As Luxembourg’s private sector pension reform discussions near conclusion, our colleagues from RTL Infos examine six key questions surrounding a system projected to soon face deficits.

Luxembourg’s legal retirement age of 65 positions the country midway in European comparisons – neither the most lenient nor the strictest. However, its 40-year career requirement for full pension benefits remains shorter than neighbouring nations (41-43 years in France, 45 years in Germany and Belgium).

Recent data from the General Inspectorate of Social Security (IGSS) reveals that between 2011–2023, Luxembourg workers retired at an average age of 61 years and 3 months. Three-quarters opted for early retirement, while only one-quarter waited until 65.

While Minister of Social Security Martine Deprez has guaranteed the 65-year threshold will not change, proposals are emerging to extend working lives. These include both compulsory measures (increasing required contribution years or adjusting early retirement thresholds) and incentives (bonuses for delayed retirement).

In its report presented at the beginning of April, the Idea Foundation noted that Luxembourg guarantees the longest retirement in Europe: 25 years. With rising life expectancy, the think tank recommends adjusting both retirement age and contribution periods accordingly to maintain system sustainability.

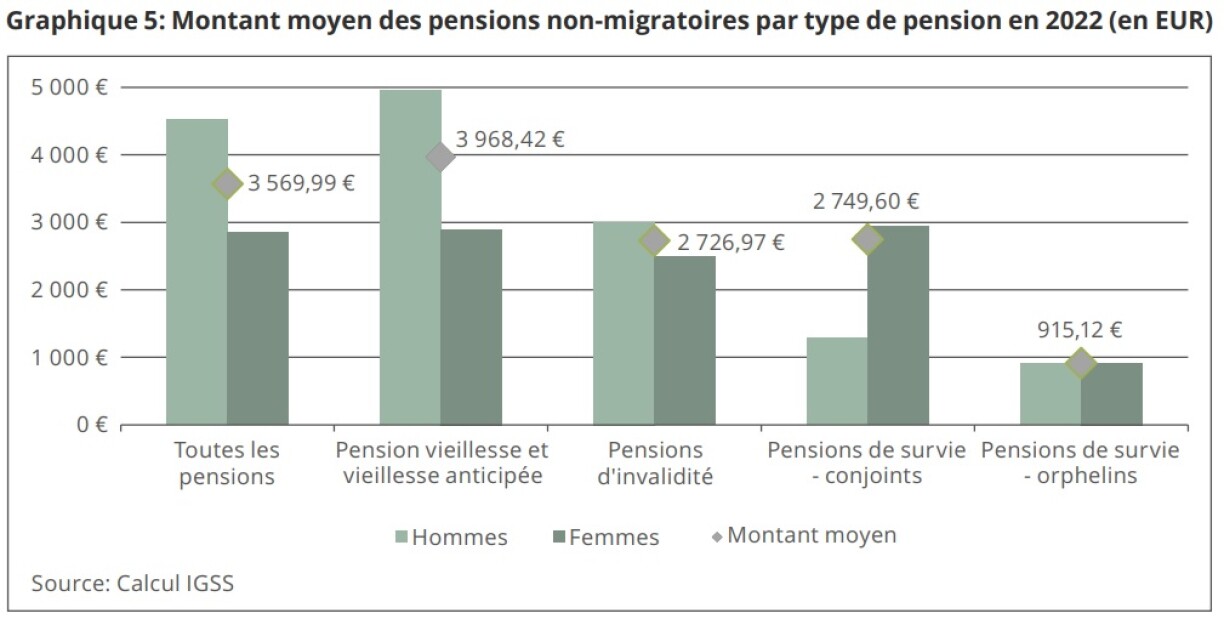

As of December 2023, the average Luxembourg pension stood at €2,398.30 across all categories including old-age, survivor’s, and disability pensions. Significant variations emerge when examining work history, with those who worked exclusively in Luxembourg receiving €3,570 monthly on average, while beneficiaries with international career segments received €1,614.50 – amounts typically supplemented by foreign pensions.

According to the website Toute l’Europe, Luxembourg pensioners had an income 10% higher than workers in 2020, a unique case in Europe.

Yet this apparent generosity masks stark disparities: the minimum pension does not protect against the risk of poverty (see next point), while the maximum pension, capped at around €10,600, is five times higher but is only received by a very small number of people.

The Chamber of Employees warns that the minimum pension of €2,293.55 gross (as of 1 January 2025) falls below Luxembourg’s at-risk-of-poverty threshold of €2,452 net (2022 standard). Their analysis shows 18% of pensioners receive less than €2,000 monthly gross, with women disproportionately dependent on minimum payments – a trend that perpetuates workplace gender gaps into retirement.

A full career therefore no longer automatically guarantees protection from financial precarity, the Chamber emphasised that even beneficiaries with complete contribution histories face living standards below what the national poverty metric defines as adequate.

The government’s reform efforts rely on projections from the IGSS, which consistently warn of an impending imbalance: without intervention, pension expenditures will soon outpace contributions.

The evolving timeline of these forecasts shows how predictions have shifted. A 2016 projection initially identified 2023 as the deficit threshold, while updated 2018 calculations pushed this to 2024. The 2022 estimate extended the timeline to 2027, and the latest 2025 forecast now anticipates shortfalls beginning in 2026.

These revisions stem from variables including Luxembourg’s economic growth, demographic shifts, and the compensation fund’s market-linked performance. While these factors have maintained system balance thus far, they also create short-term forecasting challenges. Notably, policymakers, unions, and employers agree that banking on future economic booms would be irresponsible.

The IGSS maintains its longer-term warning that current reserves may be depleted within 20 years.

Luxembourg’s current system caps pension contributions at five times the minimum wage (approximately €13,000 monthly in 2025), excluding higher earnings from retirement calculations.

One avenue that has been suggested would therefore be to remove the cap on this amount, in order to generate more revenue to finance pensions. But according to the Idea Foundation, high earners who contribute more would be entitled to higher pensions, further burdening the system. To address this, the Idea Foundation proposes applying reduced contribution rates of 3% (instead of the standard 8%) to earnings above the current cap.

Trade unions have raised the possibility of removing the cap on the maximum contribution amount, without offering anything in exchange to high earners. This would create a financial windfall for the State but would create inequality between the highest paid employees and the rest of the population. The decision, which is highly political, therefore rests with the government. This politically sensitive decision ultimately rests with the government.

With Luxembourg’s pension system facing potential deficits as early as 2026, the question of whether to utilise the €27 billion reserve – equivalent to over four years of expenditures, if contributions were to stop overnight – has become central to reform discussions.

However, IGSS projections warn the current model could deplete this reserve completely by the 2040s. At a roundtable organised by the Idea Foundation on 3 April, stakeholders voiced strong reservations about tapping into these funds. Marc Wagener, director of the Association of Luxembourg Employers (UEL), emphatically stated: “The reserve must be protected. For goodness sake, let’s not plunder it.” This position found alignment with the Idea Foundation, whose director Vincent Hein clarified their stance was not “pro-boss”, but rather pragmatic, noting Luxembourg’s pensioners already enjoy incomes 10% higher than workers.

The debate also highlighted the reserve’s dual function in Luxembourg’s capitalist economy. As a market-invested fund, its yields currently supplement system revenues – meaning any draw down would simultaneously reduce this critical income stream.

MP Djuna Bernard of the Green Party (Déi Gréng) reinforced that the reserve was never intended for complete expenditure.

During the presentation of the think tank’s April report, former director of the Idea Foundation and economist Muriel Bouchet asserted that the longer Luxembourg takes to balance its system, the greater the efforts required.