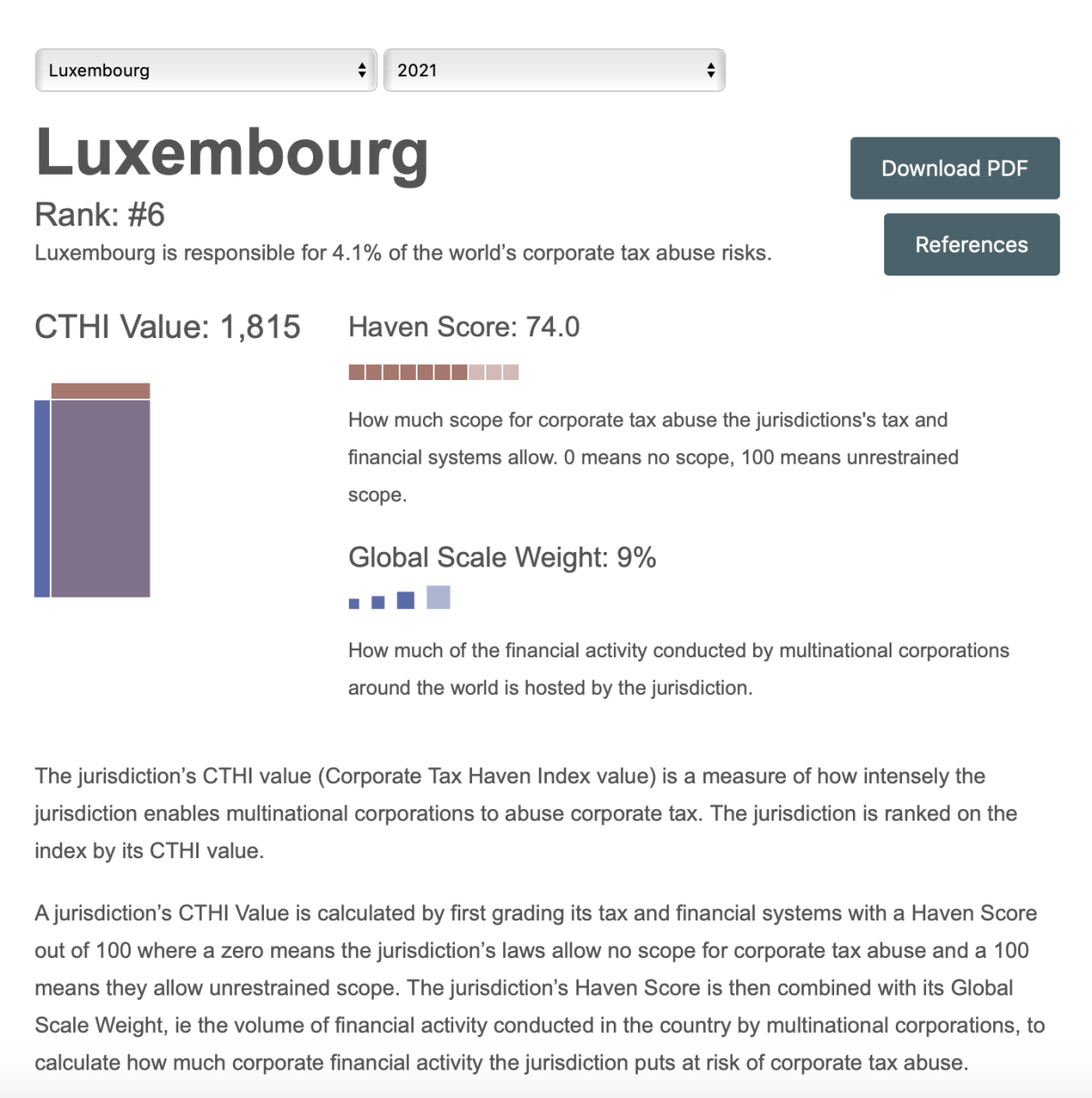

The Tax Justice Network’s latest report indicates that Luxembourg remans high on the watchlist for tax authorities, placing higher than the United Kingdom and Ireland and just below Switzerland.

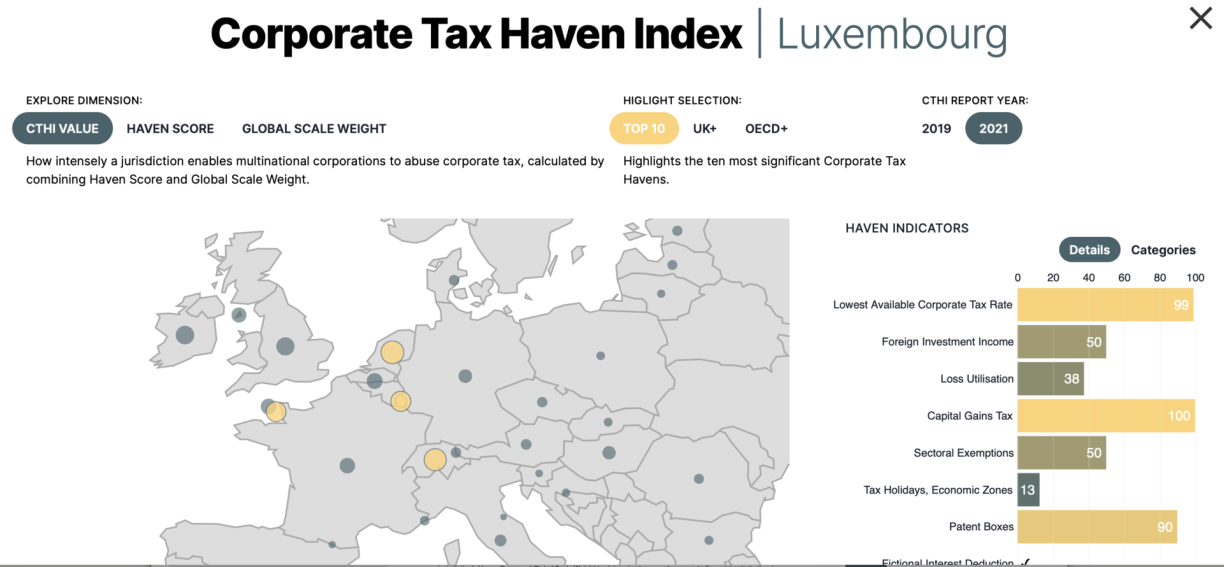

The Corporate Tax Haven Index thoroughly evaluates each jurisdiction’s tax and financial systems to create a clear picture of the world’s greatest enablers of global corporate tax abuse, and to highlight the laws and policies that policymakers can amend to reduce their jurisdiction’s enabling of corporate tax abuse.

Each jurisdiction ranked on the index is given two opportunities during the research process to feedback on and dispute the index’s results. This occurs when the preliminary findings are first prepared and when the final results are calculated. If a jurisdiction provides sufficient evidence that counters an assessment made by the index, the assessment is changed to reflect the evidence.

The UAE has entered the world’s top ten tax havens for the first time, research showed Tuesday, in a report flagging OECD nations and their dependencies for more than two-thirds of “global corporate tax abuse”.

According to the research by the Tax Justice Network, the rise in the rankings came after multinationals in South Africa and the United States routed $218 billion in funds from the Netherlands into the gulf monarchy -- equivalent to more than half of its GDP.

The news highlighted “the UAE’s growing role as the offshore financial centre of choice for multinational corporations”, Tax Justice Network’s Mark Bou Mansour wrote on the NGO’s website.

The data does not show which companies had transferred the funds, he added.

Tax Justice Network’s annual rankings name and shame countries most complicit “in helping multinational corporations pay less tax than they are expected to”.

And while the report newly named the United Arab Emirates among its top ten worst offenders, it also said OECD nations and their dependencies were responsible for more than two-thirds of “global corporate tax abuse risks”.

Of those, 45 percent comes from the “UK spider’s web” -- territories under the legal jurisdiction of the British government.

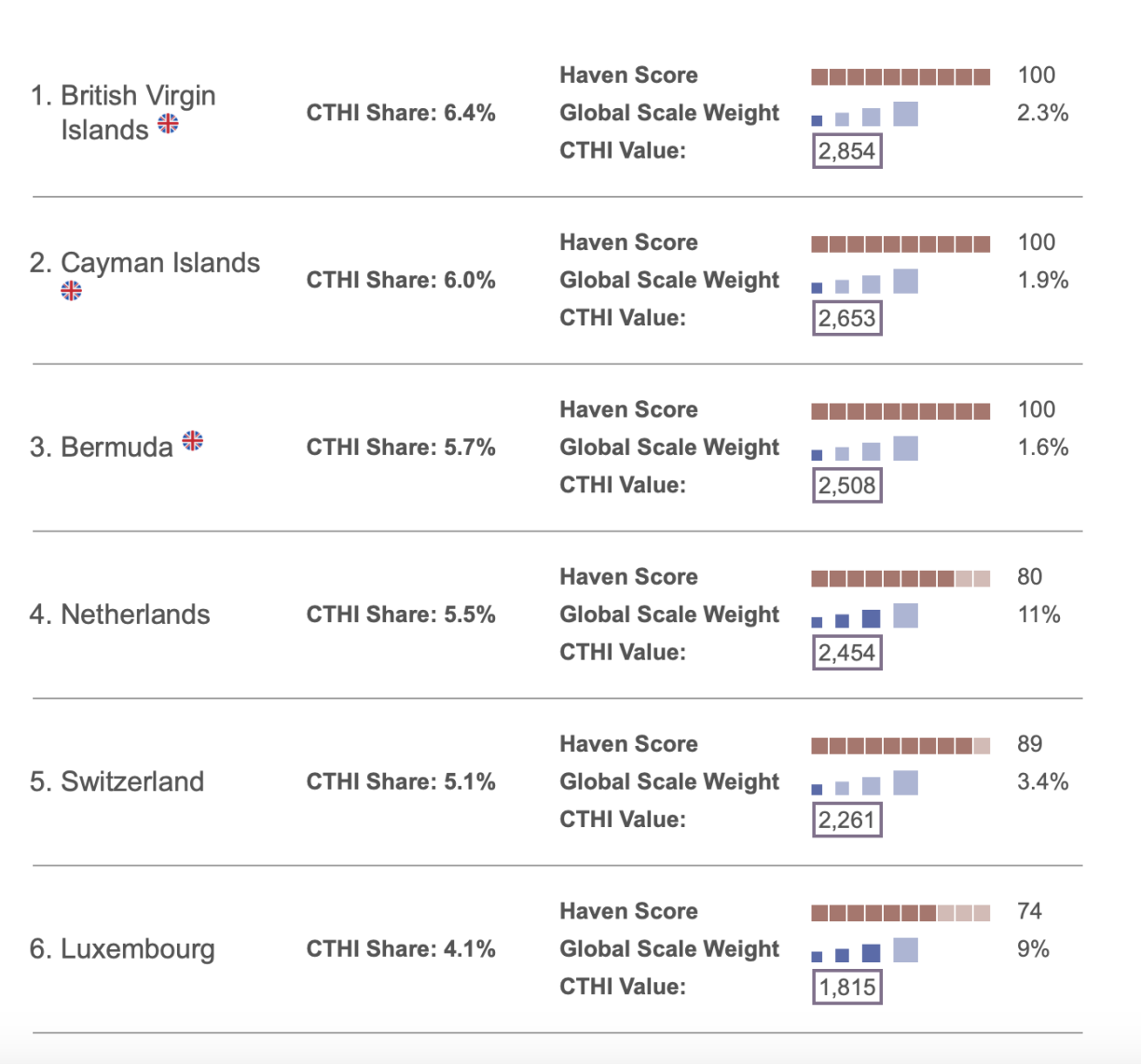

In the first three places this year are three British overseas territories: the Virgin Islands, the Cayman Islands, and Bermuda.

Crown dependency Jersey was listed number eight.

The Cayman Islands also appeared in first place on the group’s Financial Secrecy Index, after a 21 percent increase in “volume of financial activity it hosts from non-resident persons”.

The top ten offenders include Asian financial hubs Singapore and Hong Kong, as well as European Union members the Netherlands and Luxembourg.

International corporate tax avoidance leads to losses of hundreds of billions of dollars from the global economy, the World Economic Forum has said.

In a bid to curb tax avoidance, the OECD has proposed a multilateral convention -- known as the BEPS 2.0 -- that would see 137 jurisdictions impose a minimum tax rate.