In the context of this discussion, another question that regularly comes up is who benefits the most from these high prices. Many claim that if fuel prices increase, the state is the main beneficiary.

Is this claim true or false?

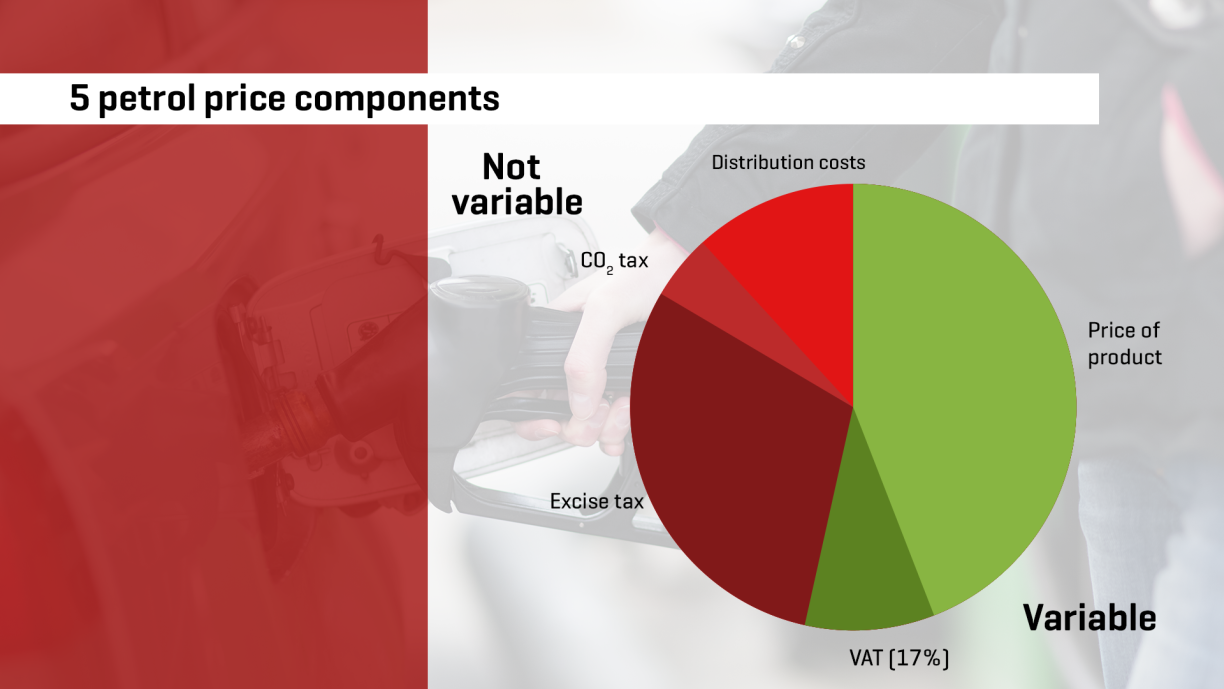

Fuel prices consist of five components: The price of the product + excise taxes + CO2 tax + VAT + distribution costs.

The base price of oil is the price of crude oil, which is fixed on the international markets based on offer and demand between producers and refineries. But the price of the product also varies depending on international current affairs, which influence the stock exchange. The listing of Luxembourgish fuel prices is determined on the European Spot Maart in Rotterdam. The Groupement Pétrolier Luxembourgeois represents the Luxembourgish sector.

Excise taxes are indirect taxes on certain products such as alcohol, cigarettes, and oil products. This tax is added directly to the sales price. Excise taxes are collected by customs authorities, which represent one of the state’s three fiscal administrations. The European Commission sets a minimum rate that is used by all countries as the basis for their own rate. In Luxembourg, excise taxes have a fixed rate which is calculated based on quantity and not on value.

The CO2 tax is an environmental tax calculated based on CO2 emissions. In 2021, the tax rate was €20/tonne of CO2 but it was raised to €25/tonne of CO2 in 2022. The goal of this tax is to reduce CO2 emissions and build up a fund to support alternative and clean energies. This tax is also collected by customs authorities.

VAT is a proportional flat-rate tax on revenue which everyone must pay when purchasing goods or services. The VAT for petrol and diesel is 17%.

This includes costs for the transport of the fuel as well as costs for the operation and management of service stations.

The price of fuel changes regularly, and sometimes the difference can be quite significant. The following two examples illustrate where the money flows and what the difference can potentially be.

On the basis of three dates, we will analyse the difference between “high fuel prices” (10 March 2022) caused by the war in Ukraine, and “low fuel prices” (24 April 2020) as a result of lockdown. We will also add a date from February 2022 as an average. All figures are rounded up to two digits after the decimal point to make the calculation clearer.

Price 1 February 2022 vs Price 10 March 2022

“One month later, and prices explode”

March 2022 vs April 2020

“Two years earlier”

These examples, which are based on diesel, can be converted to petrol, both for 95 octane and 98 octane. Taxes such as the CO2 or excise taxes are slightly higher for petrol compared to diesel. The base price of the product also varies, which changes the VAT! Details on taxes and excise duties can be found here:

https://douanes.public.lu/content/dam/douanes/fr/accises/Taux-Accises-LU-2022-02.pdf

The money that the state makes through excise duties (taxes, CO2, and distribution) does not vary proportionally to the price at the petrol station, as the following graph shows.

Conclusion of the fact check

No matter if diesel or petrol and independent of the price at the petrol station, the state always earns 0.42 cents per litre of fuel from flat-rate taxes (excise duties and CO2). Distribution costs would have to be recovered by the petrol station operators for their salaries and fees. What changes, however, is VAT. When fuel prices are high, the state earns more from VAT.

The RTL Fact Check shows that when fuel prices increase, the state effectively does indeed make more money per litre sold. However, it should be pointed out that high prices also have an impact on consumer behaviour. Petrol stations usually sell less fuel, when prices are high.

Upon enquiry, the Ministry of Finance provided the following figures on the profits form VAT and excise taxes (as of 28 February 2022). In the case of excise taxes on petrol, the state earned 9.6% more compared to the same period last year. On the other hand, the state is currently €3.2 million below the profits projected in the 2022 budget. The situation is similar for diesel with an increase of 9.6% compared to 2021. In the case of diesel, the state is €23 million below the excise taxes projected in the last budget.

As for profits from VAT (not just oil products), the state made €27.7 million more in early 2022 than projected in the 2022 budget. Due to the bracket creep, the state earns more profits from VAT, as it constitutes a fixed per centage of the sales price.(*)

The real winners of high fuel prices

Producers, refineries, and distributors are the big winners of high fuel prices.

If a distributor is able to manage large stocks, they can also speculate more by having greater flexibility when it comes to monitoring the market. For them, the rule is: Profit is made in purchasing, not selling.

At the moment, the market is nervous because of the war in Ukraine, and stock exchanges react to all moves made by the key players in this business. This causes the great variations in the price of the barrel, which in turn have repercussions on the price at the petrol station. The psychological aspect also plays a major role at the moment.

(*)

After this fact check was published, the Ministry of Finance corrected its initial statement and clarified that the figures related to VAT profits are actually deficits and not surpluses. This means that, contrary to what was initially stated, the state did not record additional earnings of €27.7 million as of 28 February 2022, but actually made €27.7 million LESS than what was projected in the 2022 budget. As a result, the combined revenue of VAT and excise taxes has not yielded any additional profits.