Since January, banks have already been required to receive so-called instant payments, or transfers that are processed immediately. From Thursday onwards, every bank will also need to be able to send them. The new system means that funds will have to reach the recipient’s account within ten seconds for any euro transfer within the SEPA.

According to Paul Wilwertz from the Luxembourg Bankers’ Association (ABBL), this will make money transfers much more practical in urgent situations. He explained that someone could, for instance, send money instantly to a child abroad who needs it urgently, with the funds arriving within seconds. He also pointed out that this could be useful in everyday cases, such as at a flea market where sellers do not accept credit cards and the buyer has no cash. In such a case, the buyer could simply make a direct transfer, Wilwertz said.

Wilwertz noted that, for some banks, this new system will automatically become the standard. In others, he said, customers will need to activate the feature manually. He emphasised that this difference depends on the institution, but that transfer fees will remain identical to those for traditional transactions.

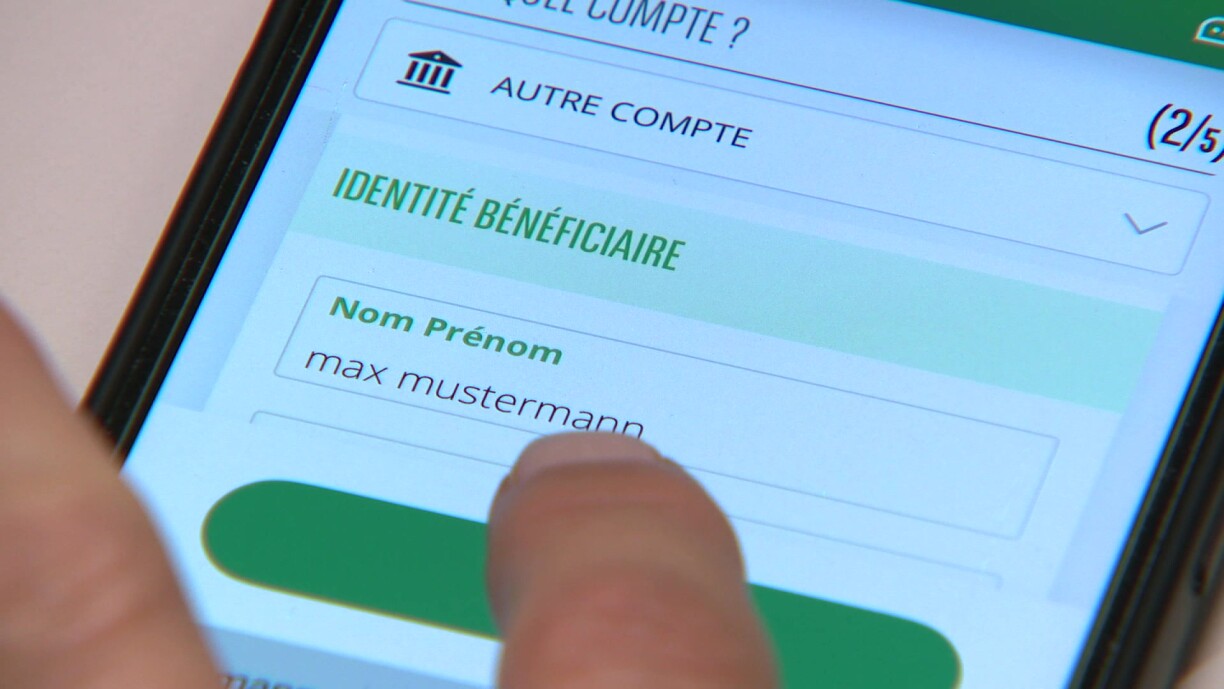

A second important change concerns beneficiary verification. Wilwertz explained that banks will now check whether the account number provided matches the beneficiary’s name. This new control mechanism is designed to help prevent mistakes and fraud, he said. For example, Wilwertz noted that if someone mistypes a name or receives a fake invoice that uses the correct company name but an incorrect account number, the system will flag the discrepancy.

There are several possible outcomes. If the name and IBAN are fully consistent, a message will confirm that the details match, and the transfer can proceed as normal. However, Wilwertz explained that if there is a minor difference, such as a missing letter in a name or a company name written slightly differently, the system will display a “close match” message. In these cases, he said, the bank will suggest alternative matches that are likely to correspond to the intended recipient, and the customer will be able to confirm the correct one before continuing.

If a person uses only an abbreviation or incomplete information for the beneficiary, the system will display a “no match” warning. There may also be instances where the verification cannot be completed because of a technical issue.

Wilwertz clarified that in all these scenarios, whether a “no match”, “close match”, or a technical error, the transfer can still be completed. However, if a customer decides to proceed despite a mismatch and the money is sent to the wrong account, the responsibility will lie entirely with the customer rather than the bank, he said.

He therefore advised users to check their list of saved beneficiaries and update any outdated details to avoid problems once the system is in place.

As for businesses, Wilwertz warned that the new process might be inconvenient, especially for companies that make bulk payments through systems such as Multiline. If one payment in a batch contains an incorrect or mismatched beneficiary name, all the transfers in that batch will be temporarily blocked until the issue is resolved, he stated, adding that in such cases, companies will need to manually validate each transaction individually. He suggested that businesses wishing to avoid this can contact their bank to request an “opt-out”, which would disable the verification for their grouped payments.

Wilwertz also cautioned that people should take their time when making transfers and remain alert to potential scams, such as suspicious calls or messages pretending to come from their bank.