For many in Luxembourg, homeownership represents a key life goal. However, purchasing property presents unique challenges for single buyers relying solely on one income, compared to couples who typically benefit from dual salaries and larger tax advantages.

Purchasers of primary residences qualify for a tax credit on notarial deeds (known as the ‘Bëllegen Akt’, or ‘Cheap Act’, in Luxembourgish), recently increased to €40,000 per person (€80,000 for couples). This credit generally covers registration duties in most cases.

First-time buyers can access 100% financing without a deposit, though banks typically require a permanent employment contract (CDI) and sometimes a guarantor. For repeat buyers, lenders generally mandate a 10% deposit as standard practice.

With Luxembourg City’s high commercial density pushing prices upward, single buyers often look to the capital’s outskirts. Pierre Clément, director of Nexvia real estate agency, confirms most first-time single purchasers target 40–50m² properties, as studios are frequently snapped up by buy-to-let investors.

Notably, Luxembourg law imposes no minimum size requirement for primary residences.

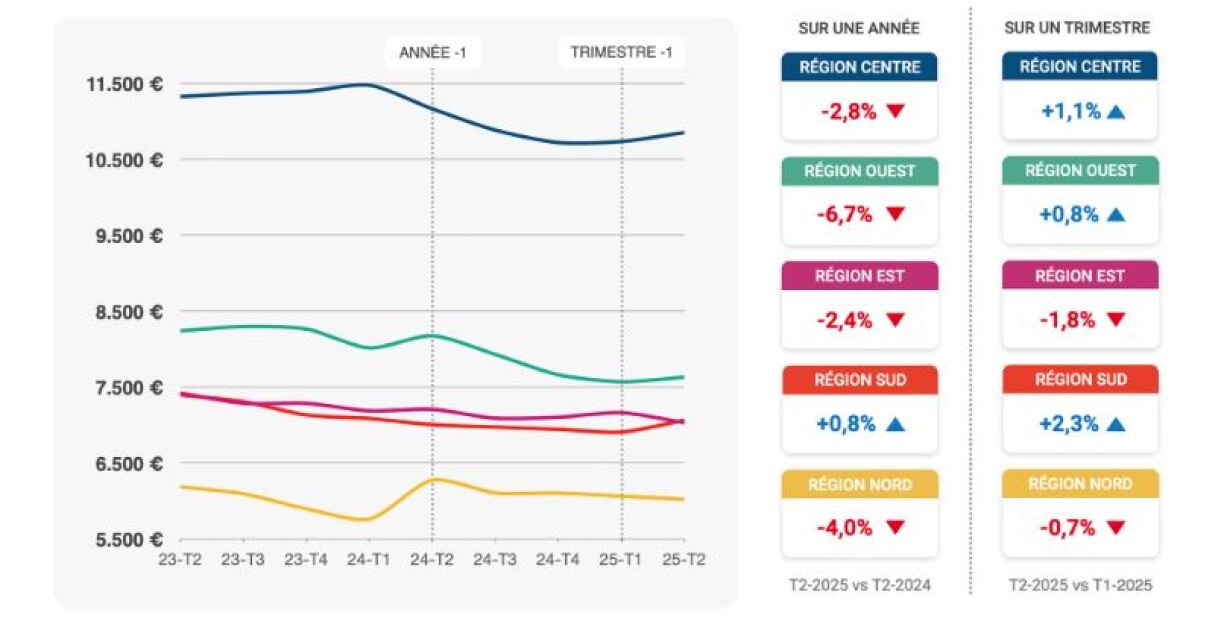

After two years of declining values, Luxembourg’s property prices have resumed their upward trajectory. Recent data from the atHome group (published in early July 2025) shows the average asking price for new builds has again surpassed €10,000/m², while existing properties averaged €8,000/m² in Q2 2025.

Though these figures reflect asking prices rather than final sale prices, they provide reliable benchmarks in the current market climate.

A 50m² existing property would typically cost around €400,000 based on these averages. However, proximity to the capital significantly impacts pricing – older properties on Luxembourg City’s outskirts can reach €10,000/m². Using a €450,000 midpoint estimate provides a practical working figure.

Crédihome’s July 2025 calculations show that financing €450,000 via a 30-year fixed-rate mortgage would require monthly repayments of approximately €2,100. Luxembourg banks generally cap mortgage payments at 40% of a borrower’s net monthly income, translating to a minimum €5,300 net salary for loan approval.

While specific terms may vary by lender, buyers realistically require over €5,000 net monthly income to qualify. Variable-rate mortgages present additional uncertainty, as the European Central Bank’s future rate decisions remain unpredictable.

When buying a new property, the equation becomes even more complex, as the advertised price often fails to match the actual purchase price. Extras such as the kitchen, interior finishes, optional cellars and underground parking spaces, construction cost indexation, and other unforeseen expenses all play a role.

Based on the latest available averages, buying a 50m² flat off-plan – known as VEFA in Luxembourg – would cost around €500,000.

To stay realistic, one must round that figure upwards, especially when looking near the capital. For example, in Kirchberg, a 49m² flat is currently listed at €750,000. Switch to Cloche d’Or, and a similar flat will cost around €610,000.

Without a cellar and parking space, a buyer might get away with €630,000, but including both, the final price is likely to be closer to €670,000.

Taking €650,000 as a reference for purchasing a 50m² flat on the outskirts of the capital, a fixed-rate mortgage over 30 years would require monthly repayments of about €2,800 as of the end of July 2025. If the bank applies the usual 40% income rule, the buyer would need to earn at least €7,000 net per month to secure the loan.

For context, the median gross salary in Luxembourg was last reported at €4,495, meaning that half of the working population earns (considerably) less than that.

It is worth noting that the above calculations are based on average property prices at the end of the first half of 2025, using the average fixed mortgage rate from late July. This context is crucial: should interest rates or property prices shift dramatically, the figures would no longer apply.

That said, there are currently no signs suggesting a steep drop in interest rates or a sharp rise in Luxembourg property prices in the coming months. In other words, these estimates are likely to remain relevant for a while.

Naturally, those looking at smaller or more distant properties will face a different set of figures, as reflected in the price averages in the south and especially the north of the country.

In any case, the salary estimates mentioned above help illustrate what such a monthly repayment would represent for a couple. In most cases, the burden would be split in two.

This means each person would need to earn a minimum of €2,650 net to afford a 50m² resale property at current rates, and around €3,500 net to afford a new build of the same size. Much more manageable, especially for first-time buyers.

Finally, affordable housing has become a real alternative for those whose incomes are not considered ‘high’ by Luxembourg standards. These properties are sold under a leasehold arrangement – ‘bail emphytéotique’ – but still enable thousands of residents to access housing at a lower cost.

Depending on the project and location, flats may start at €275,000 and houses from €420,000 to €700,000.