP) has refrained from proposing specific measures that can be directly compared to those of other parties.