The European Central Bank warned last week that a recession is looming, as it announced another jumbo interest rate hike to try to curb inflation driven up by the fallout from Russia’s war on Ukraine.

If Eurostat confirms these statistics in its November report, it would be the first time inflation in the Eurozone crosses the 10% threshold.

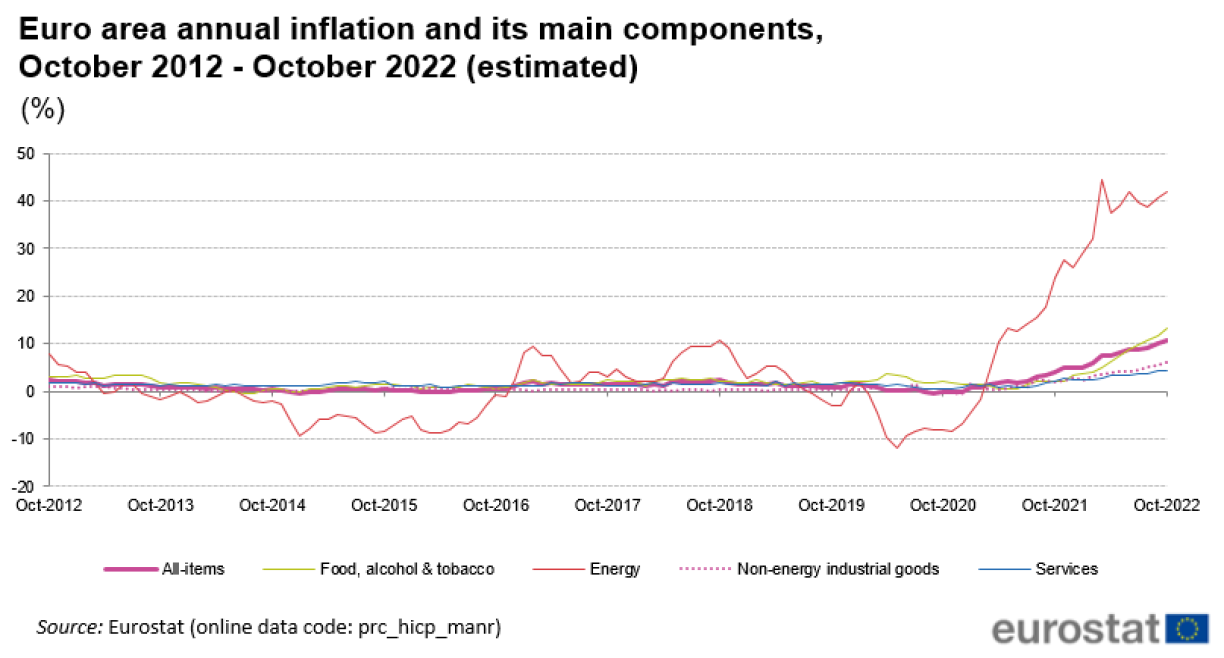

Consumer prices jumped by a fresh record of 10.7% in October, up from 9.9% the month before, stoked by an eye-watering 41.9% rise in energy costs, Eurostat said.

The third quarter figure was marginally better than expected after economic powerhouse Germany bettered forecasts with 0.3 percent growth.

Among other key economies, France and Spain were at 0.2% and Italy on Monday announced growth of 0.5%.

Overall Eurozone growth increased by 2.1% compared to the same quarter last year, Eurostat said.

But despite the mildly better-than-expected news, analysts warned that a recession appeared to be on its way regardless.

“It is a matter of how deep the recession will be and not if there will be one,” Oxford Economics said in an analyst note.

“Therefore, while Q3 was more resilient than expected a recession over the winter in eurozone is imminent.”

The European Central bank broke with more than a decade of negative interest rates over the summer in a bid to curtail price increases, and increased interest rates. Something it did again, just last week, and expects to do again, according to ECB President Christine Lagarde, before the years end.

Christos Floros covers News and Politics for RTL Today @christosfloros