On Thursday, Minister of Finance Gilles Roth and Jean-Paul Olinger, Director of the Luxembourg Inland Revenue (ACD), announced a series of measures aimed at simplifying tax procedures for taxpayers and modernising the ACD through digitisation.

“We need to make tax returns as simple as possible for taxpayers, particularly through digitisation and artificial intelligence,” said Minister Roth during the presentation. The changes, set to be introduced starting in 2025, are part of a broader effort to streamline the tax filing process.

Currently, the majority of taxpayers in Luxembourg still submit their tax returns on paper. The government aims to shift this trend, with a target of ensuring that 85% of tax returns are filed online or ideally even via an electronic assistant on MyGuichet.lu by 2028.

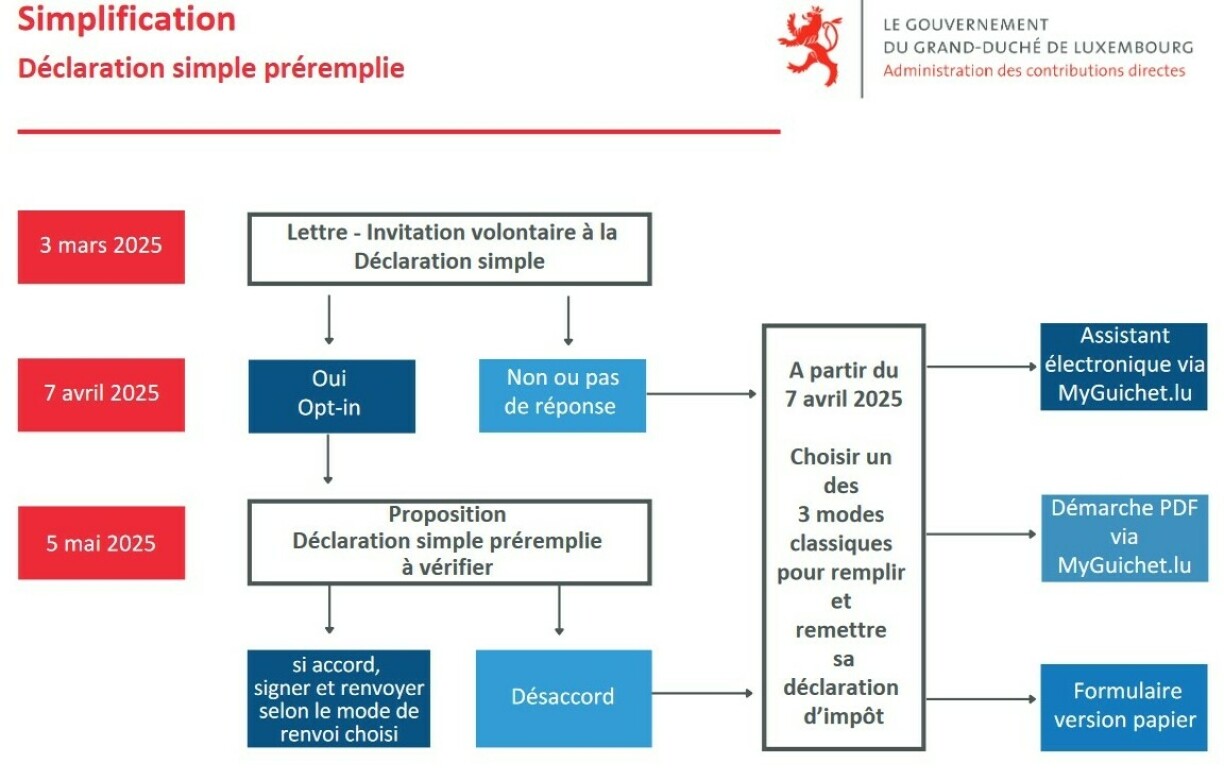

A key initiative in this modernisation effort is the introduction of an optional pre-filled tax return for individuals, scheduled to launch in March 2025. Initially, 20,000 households with straightforward income sources – such as salaries and pensions – and no additional deductions beyond the flat-rate minimum will be invited to participate. These households will receive a letter in March asking if they wish to use the pre-filled return, with a decision deadline set for April.

Those who opt in will receive a proposed tax return in May, which they are then asked to review and either reject or approve. The government aims to expand this service to cover 100,000 returns by 2028.

Minister Roth emphasised that the pre-filled returns are based on data already available to the administration and are entirely optional. “It is a proposal, not an obligation,” he stated, noting that taxpayers can choose to continue filing their returns manually if they prefer.

ACD Director Jean-Paul Olinger highlighted the additional benefits of the new pre-filled tax return system. “The goal is to reduce the workload for taxpayers by pre-filling the tax return with information the tax authorities already have,” he explained. According to Olinger, this approach offers several advantages: it saves time for taxpayers, minimises errors by using data from previous years, and simplifies the administrative process by reducing or eliminating the need for supporting documents, as the ACD already holds much of the required information.

However, Olinger acknowledged that implementing these changes will take time. Adapting legal frameworks to allow data collection from banks, insurance companies, and other sources is a necessary step. To accommodate this, the deadline for submitting the forms used for tax returns will be pushed back to April, giving the ACD the first quarter of the year to gather and update the necessary data for pre-filling.

In March, the ACD will roll out an information campaign titled “Dir frot, mir äntweren” (“You ask, we answer”). The initiative will provide the public with opportunities to engage directly with ACD representatives at various locations across the country, addressing questions and concerns about the upcoming changes.

During the same press conference, Minister Roth announced plans to present proposals for individualised taxation to the Chamber of Deputies before the end of the year, with the goal of reaching a consensus on the reforms.