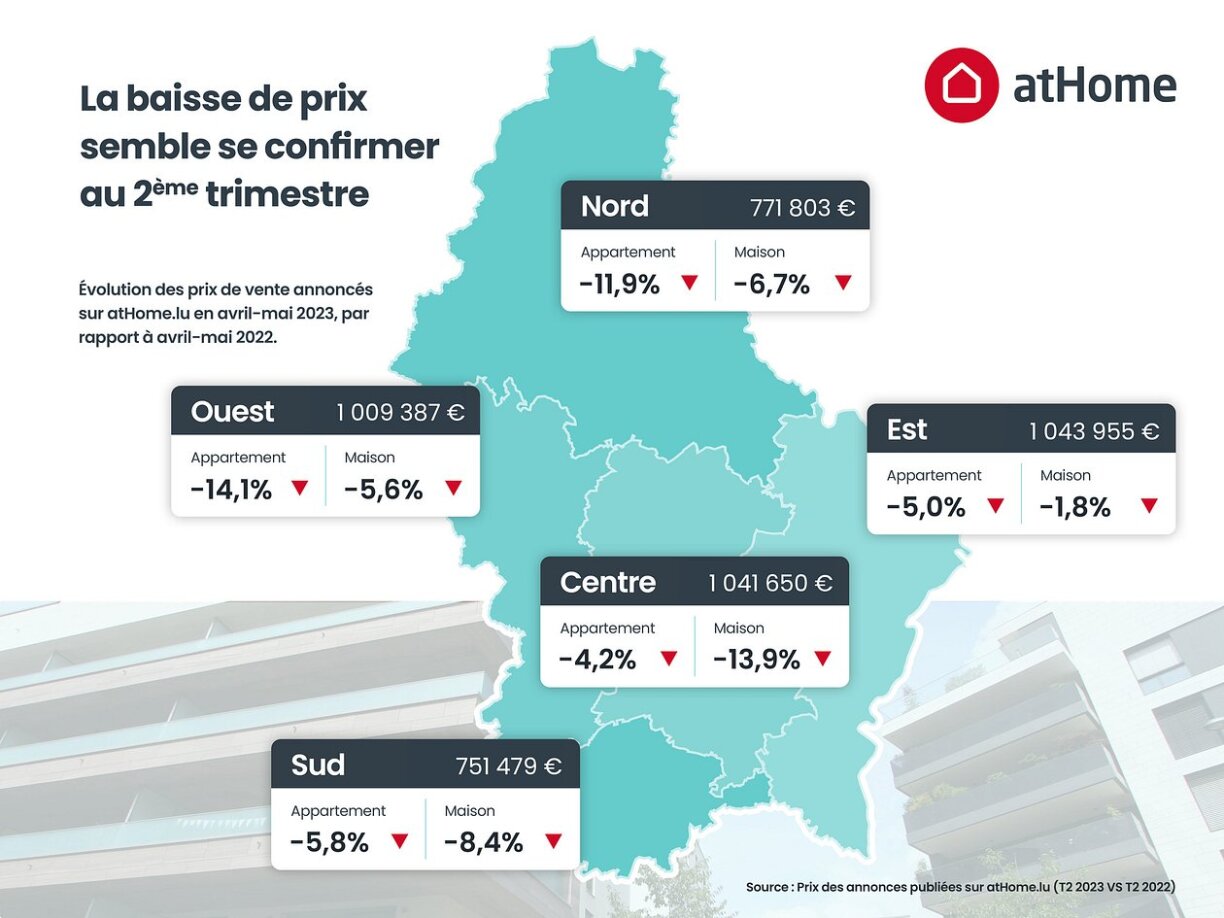

Something that was inconceivable just two years ago now seems to have become a reality: house prices are falling sharply in the Grand Duchy. While the latest figures from the Housing Observatory are still pending, data from the atHome Group provides an idea of where the market currently stands.

The latest figures are based on trends observed in April and May 2023. The property portal announced in a press release on 1 June that “The fall in advertised prices seems to have been confirmed in the second quarter of 2023.”

The most significant fall was seen in western Luxembourg, particularly for flats. AtHome’s figures show an estimated price drop of 14.1% over one year.

A significant drop was also observed on houses in the centre of the country. According to atHome data, advertised prices have fallen by 13.9% compared to the second quarter of 2022.

The value of houses and flats has further fallen in the north and south of the Grand Duchy. Reported sales prices fell by 11.9% for flats in the north of the country while houses in the south suffered the most, with a fall of 8.4%, according to atHome.

This depreciation might be hard to digest for homeowners and investors who have become accustomed to double-digit growth in recent years.

There are multiple factors that have led to this depreciation in property values. First and foremost, there is the rise in interest rates. This has led to a loss of purchasing power among potential buyers, which in return engendered a price adjustment on the property market.

The backlog of properties for sale also plays a role. Indeed, even as demand slumped, the number of homeowners deciding to sell increased sharply. In order to remain attractive, sellers have therefore had to make concessions on their prices.

Finally, the energy crisis has likely influenced the price level of properties with energy performance below the standards set in 2017. Considering that a significant portion of Luxembourg’s housing stock was built before the 1970s, this has a notable impact.

The good news is that this has enabled buyers to ‘reclaim’ the property market. According to several industry experts, they now have a negotiating margin of up to 10% of the total price.

So, for those with the means, now might be an opportunity to pick up a bargain, particularly if they are looking for a flat in the west or a house in the centre of the country.

Read also: The capital’s unprecedented price explosion at a glanceRead also: Municipality unveils Tiny House project aimed at young adults