A speech this week by Jerome Powell, the Federal Reserve boss, towers over investors who are focused on figuring out the road forward for interest rates in the months ahead.

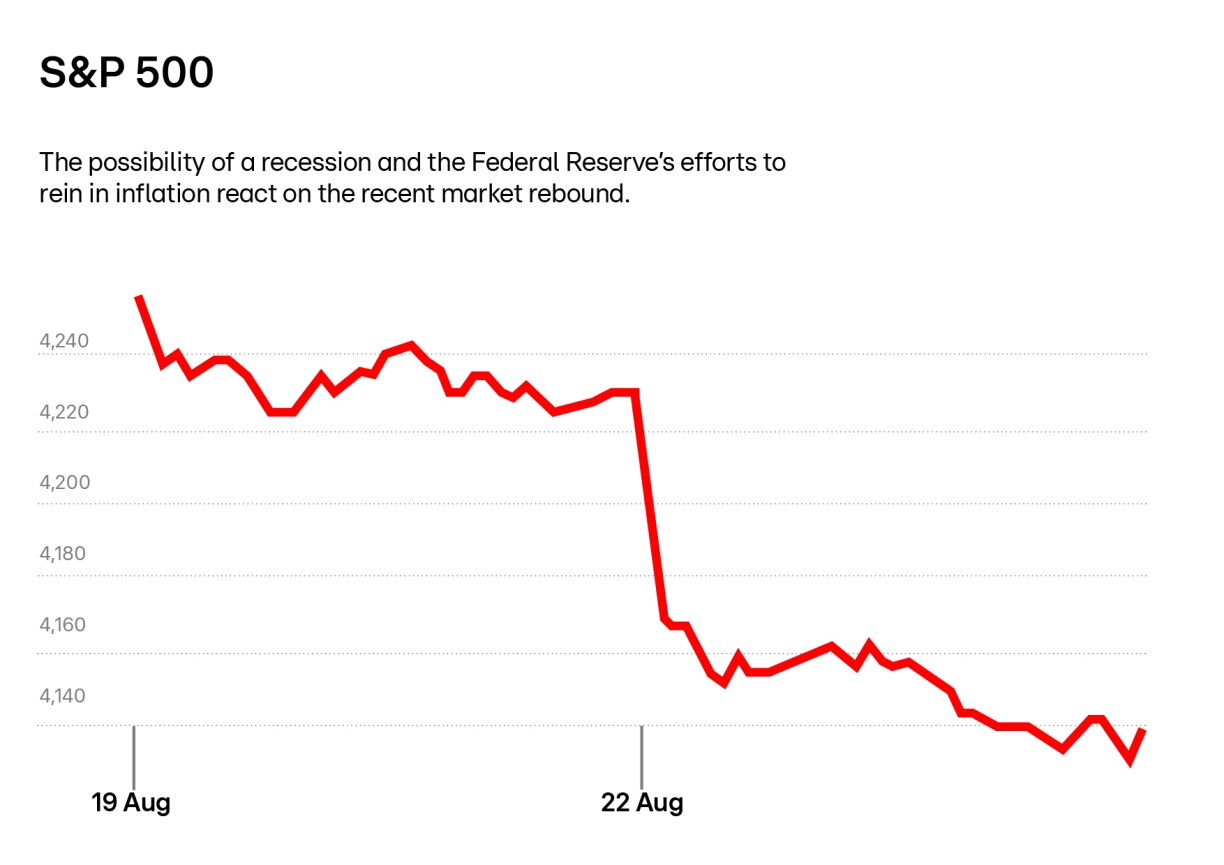

The S&P 500 index fell 2.1 percent, its worst decline since June 16 for a single day. The Nasdaq composite dropped 2.5 percent, which has nearly removed all the gains it made earlier this month.

The US is not the only economy under pressure, with governments and banks around the world facing an uphill battle against inflation, which is at multi-decade highs.

Here in Europe, the Stoxx 600 also fell, but less dramatically, from a high of 440 points on 19 Aug to a low of 432 yesterday, leaving the index at -22% since the beginning of the year.

Asian markets fell again this morning as traders grow increasingly worried that the Federal Reserve will continue to ramp up interest rates to fight inflation.

In recent weeks signs of easing price pressures and a slowing economy, along with falling energy costs caused financial markets to become optimistic the Fed would dial back or even pause rate increases.

Stocks on Wall Street rose for four straight weeks, despite a string of officials repeating the message that rates will continue to rise.

This sudden fall shows that investors realise the Fed’s fight against inflation is not yet over. The US inflation reading for July, showed gains in consumer prices were better than expected, compared to earlier months, and that had raised hopes that the Federal Reserve would ease on raising borrowing costs. Powell’s remarks show that it has only but delayed the action.